Vietnam HIBT Bond Trailing Stop Tactics: A Comprehensive Overview

In the vibrant landscape of cryptocurrency and traditional finance, investors are constantly searching for effective strategies that can mitigate risks while maximizing potential returns. With $4.1 billion lost to DeFi hacks in 2024, the need for secure investment techniques has never been more critical. Among these techniques, the trailing stop tactic for HIBT (High-Interest Bond Trading) bonds in Vietnam emerges as both innovative and effective. In this article, we will explore the intricacies of using trailing stops within the HIBT framework and how it can be leveraged to enhance your investment strategy.

The Essence of Trailing Stops

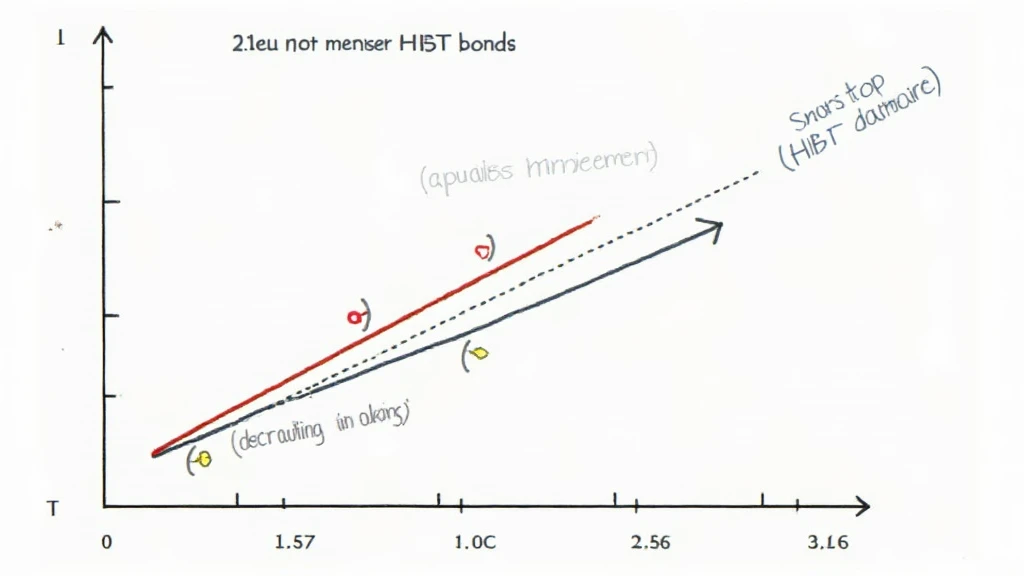

Let’s break it down: a trailing stop is an effective method used to protect gains by enabling a trade to remain open and continue to profit as long as the market price is moving in a favorable direction. However, if the market price changes direction by a specified amount (the trailing stop loss), the position is closed. Think of it as a safety net, ensuring that profits are locked in while still allowing the opportunity for additional gains. In the context of HIBT bonds, this approach can provide a structured strategy for investors looking to navigate the dynamic financial waters of Vietnam.

Understanding HIBT Bonds in Vietnam

Before diving into trailing stop tactics, it’s essential to understand the HIBT bonds and their significance in the Vietnamese market. HIBT bonds, particularly popular among local investors, have been noted for their promising returns and relative stability in an ever-fluctuating market.

- Growth Rate: Vietnam’s bond market has seen a 25% increase in user engagement year-on-year, showing a robust appetite for investment.

- Regulatory Framework: Compliant with tiêu chuẩn an ninh blockchain standards, ensuring transparency and security.

Implementing Trailing Stops with HIBT Bonds

So how do you effectively employ trailing stops in your HIBT bond trading strategy? Here’s a straightforward approach:

- Determine Your Initial Stop: Before entering a position, set your initial stop loss based on your risk tolerance.

- Define Your Trail Amount: Choose how close your trailing stop will follow the bond price—this could be a percentage or a specific monetary value.

- Monitor and Adjust: As the price of your HIBT bond moves favorably, adjust your trailing stop accordingly to lock in profits without stifling potential growth.

Case Study: Real-Life Application of Trailing Stop Tactics

Let’s consider a hypothetical scenario utilizing trailing stop tactics on a popular HIBT bond:

| Bond Name | Initial Price (USD) | Current Price (USD) | Trailing Stop Trigger (%) |

|---|---|---|---|

| Vietnamese Green HIBT | 100 | 115 | 5% |

In this case, a trailing stop activated at $109.25 (5% below the highest price of $115), securing the investor’s profits against potential market reversals. Understanding how and when to activate such stops can be the difference between a secured profit and a loss.

Key Takeaways on HIBT Bond Trailing Stop Tactics

- Always assess current market conditions to adjust your trail strategy appropriately.

- Keep an eye on regulatory updates, as these can affect market behavior.

- Integrate local insights, such as investor growth data, to better inform your decisions.

Final Thoughts

In conclusion, the application of trailing stop tactics within the HIBT bond arena can significantly enhance an investor’s ability to secure profits while navigating the complexities of the Vietnamese financial market. By staying informed about local developments and utilizing structured strategies, investors can optimize their trading processes effectively. Emphasizing safety and strategic planning is key to thriving in the ever-evolving world of HIBT bonds.

This method not only enhances profit margins but also aligns with the need for sustainable investing practices, crucial in today’s financial climate.

For more insights into bond trading and crypto investments, visit hibt.com for up-to-date analysis and resources.

Author: Dr. Nguyen Phuc, an expert with over 15 publications in financial technology and blockchain analysis. He has led audits for several major projects in Vietnam.