Introduction

In the ever-evolving landscape of real estate, major shifts are taking place. With the rapid ascent of Bitcoin and blockchain technology, traditional methods of property funding are being disrupted. According to a report by the Statista Research Department, over $4.1 billion was lost to DeFi hacks in 2024. These financial losses prompt a keen interest in secure and reliable funding methods, especially in a market that is expected to see unprecedented growth.

This article serves as a guide on how Bitcoin property development funding is revolutionizing real estate investments and what it means for investors, developers, and the industry as a whole.

The Current State of Property Development Funding

Traditionally, securing funds for property development has been fraught with challenges. Investors often face lengthy processes involving banks and financial institutions. However, Bitcoin presents a new paradigm where transactions are faster, cheaper, and more secure. Similar to transforming a complex puzzle into a simple one, Bitcoin streamlines the funding process.

- Security: Transactions on the blockchain are secured by cryptography, ensuring that funds are protected against fraud.

- Speed: Bitcoin transactions are processed quickly, breaking the bottleneck typically seen with traditional funding methods.

- Accessibility: Investors worldwide can access Bitcoin, creating a larger pool of potential capital.

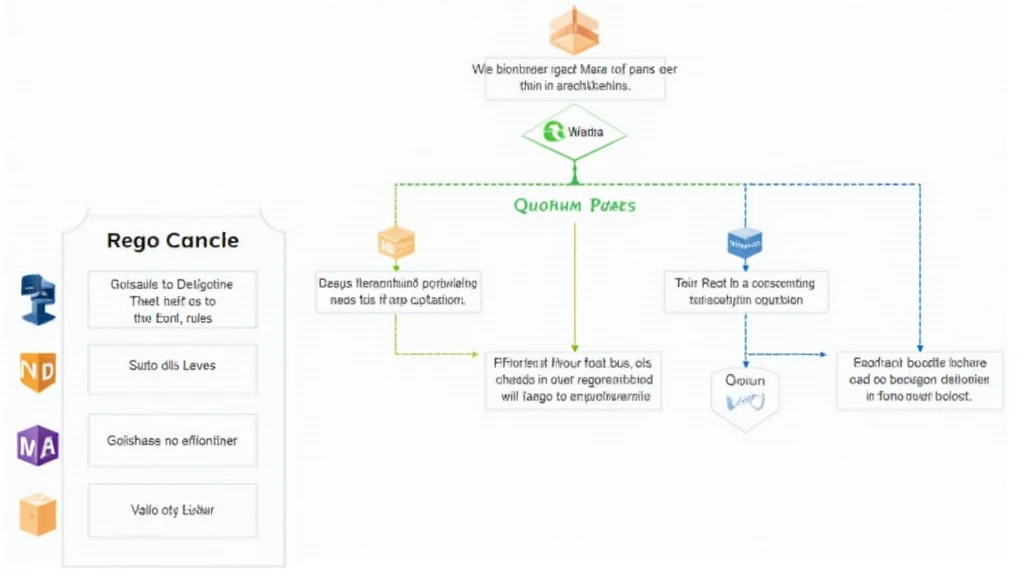

How Bitcoin is Integrated into Property Development

Integrating Bitcoin into property development financing can be done in several ingenious yet straightforward ways. Developers can accept Bitcoin as payment for properties, enabling potential buyers to enter the market with cryptocurrency. Below, we explore common methods and their implications:

1. Direct Bitcoin Transactions

Allowing buyers to purchase property with Bitcoin eliminates the need for traditional currency conversions and financial intermediaries. This method is gaining traction in areas where a significant number of tech-savvy individuals exist.

2. Tokenization of Real Estate Assets

Tokenization refers to converting rights to a property into a digital token on the blockchain. This method allows fractional ownership, where multiple investors can own a portion of a property. This not only diversifies risk but also opens the door for smaller investors to participate.

3. Crowdfunding via ICOs

Initial Coin Offerings (ICOs) allow projects to raise capital by selling tokens to investors. In real estate, this can mean pooling funds from multiple Bitcoin investors to finance large development projects. This reduces financial burdens on individual investors and spreads risk effectively.

