Bitcoin Halving Historical Data: Impact and Insights

With the recent surge in Bitcoin prices, many investors are turning their attention to the upcoming halving event scheduled for 2024. Understanding Bitcoin halving historical data is crucial for any crypto enthusiast or investor. Halving events have historically been a significant catalyst for price changes and market behavior. For instance, did you know that after the 2020 halving, Bitcoin’s value skyrocketed from around $8,700 to nearly $64,000 in the following year? This article will uncover the effects and importance of halving events, supported by historical data and trends.

What is Bitcoin Halving?

Bitcoin halving is a fundamental event embedded in the protocol of Bitcoin, where the reward for mining new blocks is halved, effectively reducing the rate at which new bitcoins are generated. This occurs approximately every four years and is an essential part of Bitcoin’s monetary policy that influences its supply and, subsequently, its price.

- First Halving (2012): The mining reward dropped from 50 BTC to 25 BTC.

- Second Halving (2016): The reward was halved again from 25 BTC to 12.5 BTC.

- Third Halving (2020): Bitcoin mining rewards were reduced from 12.5 BTC to 6.25 BTC.

Each of these events has correlated with an increase in Bitcoin’s price in the years following the halving. Understanding these patterns can be significant for strategizing investment.

The Economic Impact of Bitcoin Halving

There are several economic implications of Bitcoin halving historical data:

- Supply and Demand Dynamics: Halvings decrease the supply rate of Bitcoin, creating upward pressure on prices if demand remains steady or increases.

- Market Speculation: Investors often purchase Bitcoin ahead of a halving, expecting a price increase post-event, which itself can drive prices up.

- Mining Economics: Halving impacts miners significantly. For instance, many miners may find it unprofitable to mine if Bitcoin prices do not rise post-halving.

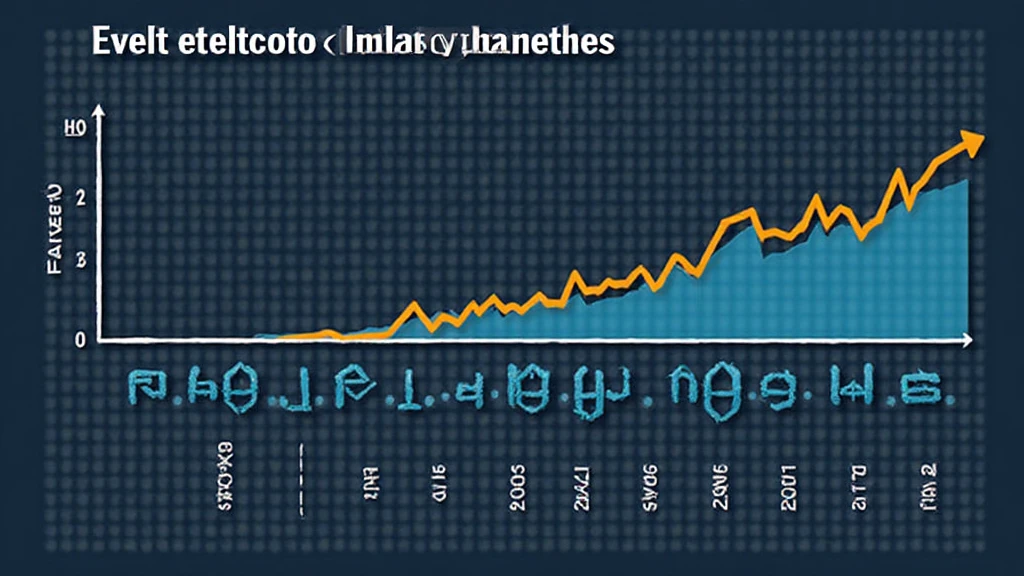

Historical Data Overview

To illustrate the significance of this event, let’s analyze the historical price changes associated with past halvings:

| Halving Date | Block Reward | Price at Halving | 1 Year Later |

|---|---|---|---|

| November 28, 2012 | 50 BTC to 25 BTC | $12.31 | $1,139.89 |

| July 9, 2016 | 25 BTC to 12.5 BTC | $650.63 | $2,525.85 |

| May 11, 2020 | 12.5 BTC to 6.25 BTC | $8,566.00 | $64,863.10 |

As observed, there’s a clear pattern: each halving has led to a substantial increase in price over the next twelve months. According to Hibt, the upcoming halving is expected to follow this trend, making it vital for investors to keep a close eye on the market dynamics.

Investment Strategies Around Halving Events

Given the historical impact of halving events, potential investment strategies include:

- Long-term Holding: Buying Bitcoin ahead of the halving and holding for a year is a common strategy.

- Dollar-Cost Averaging (DCA): This method allows investors to reduce the impact of volatility by investing fixed sums regularly.

- Use of Derivatives: Engaging in options and futures trading can capitalize on anticipated price movements.

Vietnam Perspectives on Bitcoin Halving

Vietnam has seen a remarkable growth in the cryptocurrency market, with a user growth rate that surged by 80% in 2022. This includes both retail and institutional investors alike joining the Bitcoin network. The Bitcoin halving event not only holds global implications but also affects local markets, paving the way for more interest from Vietnamese investors.

As Bitcoin undergoes its halving, users in Vietnam are increasingly seeking information on how they can benefit from these changes. Local exchanges and communities are buzzing with discussions around investment strategies and potential returns.

Preparing for the Next Halving: What Investors Should Know

As we approach the next Bitcoin halving event:

- Stay Informed: The crypto space can change rapidly. Following credible news sources and expert insights will keep you updated.

- Analyze Market Trends: Look for patterns in the price movement leading up to and following previous halvings.

- Engage with Communities: Join local and online crypto communities to share insights and strategies regarding Bitcoin and other cryptocurrencies.

Remember, this is not financial advice. Consult local regulators and consider your financial situation before making any investment decisions.

Conclusion: The Future of Bitcoin Post-Halving

In summary, understanding Bitcoin halving historical data equips investors with the knowledge to navigate the crypto landscape. Historical price movements suggest that halvings typically lead to significant price increases, yet other factors such as market sentiment and external economic indicators also play crucial roles.

As experts point out, Bitcoin’s supply-demand dynamics along with halving events will continue to shape the future of this digital asset. For anyone looking to dive into cryptocurrency, monitoring Bitcoin’s upcoming halving should be top of mind.

For more insights and guides on cryptocurrency investment, visit mycryptodictionary.

Author: Dr. Nguyen Hoa, acclaimed blockchain specialist, with over 15 published papers in digital asset security and a lead auditor of notable projects.