Introduction: The Growing Landscape of DeFi in Vietnam

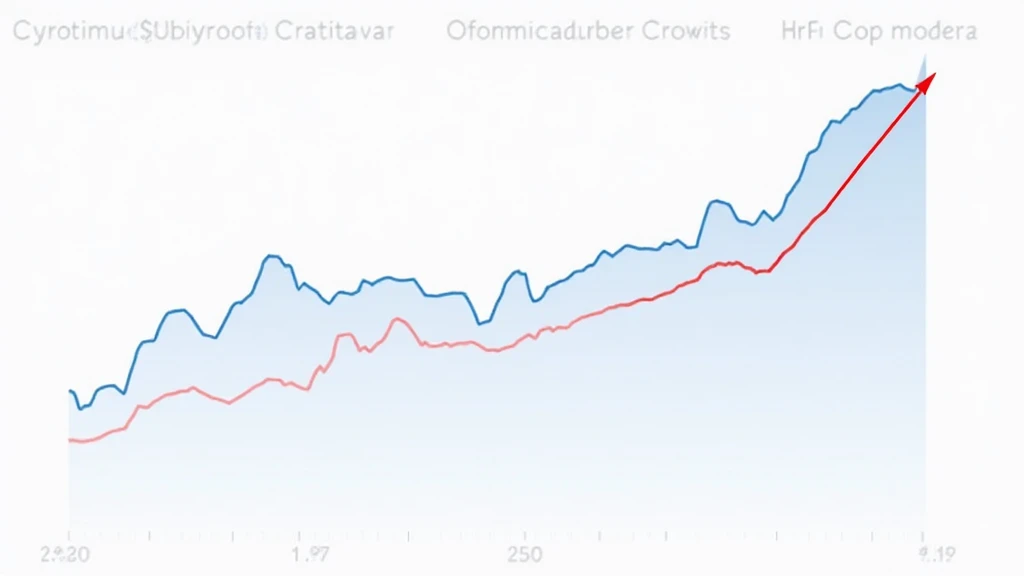

As of 2024, the DeFi ecosystem has witnessed an explosive growth, with an estimated $4.1 billion at stake in various protocols globally. Vietnam, in particular, has carved a niche for itself in this vibrant scene, boasting a significant increase in crypto adoption. According to recent statistics, Vietnam’s crypto user growth rate stands at an impressive 39% year-on-year.

In this article, we will delve into the most effective Vietnam DeFi yield farming strategies, urging readers to harness the potential to maximize their returns. Whether you are a novice or an expert, the following strategies and insights are vital for navigating the complexities of yield farming in Vietnam’s DeFi landscape.

Understanding Yield Farming

Yield farming can be compared to traditional banking; however, instead of keeping your money in a savings account, you are lending your cryptocurrencies to borrowers. In exchange, you earn interest, much like receiving an interest payment from a bank. Let’s break down yield farming and its components:

- Providing Liquidity: By supplying assets to liquidity pools, users earn fees and rewards.

- Staking: Locking cryptocurrencies in a protocol allows participants to earn additional tokens.

- Utilizing Protocols: Engaging with various DeFi protocols enables diversification of yield opportunities.

Key Yield Farming Strategies for Vietnamese Investors

Now, let’s explore specific yield farming strategies tailored for the Vietnamese market, which will help maximize returns while mitigating risks.

1. Participate in Local DeFi Projects

Vietnam boasts several burgeoning DeFi projects that cater to local needs. By participating in these projects, you can benefit from early adopter advantages and specific community rewards:

- Fiinance: A local platform designed for crypto lending and borrowing.

- Coin98 Finance: A multi-chain ecosystem facilitating cross-chain asset management.

2. Optimize Liquidity Provision

One of the core aspects of yield farming is liquidity provision. By providing liquidity to popular trading pairs, users can earn a share of trading fees. Here’s how to optimize this:

- Select high-volume trading pairs. For example, pairs involving USDT or BTC often experience robust trading activity.

- Incorporate impermanent loss strategies by diversifying investments across different pools.

3. Utilize Automated Yield Aggregators

Automated yield aggregators simplify the farming process. These platforms strategically move funds between various protocols to maximize yield rates. Notable aggregators include:

- Yearn.finance: Offers yield optimization strategies for DeFi assets.

- PancakeSwap: A popular choice due to its low fees and high yields.

4. Engage in Governance Token Farming

Many DeFi platforms offer governance tokens as rewards for yield farming. These tokens grant users voting powers and additional income opportunities. Prioritize platforms like:

- Aave: Provides governance tokens through lending.

- Uniswap: Introduces liquidity mining yield opportunities.

Key Considerations for Yield Farming in Vietnam

While yield farming presents lucrative opportunities, several factors must be taken into account:

- Regulatory Environment: Vietnamese regulators are closely monitoring DeFi projects. Ensure compliance with local laws to mitigate risks.

- Security Risks: With hacks and scams on the rise, it’s crucial to leverage protocols with robust security measures.

- Volatility: Yield farming returns are often tied to market behavior, as seen with cryptocurrencies like Bitcoin and Ethereum. Stay informed about market developments.

Real-World Case Studies

To provide further clarity on effective yield farming strategies, we present some case studies from the Vietnamese DeFi sphere:

- Case Study 1: Growth of Fiinance – In a recent implementation, Fiinance reported that users yielded over 30% APR for liquidity providers within just three months of launch.

- Case Study 2: Coin98 Finance Adoption – Coin98 Finance saw a surge in liquidity, leading to a job creation increase of 20% in the local crypto sector.

Future of DeFi in Vietnam

As we look to the future, the DeFi space in Vietnam is set to evolve with growing user adoption. The introduction of new protocols, funding opportunities, and increased regulatory clarity will likely foster a more robust DeFi ecosystem. Additionally, increased awareness of tiêu chuẩn an ninh blockchain will enhance investor confidence.

Conclusion: Embracing Vietnam DeFi Yield Farming Strategies

In conclusion, mastering Vietnam DeFi yield farming strategies is crucial for maximizing your returns amidst a competitive landscape. As the market continues to grow, leveraging local projects, engaging in liquidity provision, and adopting automated strategies will position you for success. Remember that ongoing education and staying updated with the latest trends are key in this rapidly changing field.

For more insights about crypto opportunities in Vietnam, visit mycryptodictionary.

Author: Dr. Nguyen Tran, a blockchain security expert with over 15 published papers and experience leading multiple successful audits in the DeFi sector.