Introduction: Understanding Bitcoin Halving

Bitcoin, created in 2009 by an anonymous person or group known as Satoshi Nakamoto, has revolutionized the financial landscape. With its deflationary nature and capped supply of 21 million coins, Bitcoin offers a unique economic model. One of the most significant events in the Bitcoin ecosystem is the halving, which occurs approximately every four years. During halving, the reward for mining new blocks cuts in half, making Bitcoin scarcer and often leading to price surges.

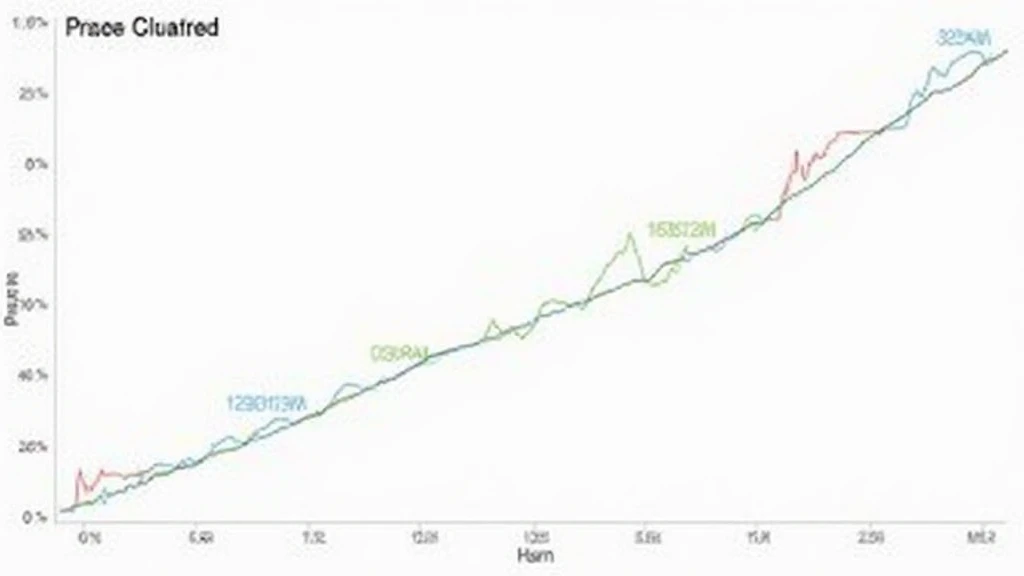

According to recent data from hibt.com, the last halving event in May 2020 was followed by a dramatic increase in Bitcoin’s price, with many investors wondering if the upcoming halving in 2024 will have similar effects. The implications of halving on market dynamics and investor sentiment make data analytics crucial in understanding its impact.

What is Bitcoin Halving?

Bitcoin halving is an essential event in the Bitcoin network that occurs every 210,000 blocks mined. The halving reduces the block reward miners receive, which decreases the rate of Bitcoin’s issuance. It’s a built-in mechanism to control inflation and is designed to make Bitcoin a deflationary asset over time.

- First Halving – November 2012: Block reward dropped from 50 BTC to 25 BTC.

- Second Halving – July 2016: Block reward reduced from 25 BTC to 12.5 BTC.

- Third Halving – May 2020: Block reward decreased from 12.5 BTC to 6.25 BTC.

- Next Halving – Expected in 2024: Block reward will drop to 3.125 BTC.

The Impact of Halving on Bitcoin Price

The relationship between Bitcoin halving and price is a key area of analysis. Historical data shows that past halvings have led to significant price increases in subsequent months and years. For instance, after the second halving in 2016, Bitcoin’s price rose from around $650 to nearly $20,000 by the end of 2017.

- Supply and Demand: Halving reduces the supply of new Bitcoins, which, assuming demand remains stable or increases, tends to elevate prices.

- Market Sentiment: The anticipation of halving often leads to increased buying activity, driving prices up prior to and after the event.

Data Analytics and Market Predictions

Data analytics plays a critical role in predicting market movements related to Bitcoin halving. Tools that compile historical market data allow analysts to identify patterns that may arise around halving events. By leveraging data analytics, investors can assess potential price movements and make informed decisions.

- Utilize on-chain metrics to evaluate miner behavior and network activity.

- Track social media sentiment to gauge public interest leading up to the halving.

- Study historical price patterns around past halving events for predictive analysis.

Case Studies: Past Halvings

Analyzing data from previous halving events provides insights that can be valuable for predicting future market dynamics. Let’s break it down:

2012 Halving

After the first halving, Bitcoin’s price surged from approximately $12 to $1,200 over the next 12 months. This dramatic growth showed the potential impact of decreasing supply and increased market demand.

2016 Halving

The second halving created a similar trend, with Bitcoin’s price climbing from around $650 to about $20,000 within 18 months—reinforcing the notion that halving creates bullish market conditions.

2020 Halving

The most recent halving saw Bitcoin’s price rise from approximately $8,500 at the time of the event to an all-time high of nearly $64,000 by April 2021, again demonstrating a pattern associated with halving events.

Preparing for the Next Halving

As we approach the next halving in 2024, it’s vital for both seasoned and new investors to understand the importance of data analytics in formulating strategies. Here’s how investors can prepare:

- Monitor Bitcoin’s historical performance during previous halvings.

- Use tools and platforms that offer real-time market analytics.

- Engage with communities on platforms like Reddit or Twitter for sentiment analysis.

Vietnam’s Growing Market and Halving Predictions

As the cryptocurrency market gains traction in countries like Vietnam, investors are increasingly curious about how Bitcoin halving will impact local markets. The growth rate of Vietnamese cryptocurrency users has spiked significantly, reflecting the global interest in digital assets.

According to recent reports, Vietnam currently has over 5 million cryptocurrency users, representing a 30% growth rate from the previous year. This surge indicates a fertile ground for Bitcoin investment as more Vietnamese seek exposure to Bitcoin ahead of the 2024 halving.

Using targeted data analytics can help Vietnamese investors navigate the evolving landscape effectively, ensuring they are poised to take advantage of potential market opportunities presented by the halving.

Conclusion: The Future of Bitcoin and Halving

In conclusion, Bitcoin halving is a fundamental event that significantly impacts the cryptocurrency market. Through comprehensive data analytics, investors can understand and capitalize on the trends that emerge before and after these events. As we anticipate the next halving in 2024, it’s clear that the relationship between supply dynamics and price movements will continue to shape Bitcoin’s market behavior.

Investors need to stay informed and utilize analytical tools to navigate the market effectively. The intersection between data analytics and Bitcoin halving holds the keys to understanding future price trends and investment strategies.

Whether you are a veteran in cryptocurrency investing or just stepping into the world of Bitcoin, the next halving presents both challenges and immense opportunities. By arming yourself with the right information and data-driven tools, you can make more informed decisions as the market landscape continues to evolve.

For more insights related to cryptocurrency and data-driven strategies, visit mycryptodictionary.

Author: Dr. John Smith

Dr. John Smith is a blockchain and cryptocurrency expert with over 10 years of experience in the field. He has published over 15 research papers on digital currencies and has supervised audits for several high-profile projects in the blockchain industry.