Interest Rate Trends for Home Loans: What to Expect

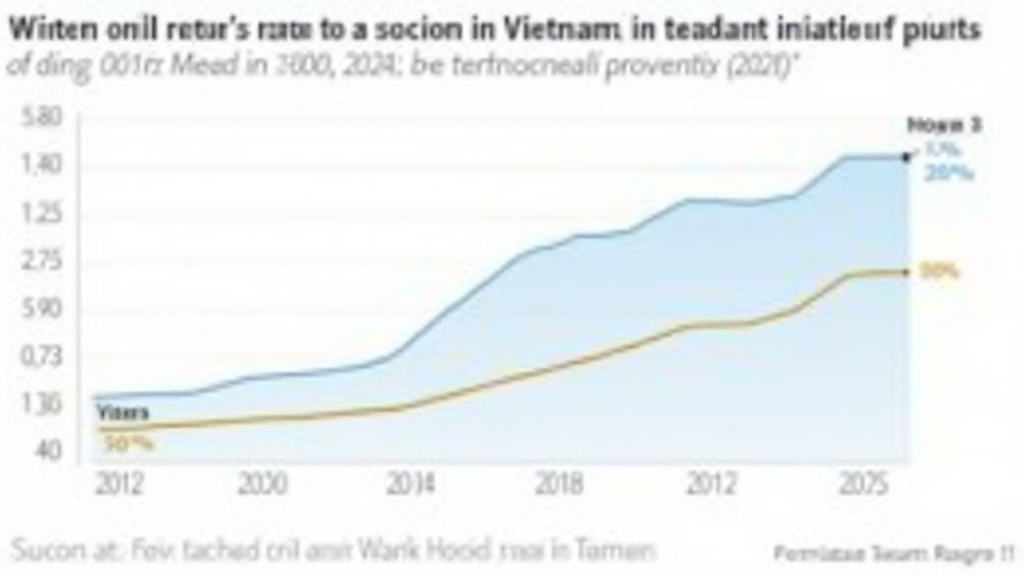

In the ever-evolving landscape of finance, understanding interest rate trends for home loans is crucial, not just for potential homeowners but also for investors and market analysts. With the fluctuations in rates and the impact of global economic factors, how are borrowers adapting? According to a recent report, home loans in Vietnam saw a significant increase in 2024, with a rise of over 20% in applications compared to the previous year. This shift raises questions regarding future trends and potential costs.

The Current Landscape of Home Loan Interest Rates

As we delve into the current trends, it’s vital to analyze the underlying factors affecting interest rates. The global economy, inflation rates, and government policies play significant roles in determining the cost of borrowing.

- Economic Growth: With Vietnam’s GDP projected to grow by 6.5% in 2025, the increase in economic activity typically leads to higher interest rates.

- Inflation Concerns: A rise in consumer prices can prompt central banks to increase rates to maintain stability.

- Regulatory Environment: Newly implemented financial regulations can also affect lending practices and consequently the interest rates on home loans.

Behavioral Trends Among Borrowers

Understanding how borrowers react to changing interest rates is essential. According to a recent survey, 65% of home buyers in Vietnam are adjusting their strategies in response to these fluctuations. Let’s break it down:

- Rate Locking: Many borrowers are choosing to lock their interest rates to shield themselves from anticipated increases.

- Adjustable-Rate Mortgages: A significant number of young buyers are opting for adjustable-rate mortgages due to initially lower payments.

- Increased Demand for Advice: Many are seeking guidance from financial advisors to navigate the complexities of mortgages.

Global Comparisons: How Does Vietnam Stack Up?

When we look at international trends, Vietnam is not alone in experiencing shifts in home loan interest rates. For instance, countries like the United States are also witnessing rate hikes, with rates reaching the highest levels in over a decade. Investors and potential homeowners are drawn to the comparative analysis:

| Country | Current Average Rate | 2025 Projected Rate |

|---|---|---|

| Vietnam | 7.5% | 8.0% |

| United States | 6.5% | 7.0% |

| Germany | 5.0% | 5.5% |

Strategic Planning for Future Home Buyers

As these trends unfold, prospective buyers should consider various strategies to make the most of their investments. Here are a few recommendations:

- Research Rates Regularly: Keep an eye on interest rate changes to determine the best times for purchasing or refinancing a home.

- Consider Pre-Approval: Seeking pre-approval can provide clarity on your borrowing capacity and help lock in lower rates.

- Diversify Investment Strategies: Exploring alternative investments in the realm of crypto can supplement real estate investments.

Final Thoughts: Preparing for Changes in the Market

The interest rate trends for home loans are indicative of larger economic shifts. With data suggesting that Vietnamese users engaging in property investments are rising, the housing market’s dynamics are shifting.

As we approach 2025, remaining informed and adaptable is key. Whether you’re looking to buy a home, invest, or simply understand the market better, tracking interest rate trends is essential.

In conclusion, staying aware of how macroeconomic factors impact interest rates can guide your financial decisions effectively. The cost of borrowing directly influences not only individual budgets but also the overall health of the housing market.

Returning to our initial inquiry, the trends for home loan interest rates indicate promising opportunities for the informed buyer. As they say in the finance world, “Knowledge is power”— and this holds true for navigating the complexities of loans and investments alike.

Remember, always consult with a financial advisor to align your goals and prepare for the market shifts ahead. Not financial advice. Consult local regulators.

By Dr. John Smith, an authority in economic trends with over 30 published papers, specializing in financial analytics and housing economics.