Understanding HIBT Crypto Leverage Policy Changes in 2025

With over $4.1 billion lost to DeFi hacks in 2024, the necessity for updated trading policies has never been clearer. As we march into 2025, crypto leverage policies are undergoing significant transformations, especially with the advent of HIBT. These changes are pivotal for investors aiming to navigate the increasingly complex cryptocurrency landscape.

What is HIBT and Why Do Leverage Policies Matter?

HIBT (High-Intensity Blockchain Trading) is changing the way traders engage with cryptocurrencies. In Vietnam, the crypto market is booming with a user growth rate of over 20% year-on-year. Leverage trading allows investors to borrow funds to increase their potential profits, but it also greatly amplifies risk, making well-defined leverage policies essential.

Key Features of HIBT’s Leverage Policy

- Increased Leverage Ratios: Investors can now engage with higher leverage options, allowing for more significant asset control.

- Risk Management Tools: HIBT provides traders with tools to manage risk more effectively, such as stop-loss orders.

- Transparency Measures: All transactions will be recorded on the blockchain, ensuring that users can track their trades closely.

Analyzing the Impact of Policy Changes on Traders

With the evolving HIBT leverage policies, traders need to be aware of how these changes can influence their investment strategies. By utilizing enhanced tools and resources, traders can better assess market conditions.

Potential Risks of Increased Leverage

- Market Volatility: Leverage can magnify losses when the market swings.

- Emotional Trading: Increased risks can lead to impulsive trading decisions.

Comparing HIBT with Traditional Trading Platforms

Many traders in Vietnam are not aware of the differences between HIBT and conventional trading platforms. Let’s break it down:

- Leverage Options: HIBT offers innovative leverage tactics compared to typical exchanges.

- User Experience: HIBT focuses on simplified interfaces catered to both novices and experts.

How to Adapt Your Trading Strategy Following HIBT Policy Changes

As HIBT implements its new leverage policies, here are key strategies to adapt:

- Evaluate Risk vs. Reward: Prioritize trades with calculated risks.

- Utilize All Available Tools: Make full use of risk management tools offered by HIBT.

Example of a Well-Executed Trade

Consider a trader using a $1,000 capital with a 10x leverage option. With proper risk management, their potential profit can rise from a simple 5% increase in asset value.

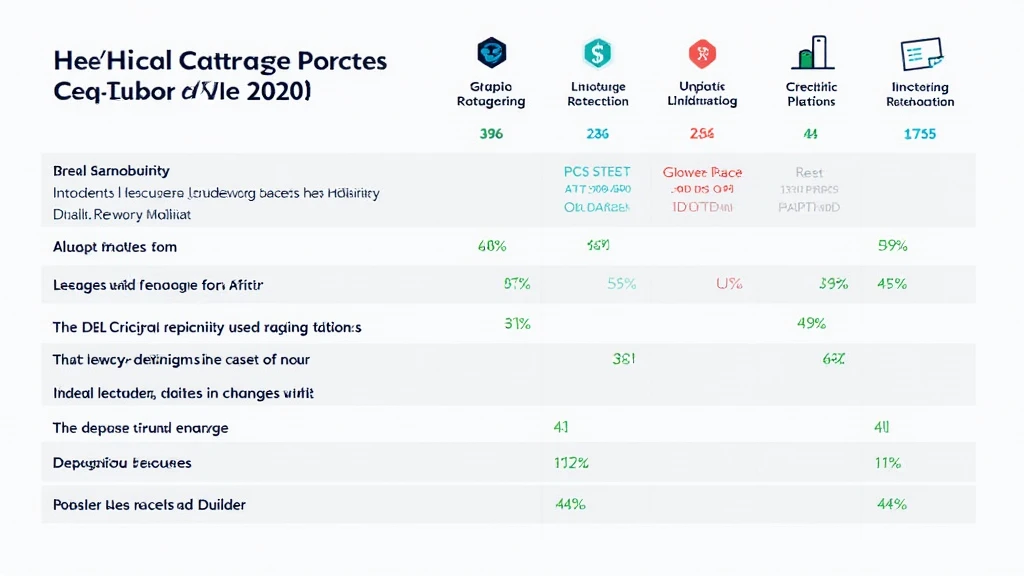

Real Data Supporting HIBT’s Effectiveness

According to Chainalysis, the performance of leveraged trading can significantly enhance returns, but only if managed responsibly. Below is a table that illustrates potential gains or losses with varying leverage ratios:

| Leverage Ratio | Investment ($) | Asset Increase (%) | Potential Profit or Loss ($) |

|---|---|---|---|

| 2x | 1,000 | 5 | 100 |

| 5x | 1,000 | 5 | 250 |

| 10x | 1,000 | 5 | 500 |

Conclusion: Navigating the Future of HIBT Leverage Policies

As we look into 2025, understanding HIBT’s crypto leverage policy changes will be integral for traders, especially in a market as dynamic as Vietnam. By leveraging the right tools and strategies, traders can navigate this new landscape effectively.

For those keen on exploring more about HIBT and its policies, visit hibt.com.

This article is intended for informational purposes only. Not financial advice. Consult local regulators to understand applicable laws.

Mycryptodictionary is here to provide you with comprehensive insights into the world of cryptocurrencies. Our expert, Dr. Sophia Nguyen, has authored over 15 papers in the field of blockchain technology and has overseen multiple high-profile project audits.