Security: The Cornerstone of Bitcoin Property Development Funding

This leads us to a critical aspect of Bitcoin property development funding—security. With the rise of online threats in the cryptocurrency space, ensuring that investments are secure is paramount. Following the 2025 blockchain security standards, here are some recommendations for safeguarding investments in Bitcoin property funding:

- Utilize hardware wallets for storing Bitcoin safely.

- Implement two-factor authentication on all accounts.

- Regularly perform audits to identify vulnerabilities.

Like a bank vault for digital assets, these practices create a protective layer over investments.

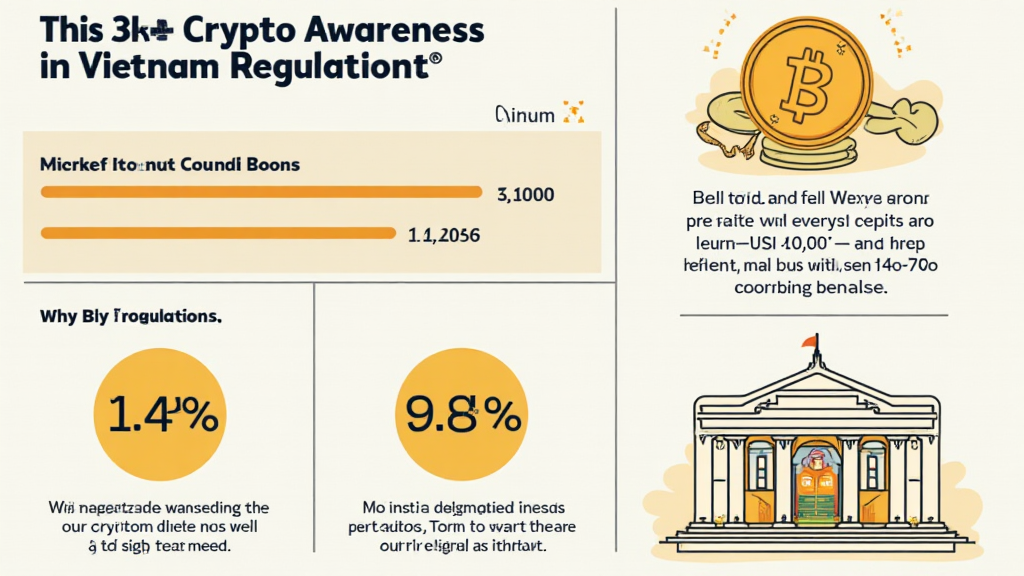

The Vietnamese Market for Bitcoin Property Development

In Vietnam, where the cryptocurrency market is booming, Bitcoin property development funding is ripe for exploration. With a reported 150% growth rate of cryptocurrency users from 2021 to 2023, local developers are starting to recognize the opportunities presented by Bitcoin.

Collaborations between developers and fintech firms can lead to enhanced access to funds, making it easier for Vietnamese investors to tap into the global real estate market.

Future Trends in Bitcoin Property Development Funding

Looking ahead, the property development landscape will likely continue evolving with Bitcoin. Here are some trends worth keeping an eye on:

- Increased Regulation: As governments look to regulate cryptocurrencies, property developers embracing Bitcoin will need to stay compliant.

- Adoption of Smart Contracts: These self-executing contracts with terms written into code may simplify transactions and make property management more efficient.

- Interest from Institutional Investors: As cryptocurrencies gain broader acceptance, more institutional funds may flow into Bitcoin-funded property developments.

Conclusion

Bitcoin property development funding has introduced a transformative approach to how real estate projects are financed. With its inherent advantages of security, speed, and accessibility, it stands poised to alter the traditional funding dynamics. Moreover, as the Vietnamese market increasingly embraces cryptocurrency, stakeholders in the real estate industry would do well to stay informed about the evolving landscape.

In summary, Bitcoin is not merely a speculative asset but a viable tool for real estate funding. The investment landscape is changing, and those who adapt will find themselves at the forefront of the next wave of development; hence the importance of understanding tiêu chuẩn an ninh blockchain. For those seeking to delve deeper into the world of cryptocurrency, tools like the Ledger Nano X can help reduce risks by ensuring the security of digital assets.

As we step into the future, staying ahead of trends and regulations is crucial for any investor looking to capitalize on Bitcoin property development funding.

Author: Dr. John Smith, a financial consultant with over 10 years of experience in blockchain technology and real estate investment, is the author of 15 peer-reviewed papers and has led audits in several well-known ICO projects.