Introduction: A Climate Crisis Needing Urgent Solutions

Climate change continues to pose significant threats globally, with rising global temperatures and increasing natural disasters. According to a recent report by the IPCC, the world has already warmed by 1.1°C. This urgent situation compels sectors across the globe to mobilize resources effectively to combat climate change. Enter HIBT bond climate initiatives, designed to channel investments toward sustainable solutions. These market mechanisms encourage green finance and drive impactful climate projects.

The Role of HIBT Bonds in Climate Initiatives

So, what exactly are HIBT bonds? HIBT refers to ‘High Impact Bond Targeting,’ a financial instrument aimed at funding renewable energy projects, conservation efforts, and other initiatives aligned with climate goals. Just like how traditional bonds fund infrastructure development, HIBT bonds pave the way for a sustainable future. They represent a growing trend in ESG (Environmental, Social, and Governance) investments.

Why HIBT Bonds Matter

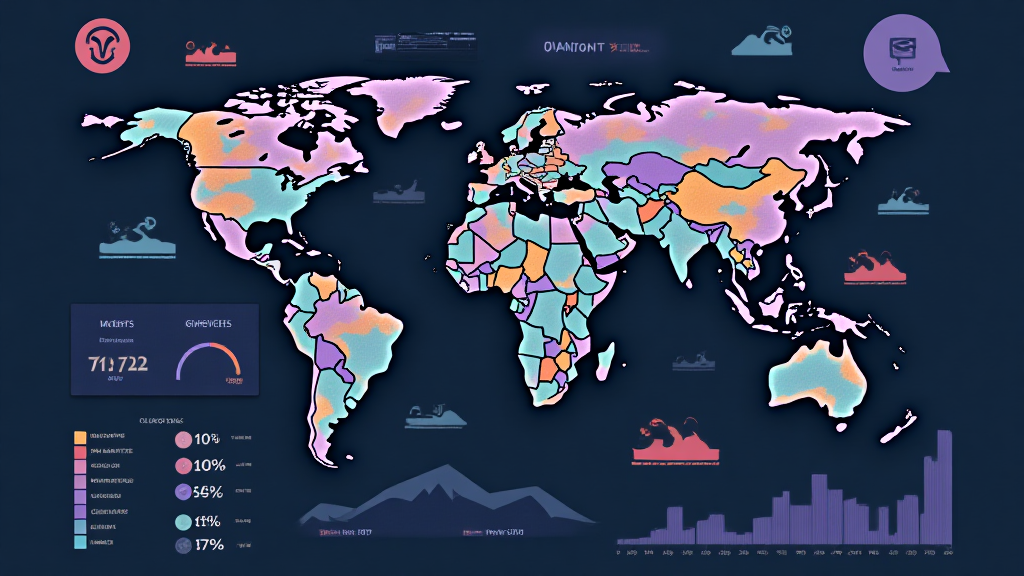

Investors increasingly recognize the importance of sustainability in their portfolios. According to a survey conducted by Morgan Stanley, about 85% of investors showed interest in sustainable investing in 2024. This surge reveals a shift in how capital is allocated; there is a substantial demand for projects that deliver both financial returns and contribute positively to environmental goals.

Understanding the Mechanics of HIBT Bonds

To navigate the complexities of this financial innovation, let’s break down how HIBT bonds operate:

- Investment Pooling: Just like traditional bonds, investors pool their capital together. This creates a substantial fund dedicated to climate initiatives.

- Project Selection: These funds are then allocated to selected projects based on their potential impact and viability.

- Returns: Investors receive returns proportional to the success of the funded projects.

- Monitoring and Reporting: Transparency is crucial. Project outcomes are monitored, and investors receive reports on their impact, ensuring accountability.

