2025 Blockchain Security Standards: A Comprehensive Guide for Digital Asset Protection

With $4.1 billion lost to DeFi hacks in 2024, the need for robust blockchain security standards has never been clearer.

This article explores essential security measures in the world of cryptocurrency, specifically tailored for the Vietnam crypto market. As more users explore the landscape of digital assets, ensuring the ROI of their investments demands both knowledge and understanding of security practices in the blockchain space.

Understanding Crypto Security: What You Need to Know

Crypto security isn’t just about safeguarding your assets; it’s about building trust in a decentralized financial ecosystem. Here’s the catch: most users underestimate the risks involved in holding digital currencies.

- According to a report from hibt.com, cyber threats are evolving, making it crucial for users to understand blockchain vulnerabilities.

- In Vietnam, the growth rate of crypto users surged by 162%, reflecting the increasing interest in digital assets.

Common Vulnerabilities in Blockchain Security

Like a bank vault for digital assets, blockchain security must address several common vulnerabilities:

- Consensus Mechanism Attacks: Misleading information can undermine network integrity.

- Smart Contract Vulnerabilities: These can range from coding errors to misuse, leading to potential financial losses.

- Phishing and Scam Risks: As users become savvier, so do scammers with increasingly sophisticated strategies.

Security Standards to Consider in 2025

In light of recent threats, new standards must be adopted to ensure the safety of digital assets. Here’s how to secure your investments:

- Adopt Stronger Authentication Methods: 2FA (Two-Factor Authentication) is essential.

- Regular Audits for Smart Contracts: Tools for auditing smart contracts are fundamental. Make sure to read about how to audit smart contracts.

- Use Secure Wallets: Hardware wallets like Ledger Nano X reduce hacks by 70% and are highly recommended.

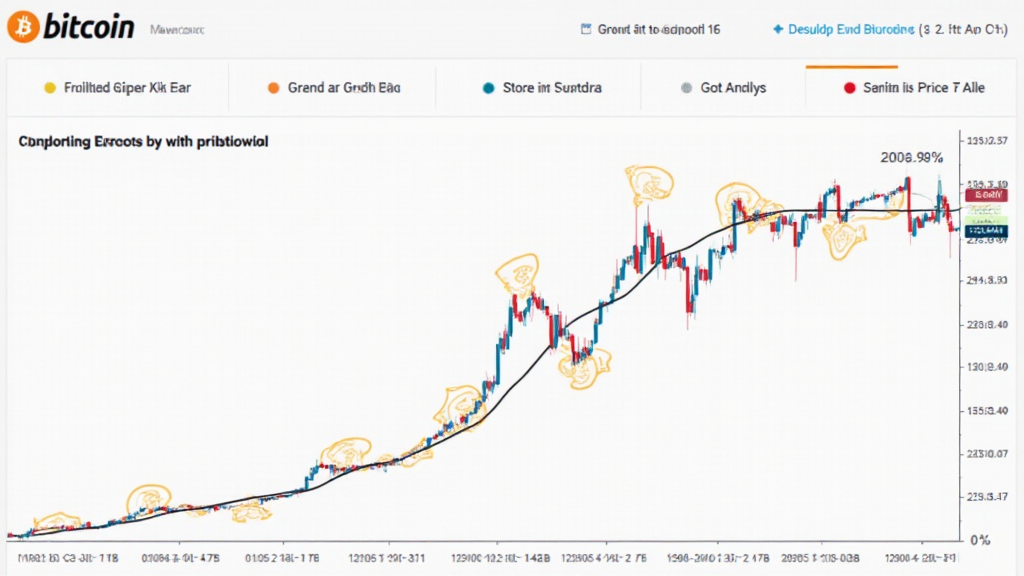

Calculating Crypto ROI in Vietnam

When engaging in crypto markets, calculating your return on investment (ROI) is critical.

- The formula for ROI is: ROI = (Current Value – Cost of Investment) / Cost of Investment x 100%

- In Vietnam, with the increase in crypto investments, understanding how to effectively calculate ROI helps mitigate risk.

The Role of Local Market Data

As noted in recent studies, the Vietnamese crypto market is thriving.

- With an estimated user base growth rate of 162%, local traders need to be knowledgeable about investment strategies.

- This includes evaluating the historical performance of cryptocurrencies and forecasting future growth.

Best Practices for Securing Your Investments

Here’s how to enhance your crypto safety and confidence:

- Educate Yourself: Stay updated with security news and standards.

- Utilize Trusted Platforms: Rely on platforms with high security ratings, such as mycryptodictionary.

- Continuous Monitoring: Regularly check your investments and remain vigilant against suspicious activities.

Conclusion

In the face of increasing threats and a rapidly evolving landscape, understanding blockchain security and implementing best practices are essential for every crypto investor, especially in Vietnam. By adopting these measures, users can protect their digital assets and maximize their investment ROI.

For those looking to explore more about cryptocurrency and how to effectively secure their investments, head over to mycryptodictionary for valuable resources and tools.

Expert Author: Dr. Nguyen Minh Tuan

– A renowned blockchain analyst, with over 10 published papers on digital asset security and extensive experience in auditing high-profile smart contract projects.