Vietnam Crypto Exchange Compliance Checklists: Ensuring Security and Trust

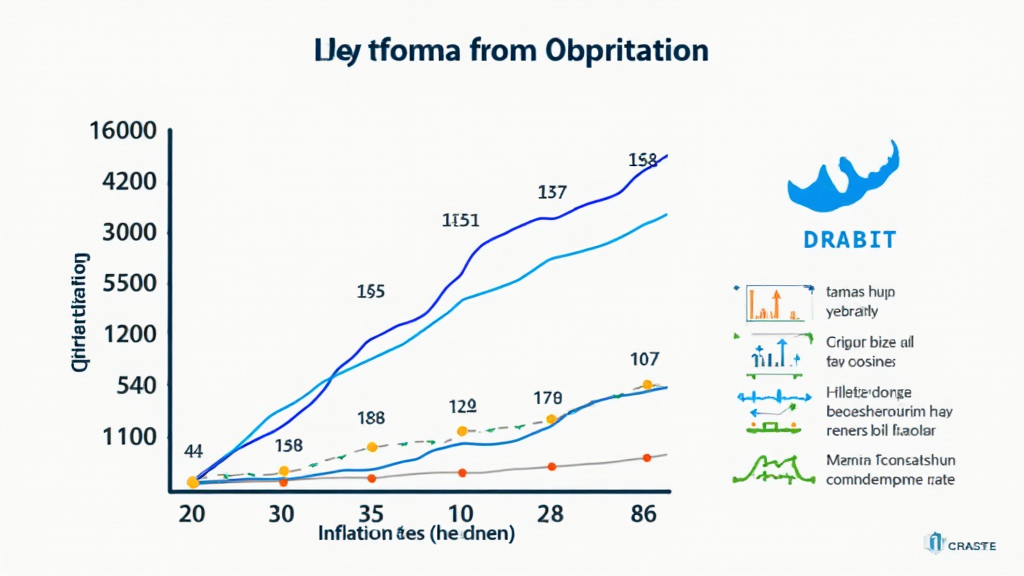

As the cryptocurrency market continues to flourish, with an astonishing growth rate of over 100% among Vietnamese users in the past year, ensuring compliance within Vietnam’s crypto exchanges has become paramount. In 2024 alone, $4.1 billion was lost to hacks in the DeFi space, igniting the need for robust compliance frameworks. This article delves deep into the compliance checklists needed for crypto exchanges in Vietnam, ensuring that operators can maintain trust, security, and regulatory adherence.

Understanding the Importance of Compliance

Compliance in the crypto landscape is akin to a bank vault designed to protect assets. It mitigates risks related to fraud, hacking, and regulatory penalties. For Vietnamese crypto exchanges, adhering to compliance standards establishes legitimacy and fosters trust among users. Here’s a breakdown of why compliance is essential:

- **Reputation Management**: Non-compliance can lead to a tarnished reputation, impacting user acquisition and retention.

- **Regulatory Adherence**: Vietnam has strict regulations for digital currencies that must be observed to operate legally.

- **Security Assurance**: Implementing compliance practices ensures that user funds and data are adequately protected.

Essential Compliance Checklists for Crypto Exchanges in Vietnam

Adhering to compliance standards requires a detailed checklist. Below is an exhaustive list that every cryptocurrency exchange operating in Vietnam should follow:

1. Know Your Customer (KYC) Protocols

KYC processes are designed to verify the identity of users and mitigate the risk of illegal activities. Implementing an effective KYC process involves the following:

- Collecting user identification documents.

- Verifying the authenticity of these documents through third-party sources.

- Maintaining an updated database of customer identities.

2. Anti-Money Laundering (AML) Measures

To combat the risk associated with money laundering, exchanges must follow robust AML measures:

- Establishing a comprehensive AML policy that includes transaction monitoring.

- Training staff on identifying suspicious activities.

- Regularly updating AML compliance protocols to adhere to local regulations.

3. Data Protection and Privacy Regulations

In a world increasingly concerned about data privacy, exchanges should protect their users’ information following local laws:

- Implementing strong encryption methods for user data.

- Conducting regular audits to ensure data privacy protocols are effective.

- Informing users about their privacy rights and how their data is used.

Why Adopting These Best Practices Matters

For crypto exchanges in Vietnam, compliance is not merely a requirement; it is a pathway to establish legitimacy, foster trust, and promote growth. As seen in recent data, Vietnamese users are increasingly adopting cryptocurrencies, showcasing a remarkable growth trajectory. However, this growth comes with its challenges, making compliance critical for operational success.

The Role of Regulatory Bodies in Vietnam

As the crypto landscape evolves, so do regulations. Regulatory bodies in Vietnam, like the State Bank of Vietnam (SBV), play an essential role in ensuring compliance. They issue guidelines that exchanges must adhere to avoid penalties, including the potential shutdown of operations. Here’s what exchanges should keep in mind:

- Stay updated on all regulatory changes within the cryptocurrency realm.

- Engage with regulatory bodies to clarify any doubts regarding compliance requirements.

- Provide adequate documentation during regulatory audits to demonstrate compliance.

Tools and Resources for Effective Compliance

Effective compliance doesn’t have to be an arduous task. Utilizing technology and resources can streamline compliance efforts significantly. Some recommendations include:

- KYC Automation Tools: Tools like hibt.com can help automate KYC processes, ensuring timely and accurate verification.

- AML Monitoring Software: Platforms that specialize in AML compliance can help monitor user activities in real-time.

- Data Encryption Services: Leverage encryption technologies to safeguard user data efficiently.

Future Trends in Crypto Compliance in Vietnam

As the cryptocurrency market evolves, so do compliance practices. Here’s what we predict for the future:

- Increased Regulatory Scrutiny: With more people investing, expect an uptick in regulatory oversight.

- Focus on User Education: Companies will prioritize educating users about compliance and security practices.

- Advanced Technological Solutions: Expect more AI-driven solutions to manage compliance issues effectively.

Conclusion: Building a Secure Crypto Future in Vietnam

In an ever-evolving crypto landscape, ensuring compliance is crucial for the success of exchanges in Vietnam. By utilizing the checklists and tools discussed, crypto operators can build a framework of security and trust. As we move toward 2025, ensuring adherence to compliance standards will be key to avoiding pitfalls and capitalizing on the booming digital asset economy. Now, it’s up to exchanges to heed the call for compliance and safety.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Always consult local regulators for compliance guidelines.

For more insights into blockchain security and compliance, visit mycryptodictionary.