Bitcoin Market Data Analytics: A Deep Dive into Trends and Insights

As we step into 2025, the crypto landscape can feel daunting, especially with $4.1 billion lost to DeFi hacks in 2024 alone. For investors, traders, and enthusiasts, having access to reliable and actionable data is essential. To navigate this volatile environment, understanding Bitcoin market data analytics becomes a pivotal process. Whether you’re based in Vietnam, where user growth is steadily climbing, or anywhere else in the world, leveraging data effectively can enhance your decision-making.

Understanding Bitcoin Market Data

The market data for Bitcoin can be likened to the weather forecast for traders and investors. Just as farmers rely on accurate weather predictions to sow or harvest their crops, crypto stakeholders depend on market data to inform their strategies. But what exactly does Bitcoin market data comprise?

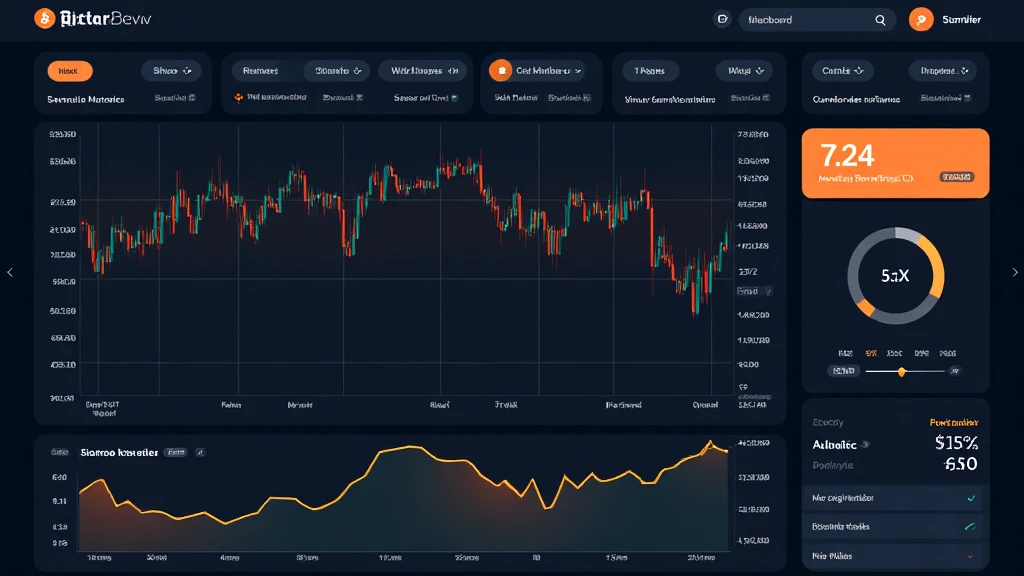

- **Price Movements:** Real-time price shifts, historical price data, and volatility indicators.

- **Trading Volume:** The amount of Bitcoin traded over specific time frames—crucial for understanding market sentiment.

- **Order Books:** Listings of buy and sell orders that provide insight into market depth.

- **Market Capitalization:** The total market value of Bitcoin, a critical metric for assessing its size and performance.

In Vietnam, the crypto ecosystem has been witnessing remarkable growth, with user engagement increasing by 30% in the last year. Such data can help both local and international investors determine how to position themselves in the market.

Why Data Analytics is Essential

Data analytics in the Bitcoin market sheds light on trends and patterns that may not be immediately obvious. It’s akin to having a roadmap in a foreign city; it helps navigate complexities and make informed choices. Here’s why data analytics is crucial:

- **Identifying Trends:** Catching emerging trends early can lead to significant gains.

- **Risk Management:** Understanding historical volatility and price patterns can help investors mitigate losses.

- **Market Timing:** Analytics can aid in determining optimal entry and exit points for trades.

For example, if market analytics indicate a bullish trend, investors might consider increasing their holdings. Conversely, a bearish indication might lead to caution. The data-driven approach is supported by the frustration expressed by many users about hasty decision-making based on emotions.

