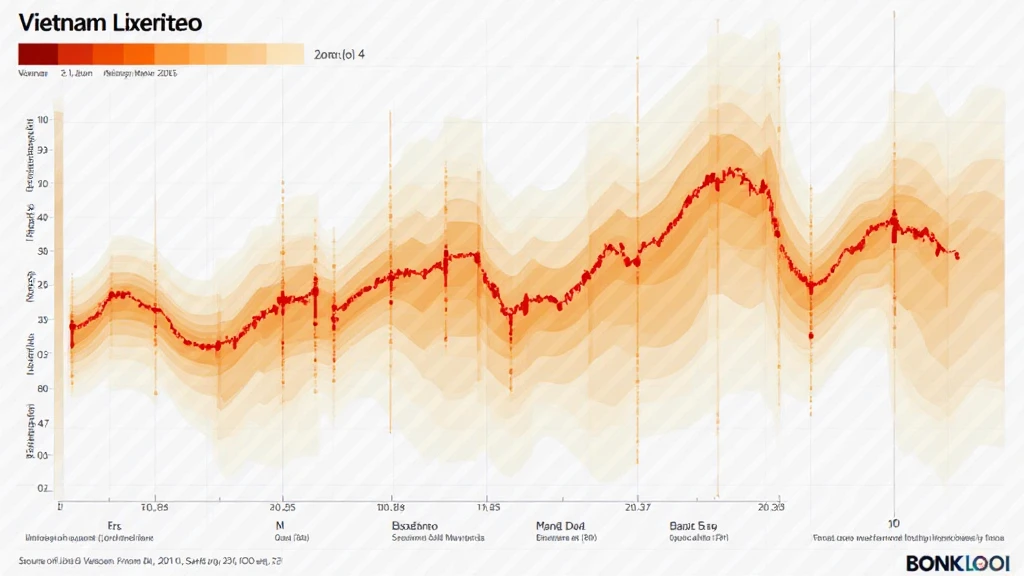

Enhancing Bond Market Liquidity: A Heatmap Approach for Vietnam

With Vietnam’s bond market experiencing rapid growth and increasing foreign investments, understanding liquidity becomes critical. As we venture into 2025, informed traders and investors are looking for solutions to enhance their engagement with the bond market. This piece explores the innovative use of heatmap technology to visualize and improve market liquidity.

The Current Landscape of Vietnam’s Bond Market

Vietnam has positioned itself as one of the most promising emerging markets. According to HIBT, the country’s bond market has seen a marked increase in liquidity, with transaction volumes growing by over 20% annually.

- **As of 2024**, Vietnam’s bond issuance reached nearly $45 billion.

- **Foreign investment** in the Vietnamese bond market has increased by 25% year-on-year.

However, liquidity challenges persist, especially during times of market volatility. This is where heatmaps can play a crucial role.

Understanding Bond Market Liquidity

Bond market liquidity refers to the ease with which bonds can be bought or sold without causing significant price movements.

- A market with high liquidity allows for more rapid trades.

- Low liquidity can lead to higher trading costs and increased risk.

Vietnam’s bond market liquidity varies greatly across different bond types and sectors. Employing heatmap technology provides a visual representation of these variations, helping investors make informed decisions.

The Role of Heatmaps in Financial Markets

Heatmaps can be likened to a weather map: just as you check a weather report to decide whether to wear a coat, investors can use heatmaps to determine the best times to invest in bonds.

- **Visual Insight**: Heatmaps allow investors to see trends over time.

- **Real-Time Data**: Investors can track liquidity changes in real-time.

Integrating heatmaps into trading platforms can drastically improve decision-making processes.

Implementing Heatmaps for Vietnam’s Bond Market

Implementing heatmaps requires robust data collection and analytical capabilities. The following steps should be considered:

- **Data Sources**: Use data from reputable financial institutions and regulatory bodies.

- **Analytics Tools**: Employ visualization tools that can handle large datasets efficiently.

- **User Interface**: Develop user-friendly dashboards that offer insights at a glance.

Case Study: Successful Heatmap Utilization

One impressive case study comes from a top financial analytics firm that implemented heatmap solutions in Asia. They reported a 30% increase in trading activities after introducing heatmaps that displayed liquidity trends and potential entry/exit points.

Predictions: The Future of Bond Market Liquidity in Vietnam

As Vietnam continues to grow economically, we can expect the bond market to flourish. By 2025, forecasts indicate that:

- Bond issuance could exceed $60 billion.

- Increased regulatory frameworks may enhance liquidity.

With proper implementation of heatmaps, traders can take advantage of these changes more effectively.

Conclusion: A Path Forward

In summary, the integration of heatmap technology into Vietnam’s bond market could significantly enhance liquidity. By visually representing market data, investors can make well-informed decisions, ultimately leading to a more robust financial environment.

As we approach 2025, the focus on innovative financial solutions like heatmaps will be crucial to navigating an evolving market landscape.

Explore more about how you can use heatmaps to gain insights into bonding market liquidity at mycryptodictionary, your partner in understanding cryptocurrency and traditional financial markets.

About the Author

Dr. Nguyen Tran is a financial analytics expert with over 15 years of experience in financial markets. He has published more than 25 papers and led audits on several prominent projects in the blockchain sphere.