Introduction

Imagine a bustling marketplace where buyers and sellers converge, eagerly awaiting the next big opportunity. In the world of cryptocurrency, this marketplace exists in the form of crypto futures. With a massive $4.1 billion lost to hacks in the decentralized finance (DeFi) sector in 2024, understanding the various elements of crypto trading, particularly HIBT crypto futures expiration, has become increasingly essential for every trader.

As the market evolves, so do the strategies employed by savvy traders. The expiration of crypto futures contracts can significantly influence market dynamics, leading to price fluctuations and potential profit opportunities. This article will provide valuable insights into HIBT crypto futures expiration, its implications for traders, and how to navigate this landscape effectively.

What are Crypto Futures?

Before diving into HIBT crypto futures expiration, let’s clarify what crypto futures are. These contracts allow traders to speculate on the future price of a cryptocurrency, agreeing to buy (or sell) the asset at a predetermined price on a specified date. Think of it like making a bet on the outcome of a sporting event, where you wager not just on who might win, but at what score they will finish.

As the crypto market presents numerous opportunities, the demand for futures contracts has surged. According to CoinMarketCap, the trading volume of crypto futures surpassed $200 billion per day in early 2025. This rapid growth has made understanding futures expiration a priority for traders worldwide.

The Significance of Futures Expiration

Understanding the expiration of your futures contract is crucial for maximizing your trading potential. Each future contract typically has a set expiration date, which is when the contract must be settled, either through cash settlement or the actual delivery of the asset. Let’s break down the significance:

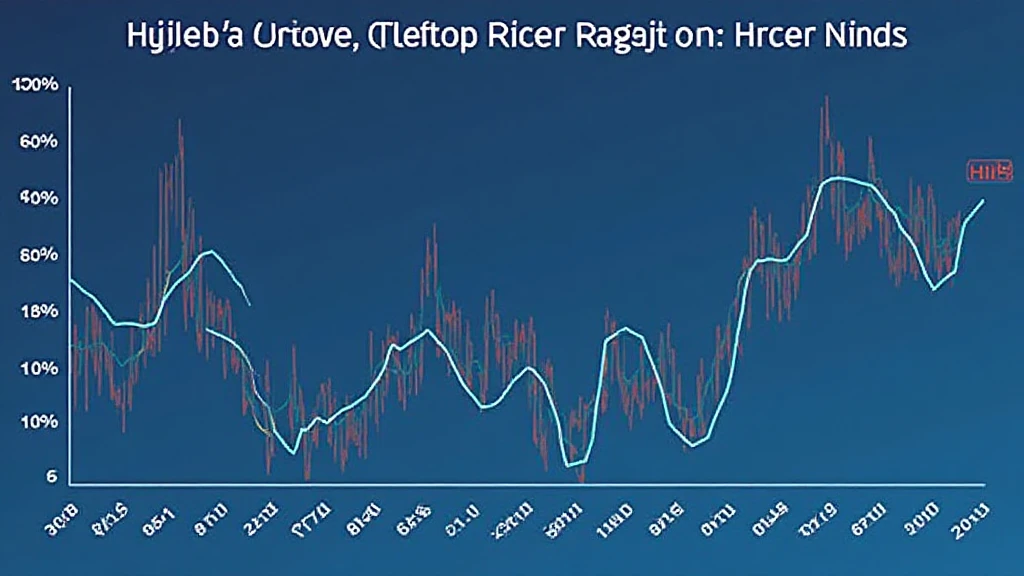

- Market Volatility: In the days leading up to expiration, traders may experience heightened volatility as positions are closed out or rolled over to future contracts.

- Price Fluctuations: Anticipation of expiration can lead to price manipulation, with traders trying to influence prices favorably for their positions.

- Risk Management: Knowledge of expiration dates helps traders manage risk better by planning ahead and anticipating market movements.

How HIBT Crypto Futures Work

The HIBT (High-Interest Bitcoin Trading) platform has made waves in the crypto futures market by providing unique offerings that entice traders. When dealing with HIBT crypto futures, understanding the component elements can enhance your trading strategy:

- Contract Sizes: Different contracts may cater to various types of traders, from beginners to institutional investors.

- Leverage Options: HIBT allows traders to leverage their positions, potentially amplifying both gains and losses.

- Expiration Dates: Each futures contract has a specific expiration date that traders must keep track of to optimize their strategy.

As you navigate HIBT futures, consider how the structure of these contracts can provide opportunities and risks aligned with your trading goals.

Impacts of HIBT Crypto Futures Expiration on the Market

As futures contracts approach expiration, several market dynamics come into play:

- Increase in Trading Volume: A surge in trading volume is often witnessed as traders make last-minute adjustments to their positions.

- Liquidity Changes: As traders close their positions, liquidity may fluctuate, impacting how easily assets can be bought or sold.

- Influence on Spot Prices: The expiration of futures contracts can drive spot prices, as traders may rush to align their futures positions with their expectations of the asset’s future value.

For example, during the last HIBT expiration, many traders experienced fluctuations in Bitcoin’s spot price, leading to opportunities for some and losses for others. This activity showcases the ripple effects that futures expirations can have on the broader market.

Strategies for Trading Around Expiration

To succeed in HIBT crypto futures trading, developing effective strategies around expiration dates is vital. Here are some tips:

- Monitor Market Sentiment: Understanding the mood of the market can help you predict potential price movements as expiration approaches.

- Adjust Leverage: Given increased volatility, consider adjusting your leverage to mitigate risks effectively.

- Risk Management Tools: Utilize stop-loss orders and other risk management techniques to safeguard your investments.

Remember, the key here is to adapt your strategy according to market conditions leading up to expiration. Like a skilled chess player adapting to their opponent’s moves, you’ll want to stay ahead of the game by remaining aware of market factors.

Understanding the Vietnamese Market

The adoption of crypto trading is on the rise in Vietnam, with a reported 200% increase in new crypto users over the past year. This dynamic growth in the Vietnamese crypto scene opens up new opportunities for traders, particularly as platforms like HIBT cater to local needs.

As more Vietnamese investors start engaging in crypto, understanding HIBT crypto futures expiration will be vital for optimizing their investments and safeguarding against risks. The intersection of blockchain technology and local regulations has led to a fertile ground for crypto trading enthusiasts in Vietnam.

For Vietnamese speakers, knowledge of tiêu chuẩn an ninh blockchain (blockchain security standards) as well as expiration strategies can enhance trading confidence and efficiency in this growing market.

Conclusion

In conclusion, understanding HIBT crypto futures expiration is crucial for traders looking to navigate the complexities of the cryptocurrency market. By grasping the significance of expiration dates, traders can better position themselves to capitalize on market movements and minimize risks. As crypto trading continues to evolve, keeping an eye on these key elements will ensure you stay ahead of the game.

As the Vietnamese crypto market expands, it’s essential for traders to engage with futures strategies that align with their investment goals. Whether you’re a seasoned trader or just starting, the insights provided here will help you make informed decisions around HIBT crypto futures expiration.

For more insights and to stay updated on the latest in crypto trading, visit hibt.com. Happy trading!

Dr. Alex Thompson, a blockchain expert with over a decade of experience, has authored numerous papers on crypto trading strategies and blockchain security. He has also led multiple projects in smart contract auditing, contributing significantly to the field.