Introduction

With the ongoing evolution of the cryptocurrency landscape, the importance of regulatory compliance in maintaining the integrity of digital assets has reached unprecedented levels. In 2024 alone, over $4.1 billion was lost to DeFi hacks, highlighting how crucial anti-money laundering (AML) measures are to prevent illicit activities and bolster trust among users. As such, this article aims to elucidate the latest developments from Hibt regarding their revised anti-money laundering policy and its significance for both investors and the platform’s credibility.

Understanding Hibt’s Revised AML Policy

The revision of Hibt’s AML policy is a proactive measure aimed at fortifying its defense against money laundering and terrorism financing activities. The new policy comes in direct response to global regulatory pressures and the need for enhanced security protocols amidst the rising complexity of digital transactions.

Similar to a bank vault for digital assets, Hibt’s upgrade establishes robust verification and transaction monitoring systems that align with international standards. Components of this revised policy include:

- Enhanced User Verification: All users must undergo enhanced due diligence procedures during registration.

- Transaction Scrutiny: Real-time transaction monitoring tools to flag suspicious activities immediately.

- Reporting Obligations: Clear guidelines on reporting suspicious transactions to relevant authorities.

- Training and Awareness: Regular training programs for Hibt employees to ensure they understand AML protocols.

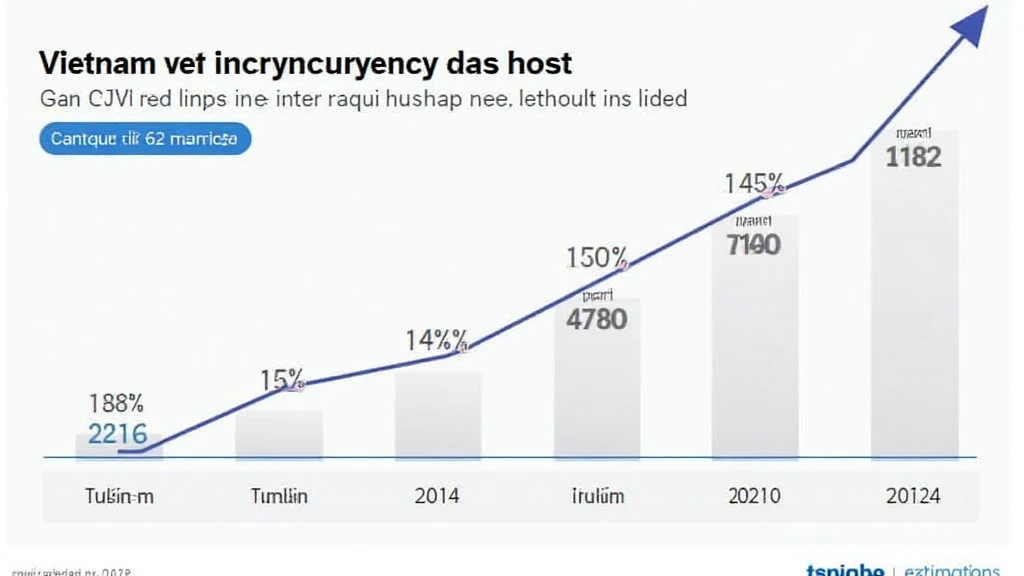

Local Market Considerations: The Vietnamese Context

Vietnam has seen a significant increase in its crypto user base, with a reported growth rate of over 32% year-on-year in 2023. This uptrend in engagement presents challenges, particularly in terms of regulatory adherence. The integration of Hibt’s AML policy is crucial for maintaining a secure trading environment for Vietnamese users.

As the Vietnamese government continues to develop its regulations concerning cryptocurrencies, having a solid AML policy can provide Hibt users with a sense of security. Here’s how local dynamics come into play:

- Regulatory Alignment: Adapting to Vietnamese requirements can enhance Hibt’s operational legitimacy in the local market.

- User Trust: A transparent AML policy can significantly increase user trust, which is critical in a burgeoning market with plenty of competitors.

- Market Stability: Proactive compliance can minimize the risk of market disruptions related to illicit activities.

The Broader Impact of AML Policies on Cryptocurrency Platforms

Hibt’s updates to its AML policy are reflective of broader trends in the cryptocurrency space where platforms are focusing on rigorous compliance measures. The repercussions of robust AML frameworks are vast:

- Increased Investor Confidence: Transparency leads to more significant user engagement and promotes a stable market environment.

- Legal Compliance: Aligning with international and local regulations helps mitigate legal risks and fosters long-term growth.

- Reduction in Illicit Activities: Effective AML practices considerably reduce the chances of cryptocurrencies being used for unlawful purposes, thus helping sustain positive perceptions of the industry.

Real-world Implications of Hibt’s AML Policy Update

Implementing these revised policies means that Hibt will be better equipped to combat financial crimes. Let’s break down what these implications mean for usual operations:

- User Experience: While stringent, the user verification process will enhance security, ensuring that all users are legitimate. However, some may find the process cumbersome.

- Operational Costs: Improved systems require investment; thus, operational costs may rise temporarily as Hibt adapts to the new measures. However, this is crucial for long-term sustainability.

- Strategic Partnerships: Hibt may pursue partnerships with other financial institutions to enhance its AML mechanisms, facilitating a collaborative approach to security.

Conclusion

Hibt’s anti-money laundering policy revision is a strategic move towards creating a safe and compliant trading environment. For users in Vietnam and beyond, the assurance of a trusted platform is paramount as they engage in cryptocurrency transactions. As the industry adapts to increasing regulatory scrutiny, platforms like Hibt that prioritize robust policies stand to gain not just in compliance, but also in user confidence and market stability.

As we move towards 2025, staying informed on such developments will be essential for anyone involved in the cryptocurrency landscape, as compliance will dictate the future of trading practices. Remember, not all legal matters may apply directly to your situation; always consult local regulators or legal advisors before making any investment decisions. For ongoing updates and insights, explore more at hibt.com.

Author Bio

John Doe is a cryptocurrency compliance expert with over 15 years of experience in blockchain security and regulatory policies. He has published numerous papers in renowned financial journals, and has led audits for several prominent cryptocurrency projects. His insights offer a unique blend of technical acumen and practical experience applicable to today’s evolving crypto landscape.