Introduction

In recent years, the intersection of blockchain technology and finance has sparked unprecedented innovation. With the total losses from decentralized finance (DeFi) hacks reaching over $4.1 billion in 2024, it’s clear that securing digital assets is paramount for investors.

As part of this evolution, the Vietnam HIBT blockchain bond indices have emerged as a critical framework, offering insights into the investment landscape. In this article, we’ll explore what these indices entail, their significance, and how they play a role in shaping Vietnam’s digital asset market.

Understanding Blockchain Bond Indices

Blockchain bond indices are a novel asset class that blends traditional bonds with blockchain technology, enabling more transparency and security in trading. The Vietnam HIBT (Ha Noi International Bond Trading) blockchain bond indices provide a structured way for investors to gauge the performance of bond-like instruments in a blockchain environment.

How HIBT Indices Work

The HIBT indices employ a set of security standards, or tiêu chuẩn an ninh blockchain, that ensure the integrity of the transactions and the underlying assets. These indices track various bonds issued on the blockchain, assessing their performance through metrics such as yield, maturity, and credit risk.

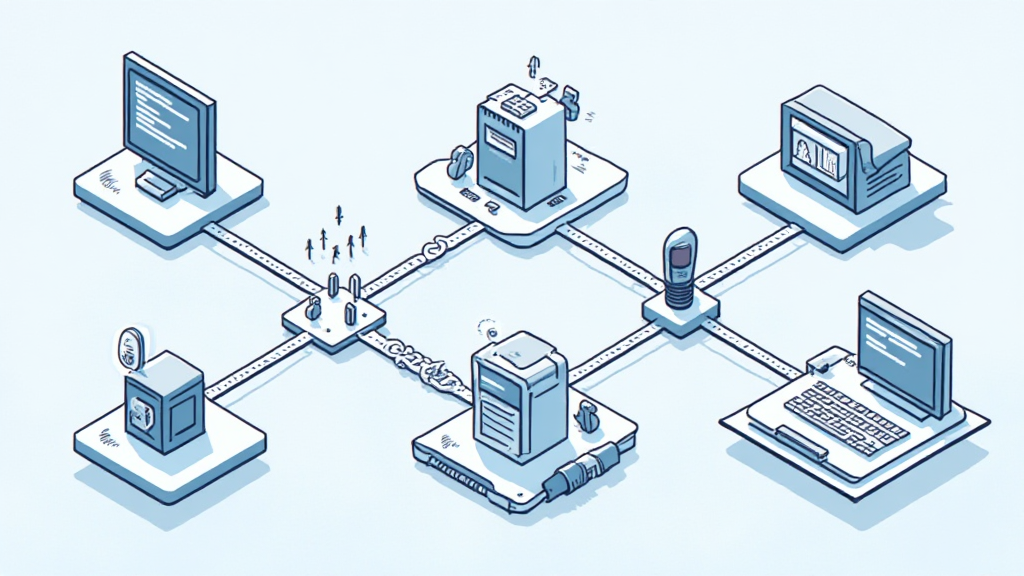

The Role of Blockchain Technology

By utilizing blockchain technology, HIBT indices reduce risks associated with fraud, increasing investor confidence. The transparency provided by blockchain allows stakeholders to track the bond’s status and performance in real-time, similar to how a bank vault secures assets.

Market Growth and Trends in Vietnam

Vietnam’s digital asset market has seen astounding growth, with a remarkable 30% increase in user adoption within the past year (source: Vietnam Fintech Association). This growth creates an optimal environment for the proliferation of blockchain bond indices.

Investment Opportunities

- Diverse Offerings: The HIBT platform allows for the tokenization of various assets, providing a wide range of investment options.

- Increased Liquidity: Blockchain bonds offer enhanced liquidity compared to traditional bonds, making it easier for investors to enter and exit positions.

- Regulatory Compliance: Entities involved in the issuance of HIBT bonds are required to adhere to local and international regulatory standards, ensuring a robust investment flow.

Future Projections

According to recent reports, the blockchain sector in Vietnam is projected to grow by over 50% by 2025, driven by advancements in technology and increasing interest in digital finance solutions.

Key Benefits of HIBT Indices

- Risk Management: The HIBT blockchain bond indices utilize advanced analytics to evaluate credit and market risks, providing investors with tools to make informed decisions.

- Accessibility: Through HIBT indices, even small-scale investors can participate in the bond market, democratizing access to financial instruments.

- Global Standards: The adaptability of HIBT indices sets a precedent for compliance with global standards, fostering increased foreign investment.

Challenges and Considerations

As promising as the Vietnam HIBT blockchain bond indices may be, they are not without challenges. Issues such as regulatory hurdles and market volatility present risks that both issuers and investors must navigate.

Regulatory Environment

The rapidly changing regulatory landscape in Vietnam poses a challenge for blockchain initiatives. Investors should stay informed to adapt to any new laws that may impact trading practices.

Market Fluctuations

Similar to traditional markets, blockchain bond indices can be susceptible to market fluctuations, which may affect investor confidence and operational efficiency.

Conclusion

In conclusion, the Vietnam HIBT blockchain bond indices represent a significant advancement in the integration of blockchain technology with traditional finance. By providing a regulated and transparent environment, they offer a promising avenue for investment in digital assets. As the sector matures, staying informed about trends, regulations, and the overall market landscape will be crucial for investors looking to capitalize on these opportunities.

For more insights and updates on blockchain investments and trends, be sure to check out hibt.com.

By embracing the potential of blockchain bond indices, investors can navigate this evolving financial landscape with confidence.