Understanding Bitcoin Trading Psychology

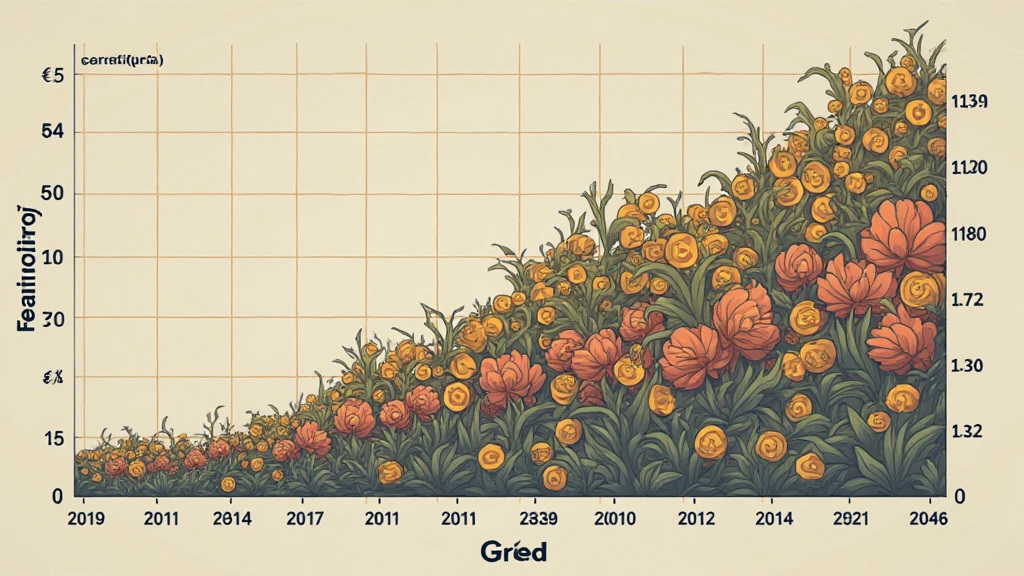

The world of Bitcoin trading is not only shaped by market trends and technological advancements but also significantly influenced by trading psychology. As cryptocurrencies evolve, traders are often driven by emotions such as fear and greed. This is particularly evident in emerging markets like Vietnam, where the Vietnamese Fear/Greed Index provides insights into market sentiment.

The question remains: How can traders in Vietnam make sense of fluctuations in sentiment and convert it into successful trading strategies?

What is the Vietnamese Fear/Greed Index?

The Vietnamese Fear/Greed Index is a tool that evaluates the prevailing emotions in the market, reflecting both fear and greed. By analyzing various indicators such as price momentum, volatility, and social media sentiment, traders gain a clearer view of the market’s psychological state.

Fear and Its Influence on Trading

Fear is a natural emotional reaction that can lead traders to make impulsive decisions. In the context of the Bitcoin market, fear typically arises from:

- Negative news affecting market stability

- Recent downturns leading to loss anxiety

- Increased volatility causing uncertainty

During periods of heightened fear, the tendency is to sell assets quickly to minimize losses. This can create a downward spiral, reinforcing negative market sentiment. For example, when Bitcoin prices dropped by 30% in early 2023, many traders panicked and sold off their holdings.

Greed and Its Market Impact

Conversely, greed can also be a potent force in trading. The allure of potential profits may lead to risk-taking behavior. Common signs of greed include:

- Investing heavily in trending digital assets

- Ignoring fundamental analysis in favor of hype

- Holding onto assets for too long in hopes of maximizing profits

In Vietnam, where interest in cryptocurrencies is surging, many traders may fall prey to the fear of missing out (FOMO). This emotional reaction can lead to inflated prices due to excessive buying, often followed by a market correction.

The Role of Cultural Factors in Vietnamese Trading

Cultural context plays a crucial role in shaping trading psychology. In Vietnam, rapid economic growth and increasing access to technology have led to a surge in interest in Bitcoin and other cryptocurrencies. According to reports, the number of active cryptocurrency users in Vietnam grew by over 25% in 2023.

The Influence of Local Market Trends

Local market dynamics significantly influence the fear/greed index. For instance, during periods of economic uncertainty or regulatory changes concerning cryptocurrencies, the sentiment can shift dramatically. Understanding these localized trends can help traders predict market movements more effectively.

Strategies to Mitigate Emotional Trading

To succeed in Bitcoin trading, especially within the Vietnamese market, it is essential to manage emotional responses effectively. Here are some strategies:

- Develop a Trading Plan: A well-defined trading strategy helps mitigate impulsive decisions driven by fear or greed.

- Stay Informed: Regularly update knowledge on market trends and technological advancements to make informed decisions.

- Set Limits: Establish clear profit and loss thresholds to avoid emotional trading mishaps.

- Utilize Tools: Employing tools like trading bots can help maintain discipline.

Analyzing Market Sentiment with Historical Data

Delving into the historical performance of Bitcoin can provide valuable insights. For example, analyzing past market movements can reveal patterns associated with fear or greed, allowing traders to anticipate potential market corrections.

Utilizing Data for Better Predictions

For instance, a study by Chainalysis in early 2023 indicated that market corrections often followed greed-driven spikes.

“According to Chainalysis, over 65% of market corrections in the past two years were preceded by an increase in greed indicators.”

The Future of Bitcoin Trading in Vietnam

The future of Bitcoin trading in Vietnam appears promising, driven by curiosity and increasing engagement in the digital economy. However, as traders navigate their journey, they must remain vigilant to the psychological factors at play. By closely monitoring the Vietnamese Fear/Greed Index and employing well-defined trading strategies, individuals can cultivate a more informed and disciplined approach to trading.

Key Takeaway: Understanding the psychological underpinnings of trading in Bitcoin is essential for traders in Vietnam. The ability to balance between fear and greed will not only enhance trading strategies but also instill confidence amidst market volatility.

Conclusion

In conclusion, exploring the HIBT Bitcoin trading psychology and the insights gleaned from the Vietnamese fear/greed index can significantly enhance traders’ understanding of the current market landscape. By utilizing this knowledge effectively, traders can better navigate the turbulent waters of Bitcoin trading and make informed decisions that align with their risk tolerance and market understanding.

As we move further into 2025, keeping abreast of both psychological trends and technical analysis will empower traders within Vietnam to position themselves strategically. If you want to dive deeper into cryptocurrency trading strategies, visit hibt.com.

Expert Author: Dr. Nguyen Anh, a leading authority in digital asset trading psychology, has published over 30 papers on cryptocurrency trends and has overseen the audit of major blockchain projects.