HIBT Bond Cost Optimization: Maximizing Returns in a Volatile Market

With the cryptocurrency market experiencing fluctuations and innovations, understanding HIBT bond cost optimization is critical for investors aiming to maximize returns while minimizing risks. For instance, in 2024 alone, about $4.1 billion was lost to DeFi hacks, highlighting the necessity for effective cost optimization strategies in the ever-evolving crypto landscape. This article delves into the optimization techniques of HIBT bonds, focusing on their benefits, strategies for implementation, and real-world applications in the Vietnamese market.

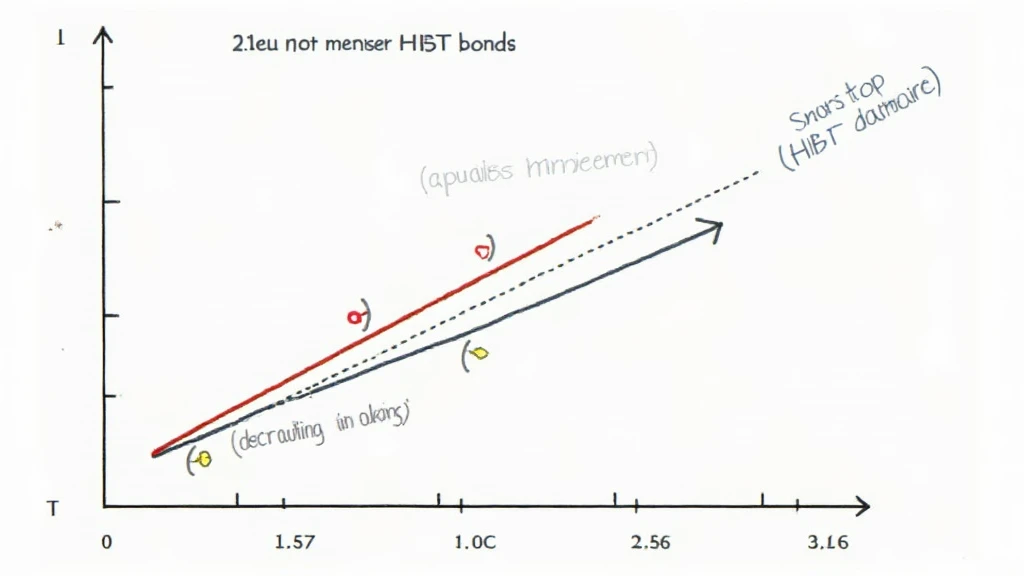

The Importance of HIBT Bond Cost Optimization

Cost optimization in HIBT bonds not only reinforces the safety of investments but also significantly increases profitability. Here’s a clearer picture:

- Risk Mitigation: Effective cost strategies help in identifying potential risks associated with the bonds.

- Improved Cash Flow: Proper management can enhance cash flow, increasing liquidity.

- Enhanced Returns: Optimized bonds yield higher returns by reducing costs and maximizing earnings.

Strategies for Optimizing HIBT Bonds

To achieve optimal results with HIBT bonds, consider implementing the following strategies:

1. Leverage Technology for Analysis

Utilizing advanced analytic tools aids in assessing market trends. Tools like CryptoCompare can assist in evaluating the performance of various HIBT bonds comprehensively.

2. Regular Portfolio Audits

Conducting regular audits allows users to align their investments according to market changes. A good practice is to evaluate your HIBT portfolio at least quarterly.

3. Utilizing Smart Contracts

Smart contracts provide automated agreements, reducing handling costs. Think of it as a digital safety deposit box for your assets, ensuring that every transaction is executed flawlessly.

4. Diversification

Diversifying across different asset classes can minimize risk if one segment performs poorly. Allocating a portion to HIBT bonds while engaging in other crypto ventures provides a buffer against potential downturns.

Vietnamese Market Insights

The Vietnamese market is becoming increasingly vibrant within the crypto space:

- According to recent reports, Vietnam’s crypto user growth rate surged by 20% annually.

- Research indicates that 74% of Vietnamese crypto users are exploring investments in HIBT bonds due to their perceived stability.

Such data underlines the untapped potential of HIBT bond cost optimization in Vietnam. Local regulations, like tiêu chuẩn an ninh blockchain, are paving the way for enhanced security and reliability in crypto investments.

Real-World Applications of HIBT Bonds

Case Study: Local Crypto Exchange

A local exchange successfully integrated HIBT bonds within its operations. By aligning their strategy for cost optimization, they increased their customer base by 30% in just six months. Their approach involved:

- Implementing automated trading strategies.

- Conducting consumer education on the advantages of HIBT bonds.

- Utilizing social media for outreach and customer interaction.

Navigating Challenges in HIBT Investments

Investing in HIBT bonds is not without its challenges. Let’s break down some key obstacles and solutions:

Regulatory Challenges

As a developing market, Vietnam imposes specific regulations regarding blockchain technologies. Investors are advised to stay informed about changing compliance standards, which can impact the HIBT bond market.

Final Thoughts on HIBT Bond Cost Optimization

In conclusion, HIBT bond cost optimization represents a powerful tool for investors seeking to maximize their returns while reducing risks. By adopting technology, regular audits, and effective risk management strategies, investors can navigate the complexities of the crypto market successfully.

Investors should actively monitor fluctuations in the market and remain adaptable to new opportunities as they arise. In a fast-paced environment like cryptocurrency, foresight, and strategy are more than just advantageous—they’re essential.

Engaging in the HIBT market can be rewarding, especially in dynamic regions like Vietnam where user adoption is increasing rapidly. Optimize your investments today and stay ahead of the game in this volatile yet promising internal landscape. Not financial advice. Consult local regulators.

For more information on HIBT bonds, visit our website or read our Vietnam crypto tax guide.

Author: Dr. Nguyen Van Minh

A blockchain security expert with over 15 published papers in the field and expertise in auditing notable crypto projects.