Exploring HIBT and Bond Liquidity Depth During Volatility in Vietnam

With the global cryptocurrency market fluctuating wildly, understanding the factors that contribute to bond liquidity depth is more crucial than ever. Specifically, the HIBT or High-Interest Bond Trading in Vietnam sheds light on how traditional financial mechanisms operate during times of volatility. In this article, we’ll delve into the intricacies of bond liquidity depth during market fluctuations and explore how Vietnamese investors can navigate this evolving landscape.

The Rise of Cryptocurrency in Vietnam

In recent years, Vietnam has seen a surge in crypto adoption, with the number of users increasing by over 250% in just two years. This dramatic growth can be attributed to various factors, including the increasing accessibility of crypto platforms and a growing interest in decentralized finance (DeFi). However, as crypto prices experience wild swings, the importance of understanding bonds as a more stable investment becomes apparent.

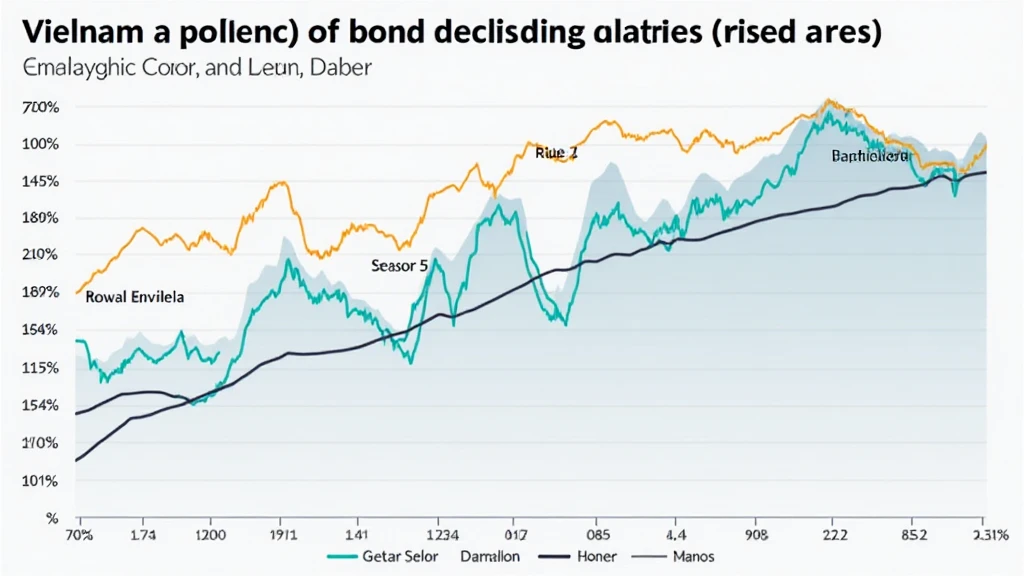

Understanding Bond Liquidity Depth

Bond liquidity depth refers to how easily bonds can be bought and sold in the market without significantly impacting their price. During periods of volatility, the liquidity depth of bonds becomes critical. For instance:

- High Liquidity Depth: This indicates that large transactions can occur without affecting the bond’s market price.

- Low Liquidity Depth: This implies that any significant transaction may lead to drastic price changes, causing investors to incur losses.

A recent report from Vietnam Bond Market Association (VBMA) revealed that liquidity depth in the Vietnamese bond market tends to diminish during periods of high volatility, which is crucial for investors focused on risk management.

The Role of HIBT in Vietnam’s Bond Market

The HIBT market in Vietnam plays a pivotal role in enhancing the country’s bond liquidity. With the government’s backing, HIBT is designed to provide higher yields compared to standard government bonds, attracting a more extensive range of investors, including foreign and institutional investors. This leads to:

- Increased Participation: A more extensive pool of participants can improve market liquidity.

- Diversification: Investors can diversify their portfolios by including high-yield bonds, especially in a volatile market.

Statistics from the State Securities Commission of Vietnam show that the participation rates in HIBT have grown by 30% annually.

Factors Influencing Bond Liquidity During Volatility

Several factors can influence bond liquidity during volatile periods:

- Market Sentiment: Investor sentiment often sways both stock and bond markets. Positive sentiment can boost liquidity.

- Policy Changes: Regulatory changes from government entities can have immediate and significant impacts on market dynamics.

- Global Economic Factors: Global economic stability is directly linked to how liquid the local bond market remains.

For instance, in April 2023, a policy change regarding tax incentives for bond investors led to notable spikes in liquidity depth, helping investors feel more secure amidst global uncertainties.

Vietnamese User Growth in Crypto Platforms

The Vietnamese cryptocurrency market is not just about trading; it also significantly impacts traditional finance, especially the bond market. The rapid increase in users is creating a more robust demand for high-yield bonds such as HIBT. Data from recent research indicates that over 40% of Vietnamese crypto users also invest in bonds, searching for stability during volatile crypto market conditions.

Conclusion

As we navigate through the complexities of the HIBT and bond liquidity depth during periods of volatility, it becomes evident that understanding these factors is essential for any investor in Vietnam’s rapidly changing market landscape. Doing so not only enhances investment strategies but also builds a robust foundation for making informed decisions amidst uncertainty.

For those interested in deeper insights, be sure to follow mycryptodictionary, where we regularly update our analyses of the evolving landscape of cryptocurrencies and traditional finance in Vietnam.

Author: Dr. Nguyen Phan, a renowned specialist in financial technology and investment strategy with over 15 published papers in the field, has led several major projects focused on enhancing local financial markets.