Introduction: The Changing Landscape of Vietnam’s Bond Market

In the ever-evolving world of finance, Vietnam has emerged as a vibrant hub for both domestic and international investors. In 2024 alone, an estimated $4.1 billion was lost to various financial lapses, drawing attention to the pressing need for robust security and thorough analysis of investment instruments. Among these, the HIBT Vietnam bond market stands out, with options that have not only gained popularity among local investors but have also attracted foreign interest.

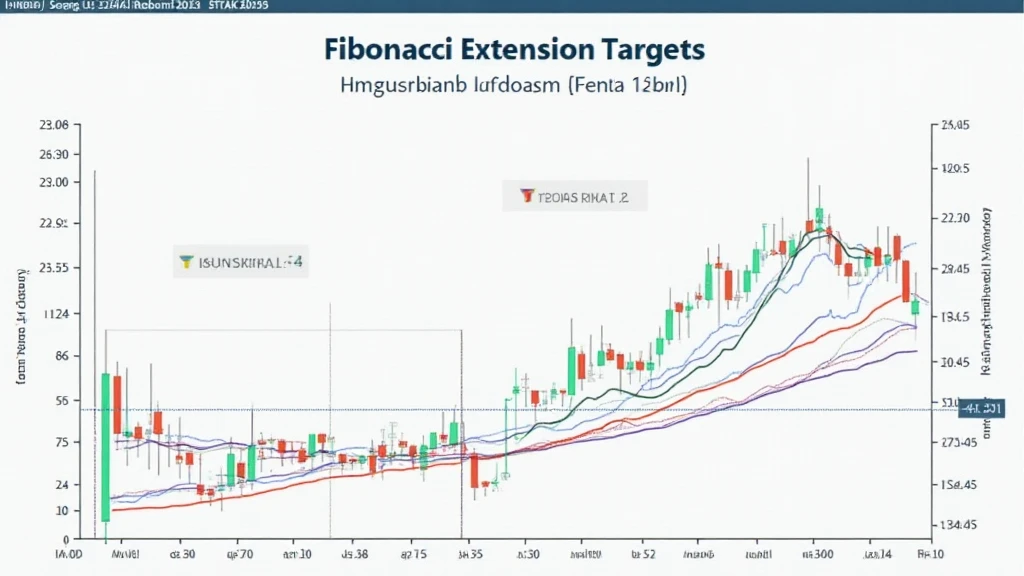

Understanding the Fibonacci extension targets is crucial for those looking to capitalize on growth opportunities in this market. These targets can serve as useful tools for predicting price movements and making informed investment decisions.

The Basics of Fibonacci Numbers: A Primer

Fibonacci numbers, a sequence where each number is the sum of the two preceding ones, have been utilized in various fields, from nature to finance. The extension levels derived from this sequence are particularly valuable for technical analysis in trading.

- Fibonacci Retracement Levels: Indicate potential support and resistance.

- Fibonacci Extension Levels: Used to forecast where prices might find their next significant resistance or support level.

For investors in Vietnam’s HIBT bonds, applying these concepts wisely can unlock greater insights into market trends.

Understanding HIBT Bonds: What You Need to Know

HIBT, or High-Interest Bond Trades, represents a significant segment of the Vietnamese market, providing lucrative options for those ready to balance risk and reward. The growth of HIBT bonds correlates with Vietnam’s economic growth, which has had a steady annual growth rate of roughly 6.5% over the past few years, according to reports by the General Statistics Office of Vietnam.

- Attractive Interest Rates: HIBT bonds often offer higher yields compared to traditional financial instruments.

- Liquidity: With the rising number of institutional investors, the liquidity of these bonds has markedly improved.

Investors should note that HIBT bonds contain risks typical of the bond market, including credit risk, interest rate risk, and market volatility.

Applying Fibonacci Extension Targets: A Practical Approach

Let’s break it down: Fibonacci extension targets can be invaluable when analyzing HIBT bonds. For example, if an investor purchase bonds at a specific price, determining potential future price points using Fibonacci levels can aid in decision-making.

Consider the following extension levels frequently used in trading:

- 61.8%: This level often serves as a primary target for traders.

- 100%: Indicates a significant move beyond the initial price level.

- 161.8%: Often viewed as an extreme target.

Investors may use historical price data to identify these levels and set realistic profit-taking strategies.

The Importance of Security Standards in Blockchain Technology

The rise of digital currencies has brought forth innovative investment avenues, including bonds linked with blockchain technology. Ensuring that your investments are safe is paramount in this age of digital finance.

As the landscape evolves, understanding tiêu chuẩn an ninh blockchain (blockchain security standards) becomes essential. Implementation of top-notch security measures can mitigate the risks associated with hacks and fraud in trading environments, contributing to market integrity.

How Vietnam’s Market is Adapting: Facts and Figures

Vietnam is not just passively watching global trends; it’s actively adapting. The local cryptocurrency market has seen a user growth rate exceeding 150% over the last two years, indicating a robust interest in innovation among the populace.

Furthermore, many local exchanges are now integrating Fibonacci tools enabling traders to make data-driven decisions. With continuous regulatory guidance, these tools can be both reliable and effective for assessing HIBT and other investment types.

Conclusion: Using Fibonacci Targets Wisely in HIBT Investments

In summary, understanding Fibonacci extension targets is a pivotal skill for investors navigating the vibrant yet intricate HIBT Vietnam bond market. These targets can help in pinpointing potential price movements and evaluating market positions effectively.

- Invest Wisely: Be sure to analyze historical patterns and current market trends.

- Stay Informed: Follow updates on market conditions and regulatory changes.

- Security First: Adopt rigorous blockchain security measures to safeguard your investments.

Investors who equip themselves with the right tools and knowledge can harness the potential of Vietnam’s financial landscape. Remember, each investment carries risk, and consulting with financial advisors or local regulators is always prudent.

For further insights into the upcoming potential of HIBT bonds and the cryptocurrency landscape, check out HIBT for accurate and up-to-date information.

Author: Dr. John Thompson, Finance Analyst and Blockchain Security Expert, has published over 20 papers on investment strategies and led audits for major financial projects across Asia.