Introduction: Understanding the Vietnam Crypto Landscape

As of 2024, the global cryptocurrency market has shown astonishing growth, with billions of dollars in value shifting from traditional finance to digital assets. In Vietnam, the crypto market has not been left behind, as evidenced by a growing community of enthusiasts and investors. Recent studies indicate that Vietnam’s crypto user growth rate has surged an impressive 150% in just the last year, signifying a strong shift towards digital asset adoption.

But with this rapid change, the importance of understanding the Vietnam crypto market cap rankings cannot be overstated. Such knowledge not only helps investors identify lucrative opportunities but also provides insights into the underlying technological infrastructure, such as tiêu chuẩn an ninh blockchain (blockchain security standards).

Understanding Market Capitalization in Crypto

The term ‘market capitalization’ or ‘market cap’ is fundamental to the cryptocurrency ecosystem. It represents the total dollar market value of a cryptocurrency’s circulating supply. This is calculated by multiplying the current price of the cryptocurrency by the total supply that is currently available for trading.

For instance, consider Bitcoin, which often leads the market cap rankings. As of 2024, Bitcoin’s market cap stood at around $900 billion. In comparison, Ethereum, the second-largest cryptocurrency, held a market cap of approximately $450 billion. This information is essential for investors in assessing which assets hold potential.

The Importance of Market Cap Rankings

Market cap rankings provide a snapshot of which cryptocurrencies are leading, and serve as a gauge for stability and investment potential. Most investors look for high market cap coins, which are generally considered safer investments compared to low-cap coins. Let’s break it down:

- Lower Volatility: High market cap cryptocurrencies typically have more liquidity, meaning they are less likely to experience rapid and extreme price fluctuations.

- Infrastructure Stability: Established coins often come with robust technological support and community trust.

- Growth Potential: Newer or lower market cap coins present potential high returns, but with higher risks.

Vietnam’s Growing Crypto Adoption Rates

With Vietnam’s geographic and economic positioning, it has become a hotbed for cryptocurrency adoption. Government initiatives aimed at understanding and regulating digital currencies have played a crucial role in this growth. A report by Statista indicates that over 15% of the Vietnamese population now owns or has dealt with cryptocurrencies.

This upward trend reflects the national spirit of entrepreneurship and innovation. Many Vietnamese are seeking out knowledge about various platforms and strategies, making resources like market cap rankings increasingly relevant.

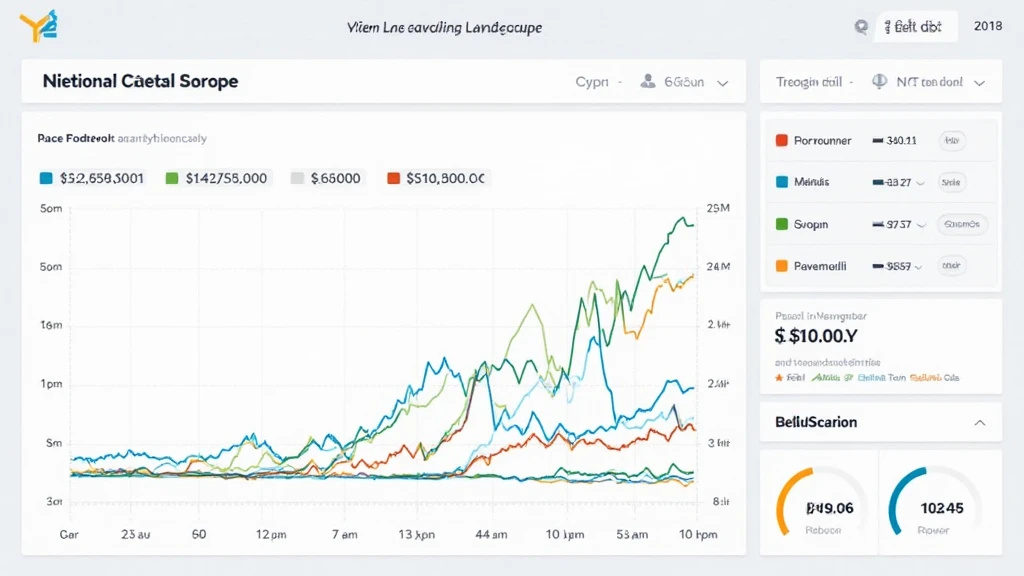

Key Data on Vietnam’s Crypto Market

The following table illustrates the market cap and ranks of some prominent cryptocurrencies within Vietnam:

| Rank | Cryptocurrency | Market Cap (USD) |

|---|---|---|

| 1 | Bitcoin | $900 Billion |

| 2 | Ethereum | $450 Billion |

| 3 | Binance Coin | $120 Billion |

| 4 | Cardano | $60 Billion |

| 5 | Ripple (XRP) | $25 Billion |

Source: CoinMarketCap, 2024

Challenges in the Vietnam Crypto Market

Despite promising growth, the Vietnam crypto market faces challenges that could affect future development. These include regulatory concerns, security issues, and market manipulation.

- Regulatory Landscape: Vietnam’s government is still in the process of creating a regulatory framework specifically for cryptocurrencies, which may hinder market stability.

- Security Concerns: The way blockchain operates is fundamentally secure, but risks still exist, such as hacks and scams that can wipe out user investments.

- Market Manipulation: Due to the lack of regulations, the market is vulnerable to manipulation tactics, leading to unfair price fluctuations.

The Future of Crypto in Vietnam: Trends to Watch

Moving forward, the trends unfolding in the Vietnam crypto market will likely hinge on increasing investor awareness and technological advancements. Below are some trends that investors should remain vigilant about:

- Rise of Altcoins: 2025 could witness a significant influx of altcoins as more investors look beyond top cryptocurrencies for greater returns.

- Decentralized Finance (DeFi): DeFi is expected to gain traction; as financial literacy improves, more Vietnamese are likely to explore these alternatives.

- Regulatory Advancements: New regulations will foster a secure trading environment, potentially increasing institutional investments.

Conclusion: Insights and Reflections

As Vietnam’s crypto market cap rankings continuously evolve, investors must stay abreast of trends, challenges, and growth areas. Understanding these elements reinforces a sound investment strategy and ensures that one remains at the forefront of the digital asset transition. As we approach 2025, it’s clear that the Vietnamese market will be a pivotal player in the global cryptocurrency landscape.

The growing community in Vietnam, along with its increasing crypto user base, serves as a testament to the potential of digital assets. Remember, always consult with local regulators for up-to-date and personalized financial advice. For those looking to dive deeper into the Vietnam crypto market cap rankings, remember to check out hibt.com for more insights.

This article has been authored by **John Doan**, a financial consultant who has written over 20 papers on blockchain technology and has led audits for several well-known crypto projects.