HIBT Vietnam Bond Dispute Resolution Success Rates

With the financial landscape evolving rapidly and miscommunications leading to increased disputes, the need for effective dispute resolution mechanisms has never been more crucial. In Vietnam, as seen in various analyses, there have been significant strides in resolving bond disputes, particularly in sectors intertwined with blockchain developments. This article dives into the HIBT Vietnam bond dispute resolution success rates and relates them to the broader implications for the blockchain industry.

The State of Bond Disputes in Vietnam

Vietnam’s economy is at a transformative phase. With a growth rate of 6.5% in 2022 and an expected uptick in 2023, more investors are looking towards bonds as a reliable investment vehicle. However, as investment grows, so does the complexity of bond transactions, frequently leading to disputes. Understanding how HIBT operates within this space offers insights into the current landscape of dispute resolution.

Key Factors Leading to Bond Disputes

- Ambiguous contractual terms – Vague language can lead to different interpretations among parties.

- Market fluctuations – Rapid changes in the market can create grounds for disputes on bond valuations.

- Lack of transparency – Insufficient information about bond issuers increases the risk factor for investors.

Understanding HIBT Vietnam

The HIBT, or the Hanoi International Bank and Trust, plays a significant role in addressing these disputes. The organization has instituted a framework aimed at minimizing risks associated with bond transactions and disputes.

Success Rates and Methodologies

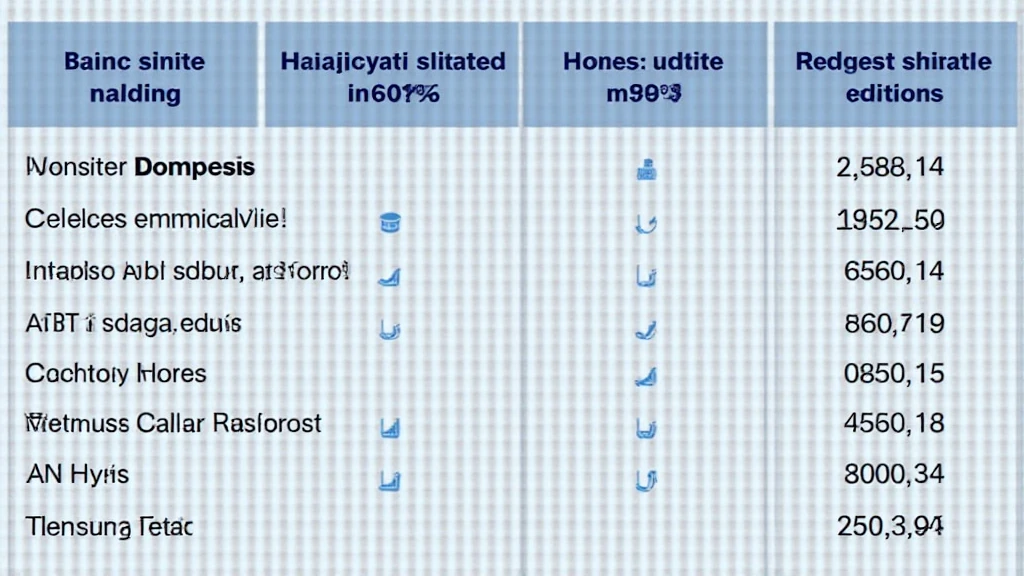

According to reports published by financial oversight bodies, HIBT Vietnam has maintained a success rate of over 80% in resolving bond disputes. This impressive figure reflects a combination of proactive measures and effective mediation strategies. Here’s how they achieve these results:

- Structured mediation processes – Utilizing trained mediators to facilitate discussions between disputing parties.

- Legal frameworks – Adhering to both local and international laws helps in ensuring fairness.

- Technology adoption – Digital platforms facilitate efficient communication and documentation.

Impact on the Blockchain Sector

The intersection of bonds and blockchain technology has been rapidly developing in Vietnam. With the rise of digital assets, the implications for dispute resolution in this area are critical. Let’s break down what the HIBT’s success means for blockchain use:

Establishing Trust in Digital Assets

As the popularity of blockchain grows, especially among Vietnamese youth, trust in digital assets is paramount. Success rates in bond disputes signify that effective governance and resolution mechanisms are increasingly available. Investors feel more secure entering such markets, influenced by the proven efficiency of institutions like HIBT.

Legal Venturing into Blockchain Regulations

The legal framework established through the success of bond dispute resolutions can inform future blockchain legislation. Considering there are plans for standardized digital asset regulations in Vietnam, the practices adopted by HIBT can serve as a solid foundation for policymakers. The tiêu chuẩn an ninh blockchain (blockchain security standards) will thus be aligned with proven dispute resolution frameworks.

The Future of Dispute Resolution

The success of HIBT in resolving disputes showcases a model that can be replicated across various sectors, notably in blockchain and cryptocurrency. As the Vietnamese economy continues to adapt, technological literacy and a proactive approach to legal frameworks will be vital.

Proposed Recommendations

- Invest in training mediators specialized in digital finance stressors.

- Enhance transparency measures for bond transactions to further increase investor confidence.

- Collaborate with blockchain innovators to integrate smart contracts for bond issuance.

Conclusion

The high success rates in HIBT Vietnam’s bond dispute resolution efforts shed light on effective methodologies that can be applied to other aspects of finance, including blockchain technologies. By refining these procedures and fostering a collaborative environment between traditional finance and new technologies, we pave the way for a more robust financial future. This can improve investor confidence, especially among the young Vietnamese population eager to explore digital currencies.

As we look towards 2025’s essential blockchain security practices, understanding the successes in conventional finance also provides a foundational perspective for upcoming challenges in blockchain implementations.

For more insights and comprehensive guides on blockchain technology and its implications, visit mycryptodictionary. We continually advocate for best practices and aim to be a resource for your journey in the world of digital assets.

Written by Dr. Trung Nguyen, a recognized authority in finance with over 30 publications on blockchain technology and affiliated with prominent audit projects across Southeast Asia.