Introduction: The Bitcoin Mining Landscape

Bitcoin mining is not just about finding the next block in the blockchain; it encompasses a myriad of challenges that miners face daily. As the popularity of Bitcoin surged, so did the mining difficulty, affecting miners globally. For instance, in 2024, approximately $4.1 billion was reported lost to DeFi hacks, showcasing the importance of security and strategy in cryptocurrency.

At mycryptodictionary, we aim to provide a thorough understanding of the Bitcoin mining difficulty analysis, detailing critical aspects that every miner or investor should be aware of. We will unravel the complexities surrounding mining difficulty, its implications, and strategies to adapt to this ever-evolving landscape.

Understanding Mining Difficulty: What Is It?

Bitcoin mining difficulty is a measure of how hard it is to find a new block. When more miners join the network, the difficulty increases, and when miners leave, it decreases, maintaining the average time between blocks at around 10 minutes. This adjustment is crucial; without it, blockchain transactions could face significant timing discrepancies.

The Adjustment Mechanism

- The Bitcoin network adjusts the difficulty every 2016 blocks, roughly every two weeks.

- This adjustment ensures that despite fluctuations in mining power, the time between blocks remains consistent.

- The algorithm calculates the time taken to mine the previous 2016 blocks and adjusts the difficulty accordingly.

For example, if blocks were mined too quickly, the difficulty would rise to slow down block production, and vice versa. This balancing act is akin to maintaining a steady speed limit on the roads, ensuring traffic flow remains efficient.

Factors Influencing Mining Difficulty

Several factors affect mining difficulty, including:

- The Number of Miners: More miners lead to increased competition, raising the difficulty.

- Hash Rate: This is the total computational power used to mine and process transactions. An increase in hash rate typically results in a rise in difficulty.

- Technological Advances: As miners develop more powerful hardware, the overall hash rate increases, necessitating an adjustment in difficulty.

As competition intensifies and technology evolves, miners in markets like Vietnam, where user growth surged by 15% in 2023, must continuously adapt.

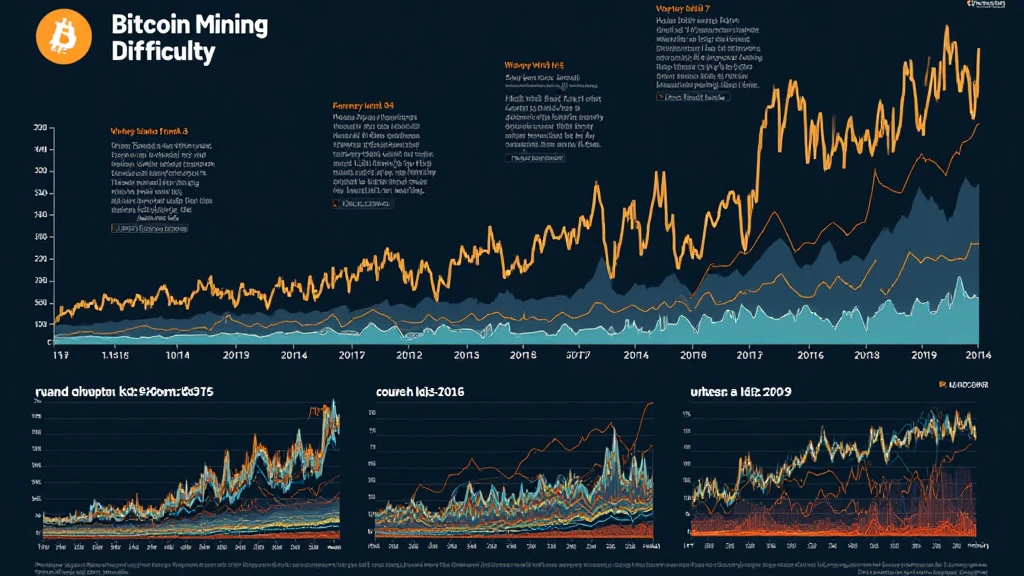

Analyzing Historical Bitcoin Mining Difficulty Trends

Understanding historical trends offers insights into future predictions. Since 2020, Bitcoin difficulty has seen significant fluctuations:

| Year | Mining Difficulty | Remark |

|---|---|---|

| 2020 | ~15T | Initial surge in popularity |

| 2021 | ~20T | Peak during the bull market |

| 2022 | ~25T | Following significant market corrections |

| 2023 | ~30T | Post-market recovery with more miners |

Source: Blockchain.com

The Impacts of Mining Difficulty on Miners

As the difficulty increases, miners face several challenges, including:

- Profitability: Higher difficulty means lower chances of earning rewards, leading to potential losses.

- Energy Costs: Mining requires substantial energy. A shift in difficulty can result in higher operational costs.

- Hardware Investment: Miners must continually upgrade their hardware to remain competitive, escalating overall costs.

Let’s illustrate this with a comparison: imagine a farmer needing to invest in more efficient machinery to maintain production levels as competition increases. Similarly, miners must invest in superior technology to keep pace with rising difficulty.

Strategies for Navigating Increasing Mining Difficulty

For miners facing increasing difficulty, various strategies can help optimize operations:

- Join Mining Pools: By aggregating resources, miners can increase their odds of earning rewards while distributing earnings.

- Invest in Efficient Hardware: Utilizing advanced ASIC miners can drastically enhance profitability.

- Explore Renewable Energy Sources: Reducing energy costs through sustainable energy options can significantly enhance margins.

As the mining landscape becomes more competitive, employing these strategies becomes essential for sustainability and growth.

Future Predictions: The Road Ahead

The future of Bitcoin mining difficulty analysis is promising yet challenging. As awareness grows, new institutions and individual miners are entering the space, leading to:

- Continued Difficulty Increases: More participants will typically lead to higher difficulty levels.

- Technological Innovations: The mining sector will likely witness significant advancements aimed at improving efficiency.

- Market Dynamics: Factors such as regulations and environmental concerns will shape how mining evolves globally.

It’s projected that by 2025, mining difficulty could reach unprecedented levels, reflecting the market’s maturity and the constant influx of new miners.

Conclusion: Staying Ahead in Bitcoin Mining

The Bitcoin mining difficulty analysis is crucial for anyone involved in the crypto space. Staying informed on trends, technological advancements, and market dynamics will empower miners and investors alike. By implementing efficient strategies and understanding difficulty fluctuations, individuals can ensure they thrive in an increasingly complex ecosystem.

So, whether you’re a seasoned miner or new to the game, remember: adapting to changes in mining difficulty can make all the difference in your profitability and longevity in the market.

For more insights and updates, visit mycryptodictionary.