Case Studies: Successful HIBT Bond Implementations

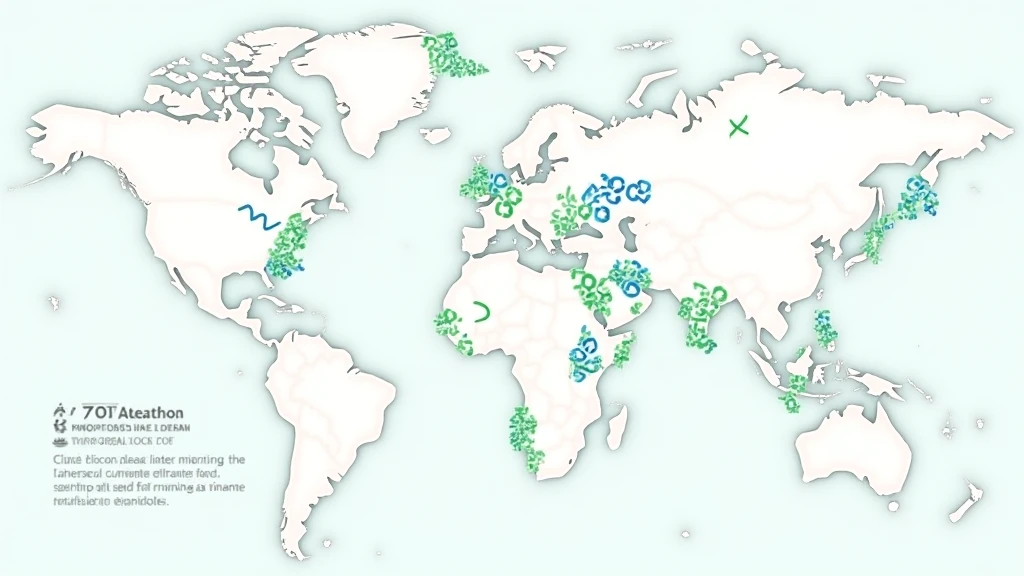

1. The Renewable Energy Project in Vietnam

In recent years, Vietnam has emerged as a leader in green financing, driving initiatives that leverage HIBT bonds. In 2024, Vietnam’s renewable energy sector grew by 20%, fueled by local and international HIBT bond investments. The country’s commitment to a green transition is evident in its ambitious target of achieving 30% renewable energy in its energy mix by 2030.

2. The Urban Sustainability Program in Southeast Asia

Another compelling case is the urban sustainability program across several Southeast Asian countries, showcasing collaboration driven by HIBT bonds. This initiative focuses on creating sustainable urban environments, with projects reducing carbon emissions by a staggering 40% in several urban areas over the last five years.

Navigating the HIBT Bond Landscape in Vietnam

As the demand for green financing increases, entering the HIBT bond market offers promising opportunities. Reports indicate that Vietnam’s green bond market is anticipated to reach $5 billion by 2025. Investors looking to navigate this landscape must focus on local regulatory frameworks and market dynamics to harness the full potential of HIBT bonds.

Potential Challenges

Though the outlook is optimistic, challenges remain:

- Regulatory Barriers: The Vietnamese regulatory framework continues to evolve, requiring continuous monitoring by investors.

- Market Understanding: Investors must be educated on the risks and rewards associated with sustainable investments.

Final Thoughts: The Road Ahead for HIBT Bonds

Ultimately, HIBT bond climate initiatives represent a crucial step toward sustainable finance. As global awareness around climate change deepens, the pressure on governments and financial markets to deliver viable solutions will only intensify. Embracing HIBT bonds could well be a game-changer, bridging the gap between financial performance and environmental responsibility.

Join the Movement

As a forward-thinking investor, getting involved in HIBT bonds not only broadens your investment portfolio but also contributes to a better world. Integrating these sustainable practices is not just smart—it’s essential. Explore opportunities and stay informed about the evolution of HIBT bonds and their local implications.

For more insights into HIBT bond climate initiatives and investment strategies, visit HIBT’s website.

About the Author

Dr. Nguyễn Văn An is a prominent climate finance expert, having published over 50 papers in the field of sustainable investment. He has led numerous high-profile audits on green projects across Southeast Asia, making him a credible voice in the era of renewable energy transformation.