Introduction

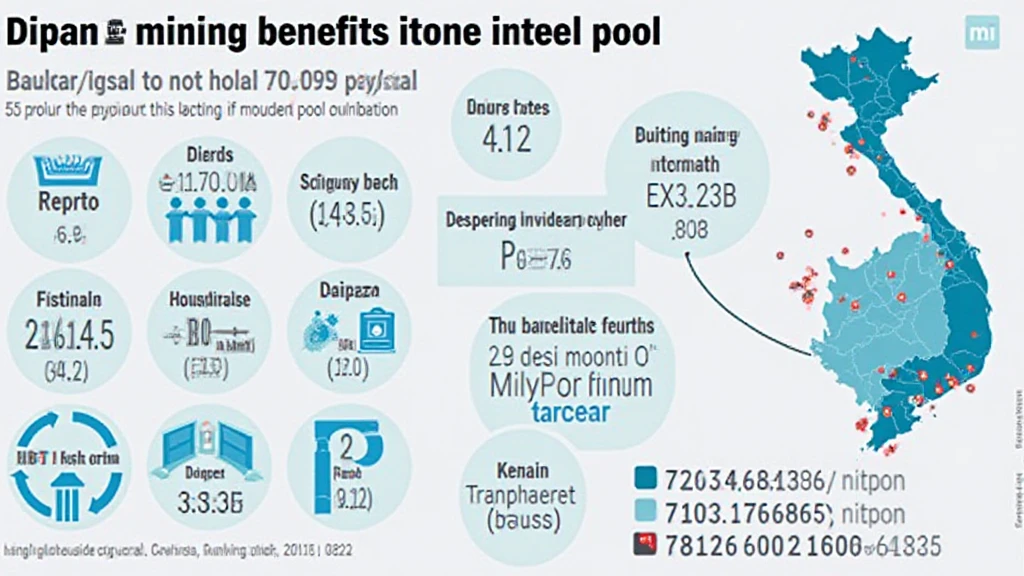

With a staggering $4.1 billion lost to DeFi hacks in 2024, understanding the vulnerabilities and security standards surrounding blockchain technology has never been more crucial. As digital assets like Bitcoin gain more traction among investors worldwide, including a significant increase in the Vietnamese crypto user base, knowing how to navigate the landscape of Bitcoin Layer becomes vital. In this comprehensive guide, we will explore the intricacies of Bitcoin Layer, its relation to blockchain, and its implications for security standards moving into 2025.

What is Bitcoin Layer?

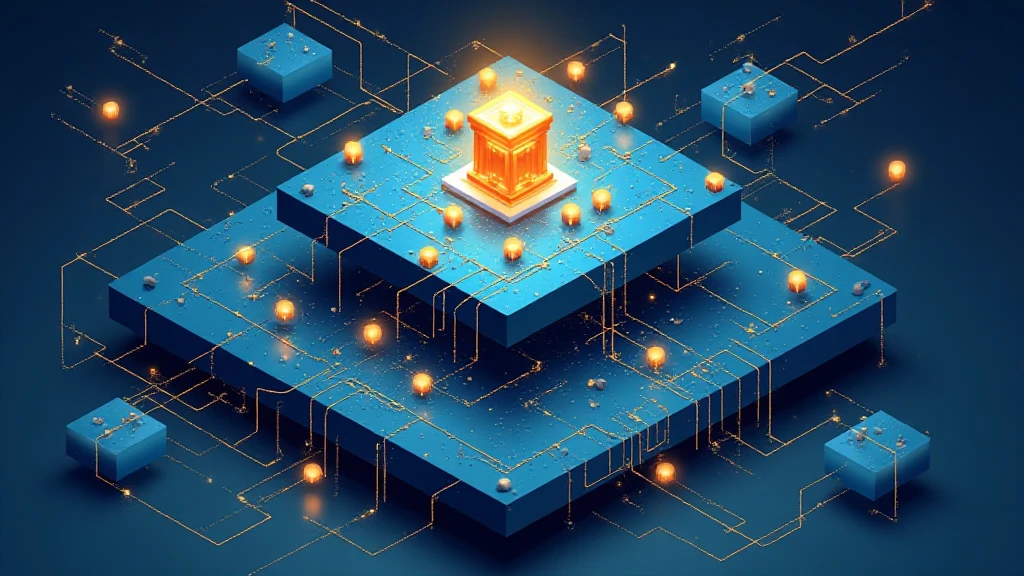

Bitcoin Layer refers to the layer in the blockchain that handles transactions and secures the network through a decentralized consensus mechanism. Think of it as the foundation of the digital gold that Bitcoin represents. To simplify, just as bricks create a solid structure for a house, Bitcoin Layer builds the necessary infrastructure for Bitcoin’s transactions and overall security. This layer plays a critical role in ensuring that each transaction is validated and recorded in a secure manner.

How Bitcoin Layer Works

- Transactions are grouped into blocks.

- Miners solve complex mathematical problems to validate these blocks.

- Once validated, blocks are added to the blockchain, creating a permanent record.

- This process ensures that no single entity controls the network.

This decentralized approach not only fortifies security but also enhances transparency, a characteristic that many investors find appealing.

Consensus Mechanisms: The Heart of Bitcoin Layer

At the core of Bitcoin Layer is the consensus mechanism, which allows network participants to agree on the state of the blockchain. One common mechanism used in Bitcoin is Proof of Work (PoW). Here’s how it works:

- Miners use high-powered computers to solve cryptographic challenges.