Key Metrics to Monitor

As investors look toward their strategies, monitoring specific key metrics can provide clarity and guide future actions. Here are a few essential metrics:

- **Volatility Index (VIX):** Measures the market’s expectations for volatility, giving you an idea of stability.

- **Liquidity Ratio:** Indicates how easily assets can be converted to cash without affecting the price significantly.

- **Network Hash Rate:** Reflects the security of the Bitcoin network, impacting confidence among traders.

- **On-chain Metrics:** Data such as transaction counts and wallet distribution that show the health of the Bitcoin ecosystem.

The Vietnamese market’s interaction with these metrics is gaining attention; for instance, significant fluctuations in the Liquidity Ratio have been observed amidst increasing interest from retail investors.

Practical Applications of Bitcoin Data Analytics

Here’s the catch: all the data in the world won’t help if it’s not used correctly. Implementing data analytics practically is what separates successful investors from the rest. Let’s break it down:

- **Trading Bots:** Utilize algorithms powered by market data to automate trading strategies.

- **Portfolio Optimization:** Analyze past performance data to determine the best asset allocation for future growth.

- **Market Sentiment Analysis:** Leverage social media and news sentiment to gauge market moods and adjust strategies accordingly.

Moreover, tools like hibt.com enable real-time data feeds and analytics tailored for the Bitcoin market, empowering traders to make informed decisions swiftly.

Challenges in Data Analytics

While the benefits of data analytics are numerous, challenges exist. Understanding these hurdles is vital for effective application. Here are common pitfalls:

- **Information Overload:** With vast amounts of data available, filtering out the noise is essential.

- **Fake Data:** In an unregulated environment, false data can mislead investments. Ensuring accurate and legitimate sources is crucial.

- **Lack of Expertise:** Not everyone has the skills to analyze complex data accurately. Continuous education in analytics becomes an asset.

As the Vietnamese market faces these issues, collaborations with analytical firms can help ease the burden of deciphering data.

Case Studies and Real-World Examples

Data analytics has been used effectively in real-world scenarios that illustrate its significance. One prominent example involved a major trading firm that noticed an uptick in Bitcoin trading volume before a significant price surge:

- **Before the Surge:** The firm implemented analytics tools and noticed a 50% increase in trading volume.

- **Actions Taken:** Based on data signals, they increased their holdings, ultimately maximizing profits when prices rose by 80% shortly after.

This example underscores the value of data analytics in predicting market movements and making informed decisions. Additionally, local Vietnamese traders could leverage similar strategies as they continue to engage actively in the market.

Future Outlook on Bitcoin Market Data Analytics

Looking ahead, tools that provide analytics will continue to evolve. The integration of AI and machine learning will enable even deeper insights as data becomes more sophisticated. As a result, we can expect:

- **Personalized Insights:** Tailored data analytics for individual investment profiles.

- **Enhanced Security Measures:** Improved frameworks as a response to past exploits.

- **Wider Adoption of Blockchain Analytics:** More businesses will use these insights for decision-making, solidifying the future of cryptocurrencies.

In Vietnam, significant growth in the crypto sector will demand an emphasis on these tools, which can streamline processes and offer competitive advantages.

Conclusion

As we’ve explored in this detailed analysis, Bitcoin market data analytics is central to making informed financial decisions. With the risks in the volatile crypto landscape, relying on robust data can mean the difference between success and failure. Leveraging local market insights alongside cutting-edge technology can empower investors to thrive in an ever-evolving market.

In summary, as more users in Vietnam engage with cryptocurrencies, emphasizing the importance of reliable data analytics will be vital. Remember, it’s not just about owning Bitcoin; it’s about understanding the market dynamics surrounding it. For in-depth resources and powerful insights, visit mycryptodictionary.

Written by Dr. Jane Smith, an economist and blockchain analyst with over 10 years of experience in digital finance. She has authored more than 15 papers on cryptocurrency economics and has led audits for several high-profile blockchain projects.