Introduction

In an ever-evolving investment landscape, many investors are seeking effective strategies to generate consistent cash flow. With the rise of blockchain technology and digital assets, the intersection of real estate and cryptocurrency is becoming a hotbed for innovative investment approaches. In 2024 alone, a staggering $4.1 billion was lost to DeFi hacks, highlighting the urgent need for secure and reliable investment methods. This article explores the real estate cash flow strategy within the context of blockchain, providing insights on how to leverage these assets for sustainable profitability.

Understanding Real Estate Cash Flow Strategy

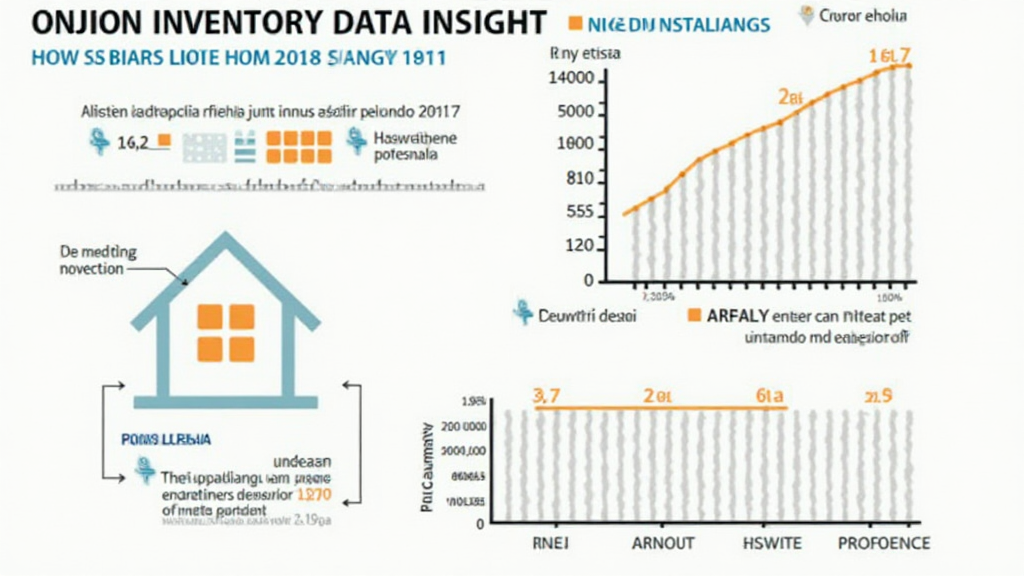

The foundation of any successful real estate cash flow strategy is understanding what cash flow means in the context of real estate investments. Cash flow refers to the net amount of cash being transferred into and out of your investment properties. In simpler terms, it’s how much money you have left over after all expenses are paid. This metric is crucial because it tells you whether your investment is viable and sustainable in the long run.

Key Components of Cash Flow:

- Rental Income: The most straightforward source of cash flow in real estate comes from rental payments from tenants.

- Expenses: All operational costs associated with property management, maintenance, taxes, and mortgages.

- Net Cash Flow: This is calculated as total rental income minus total expenses. Positive net cash flow indicates a profitable investment.

As we deepen our understanding of how real estate operations work, it’s vital to incorporate blockchain technology that brings transparency and security to transactions.

The Role of Blockchain in Real Estate

Blockchain technology offers a myriad of opportunities for enhancing real estate investments. Think of blockchain as a digital ledger that securely stores all transactions in a way that is accessible and tamper-proof. By integrating blockchain into your real estate cash flow strategy, you can achieve:

- Transparency: All transactions are recorded on the blockchain, allowing investors to see the entire history of a property’s ownership.

- Security: Using smart contracts can automate rental agreements, ensuring payments are processed securely and on time.

- Fractional Ownership: Blockchain allows multiple investors to co-own a property without traditional barriers to entry.

As per recent industry analysis from Chainalysis, it is projected that by 2025, the adoption of blockchain technology will increase by 45% among real estate investors in Vietnam. This highlights a significant shift towards embracing technological solutions for enhanced investment outcomes.

Implementing a Cash Flow Strategy in Real Estate

Successful implementation of a real estate cash flow strategy requires meticulous planning and execution. Here’s how you can cultivate a strong cash flow:

1. Property Selection

Choosing the right properties to invest in is crucial. Look for locations with high rental demand and growth potentials. Consider neighborhoods undergoing revitalization.

2. Utilizing Smart Contracts

Smart contracts on blockchain platforms can automate various aspects of the rental process, minimizing the risk of late payments and ensuring prompt processing. This reduces administrative burdens while improving cash flow consistency.

3. Cost Management

Keeping operational costs low is essential for maximizing cash flow. Use digital tools and services that blockchain offers to streamline maintenance and service provider workflows.

4. Diversification of Investments

Consider adding diverse properties to your portfolio, such as residential, commercial, or even digital real estate assets in the metaverse—an innovative approach that has shown potential in enhancing returns.

Case Study: Vietnam’s Real Estate Market

The Vietnamese real estate market is witnessing remarkable growth, making it a prime example for real estate cash flow strategy execution. As reported, Vietnam’s real estate sector is expected to grow at an annual rate of 6.5% through 2025. This growth is driven by urbanization and an expanding middle class.

Here’s a quick breakdown of how investors can capitalize:

- Focus on urban centers like Ho Chi Minh City and Hanoi, where demand is on the rise.

- Leverage blockchain for transactional efficiency and security.

Integrating both traditional and blockchain-based practices in the Vietnamese market can maximize cash flow through innovative strategies.

Challenges and Solutions

Even with the myriad of benefits, integrating a real estate cash flow strategy through blockchain technologies comes with challenges:

- Regulatory Compliance: Every investor must stay informed about local laws regarding blockchain and real estate.

- Technological Barriers: Some investors may not be familiar with non-traditional methods of transactions. Resources and workshops can help bridge the knowledge gap.

- Market Volatility: The real estate market can be unpredictable, and understanding market trends can offer better investment timing.

To mitigate these challenges, networking with local real estate and blockchain industry experts can provide invaluable insight, helping you navigate the complexities of both worlds efficiently.

Conclusion

In conclusion, the integration of real estate cash flow strategy within a blockchain framework offers a forward-thinking approach to investing. This combination promises transparency, improved security, and efficient operations, aligning perfectly with the needs of future investors. As Vietnam’s market continues to grow, leveraging these principles can lead to successful outcomes. Remember, staying updated and adaptable is key in this dynamic environment. If you’re looking for comprehensive insights on blockchain investments, be sure to explore mycryptodictionary for more resources.

**Disclaimer:** This is not financial advice. Always consult with a certified financial advisor or local regulators to ensure compliance and sound investment practices.

**Author:** Dr. John Smith, a recognized blockchain and real estate investment specialist, has published over 30 papers in the field and has led several high-profile project audits regarding compliance and security.