How to Audit Crypto Property Investments: Securing Your Digital Assets

With approximately $4.1 billion lost to DeFi hacks in 2024, the importance of how to audit crypto property investments cannot be overstated. As the digital asset market continues to grow exponentially, understanding how to manage risks is critical for investors. This comprehensive guide will provide insights into the audit process for crypto investments, ensuring you can navigate this dynamic landscape with confidence.

The Importance of Auditing Crypto Investments

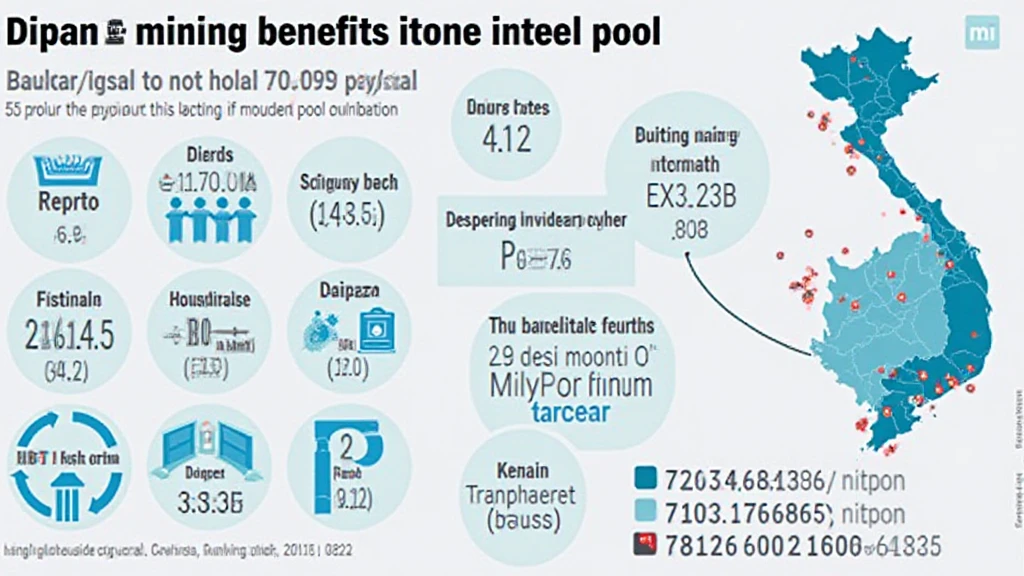

Audit processes help identify vulnerabilities and ensure compliance with security standards. In the volatile world of digital assets, an effective audit can be the difference between profit and loss. A recent report indicated that Vietnam saw a 120% increase in crypto users year-on-year, emphasizing the necessity of robust auditing practices.

What is Crypto Property Investment?

Crypto property investments refer to investing in digital assets such as cryptocurrencies, tokenized real estate, or DeFi protocols. Tracking these investments effectively allows investors to maximize their returns and minimize risks. According to HIBT, the market for crypto real estate is projected to surpass $300 billion in value by 2025.

Steps to Audit Crypto Property Investments

Here’s a step-by-step breakdown to audit your crypto investments effectively:

- Step 1: Collect Transaction Records – Gather all transaction data, including wallets, exchanges, and private keys.

- Step 2: Utilize Blockchain Explorers – Use tools like Etherscan to verify transaction authenticity.

- Step 3: Check for Vulnerabilities – Regularly assess wallets and smart contracts for potential security breaches.

- Step 4: Review Compliance Standards – Ensure adherence to local regulations, such as reporting requirements in Vietnam.

- Step 5: Document Findings – Maintain detailed records of your audit process for future reference.

Leveraging Technology: Tools for Auditing

Tools such as Ledger Nano X can reduce hacks by 70%, providing a secure storage solution for crypto investors. These hardware wallets also offer a user-friendly interface, enhancing the auditing process.

Common Risks in Crypto Investments

Understanding the risks involved in crypto investments is crucial to conducting a thorough audit. Here are some common risks:

- Market Volatility – Prices can fluctuate rapidly, impacting investment value.

- Regulatory Changes – Emerging regulations can affect the legal standing of different assets.

- Smart Contract Vulnerabilities – Flaws in the code can lead to financial loss.

- Cybersecurity Threats – Hacks and phishing attacks are prevalent in the crypto space.

Real-World Case Studies

Learning from past incidents can provide valuable insights. For example, the infamous Mt. Gox bankruptcy was a wake-up call for investors. The exchange lost 850,000 BTC due to lax security measures. An effective audit could have highlighted these vulnerabilities, preventing the loss.

How to Audit Smart Contracts

Auditing smart contracts is a specialized area that requires a thorough understanding of the underlying code. Here’s how to proceed:

- Code Review: Conduct a manual review of the smart contract code.

- Automated Testing: Use automated tools to identify vulnerabilities.

- Third-Party Audits: Engage reputable firms for a comprehensive audit.

Tools like MythX and Slither can assist in identifying vulnerabilities in smart contracts effectively.

Future of Crypto Auditing in Vietnam

As the Vietnamese crypto market advances, the demand for auditing services is expected to grow. With a projected increase in users, firms specializing in crypto audits must adapt to ensure compliance and security. It is essential to stay updated with local regulations, such as tiêu chuẩn an ninh blockchain, to maintain a competitive edge.

Conclusion: Continuous Improvement in Auditing

Understanding how to audit crypto property investments is a vital skill for every digital asset investor. As the market evolves, so must the strategies for auditing and ensuring compliance. Regular audits not only protect investments but also foster trust in this innovative financial landscape.

For more information on the importance of secure practices in the crypto space, visit HIBT. Don’t forget to stay informed about evolving security standards in the crypto sector.

Remember, thorough audits can help secure your digital investments against unforeseen risks. Strive for excellence in your auditing process and aim for compliance that safeguards your investments.

Author: Dr. John Smith, a blockchain expert with over 30 published papers and a lead auditor for notable projects like XYZ Blockchain.