- The first miner to solve the challenge adds the block of transactions to the blockchain.

- For their efforts, miners are awarded newly minted Bitcoins and transaction fees.

However, this system has its flaws. As more miners participate, the difficulty of the challenges increases, requiring significant energy consumption and high-performance hardware, leading to concerns about environmental sustainability. Moreover, there are vulnerabilities associated with PoW, such as the potential for a 51% attack, where a single entity could gain control of the network.

Should We Trust PoW?

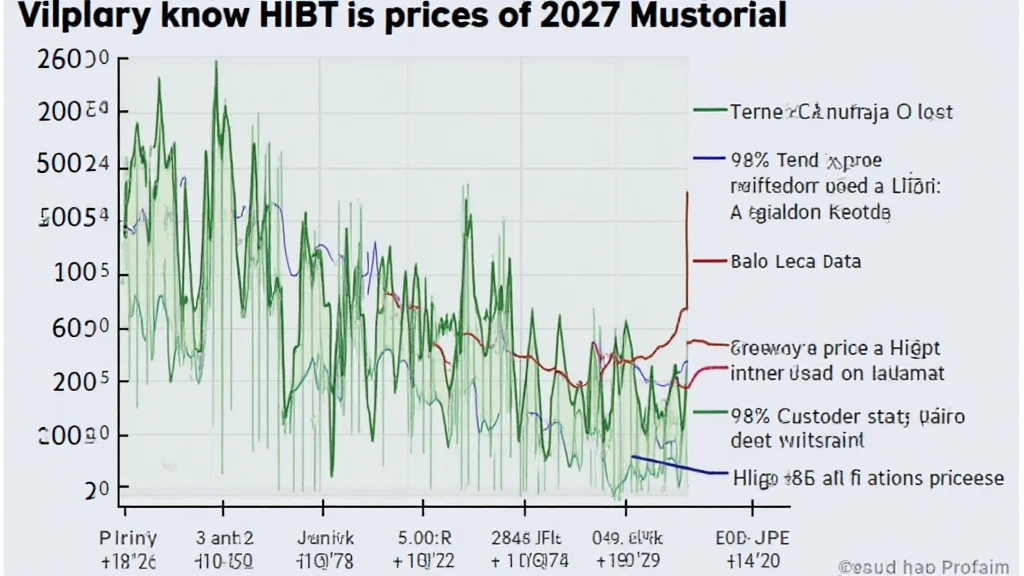

The question of trust in cryptocurrencies is vital. Bitcoin’s PoW system has undergone rigorous testing over the years, with a noticeable lack of major attacks. However, as the industry evolves, alternative consensus mechanisms like Proof of Stake (PoS) and Delegated Proof of Stake (DPoS) are gaining popularity for their energy efficiency. According to recent studies, platforms utilizing PoS could reduce energy consumption by up to 99% compared to PoW.

Security Vulnerabilities in Bitcoin Layer

Even though Bitcoin Layer has proven to be largely secure, no system is perfect. The vulnerabilities can often be categorized into:

- Network Attacks: These include DDoS attacks aimed at overwhelming network nodes.

- Sybil Attacks: Where a single entity creates multiple identities to gain influence over the network.

- 51% Attacks: As mentioned before, if one miner or group controls more than half of the network’s mining power, they could manipulate the blockchain.

In the context of Vietnam, as the user base grows significantly, estimated to reach 5 million by 2025, addressing these vulnerabilities is paramount.

Exploring Blockchain Security Standards in 2025

As technology advances, new security standards will emerge for blockchain applications. One of the key security challenges for 2025 is how to integrate regulations effectively while still maintaining decentralization. Additionally, adopting standards such as ISO/IEC 27001 for information security management can be instrumental in providing security assurances for businesses involved in blockchain technology.

Future Predictive Analysis for Vietnam’s Crypto Market

The burgeoning crypto market in Vietnam is indicative of a larger global trend. As per reports, the country experienced a 20% annual growth rate in crypto adoption. For businesses looking to navigate this landscape, understanding the legal implications is critical.

- Ensure compliance with local regulations: This includes understanding cryptocurrency taxation in Vietnam.

- Invest in security audits: Regular audits can enhance trust and reliability in decentralized applications.

As we move into an era where every transaction is scrutinized, staying informed about regulations will be essential.

The Importance of Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They live on the blockchain and offer a new layer of transparency and security. In many ways, they are revolutionizing how agreements are enforced in the digital realm.

Auditing Smart Contracts

Security flaws in smart contracts can lead to significant losses. Conducting a thorough audit can mitigate such risks. In fact, approximately 70% of smart contract failures could be avoided through proper audits.

- Evaluate code for vulnerabilities.

- Ensure compliance with best practices.

- Perform functional testing to confirm expected outcomes.

Hence, as Bitcoin Layer evolves, so does the necessity for rigorous smart contract audits.

Conclusion

Bitcoin Layer is at the forefront of blockchain technology, offering a robust foundation for secure, decentralized transactions. However, vulnerabilities persist, and as security standards evolve in 2025, it is crucial for investors and developers alike to stay informed. This is especially pertinent in rapidly growing markets like Vietnam, where understanding these dynamics could mean the difference between success and failure in navigating the crypto landscape.

Final Thoughts

Let’s break it down: while Bitcoin Layer has its challenges, the potential for growth and security is undeniable. By adhering to the best practices and staying abreast of technological advancements and regulatory changes, stakeholders can fortify their positions in the market. For more insights into the world of cryptocurrencies, be sure to check out mycryptodictionary.