Introduction

Have you ever wondered how much disruption a new financial system could bring to an emerging market? With Vietnam witnessing a staggering 200% increase in cryptocurrency users over the last year alone, the effect of crypto banking on its economy cannot be underestimated. As traditional banking systems grapple with the rise of digital currencies, understanding the nuances of crypto banking in Vietnam becomes essential for investors, regulators, and consumers alike. In this article, we will unpack the significance of crypto banking in Vietnam and what the future holds for this evolving landscape.

Understanding Crypto Banking

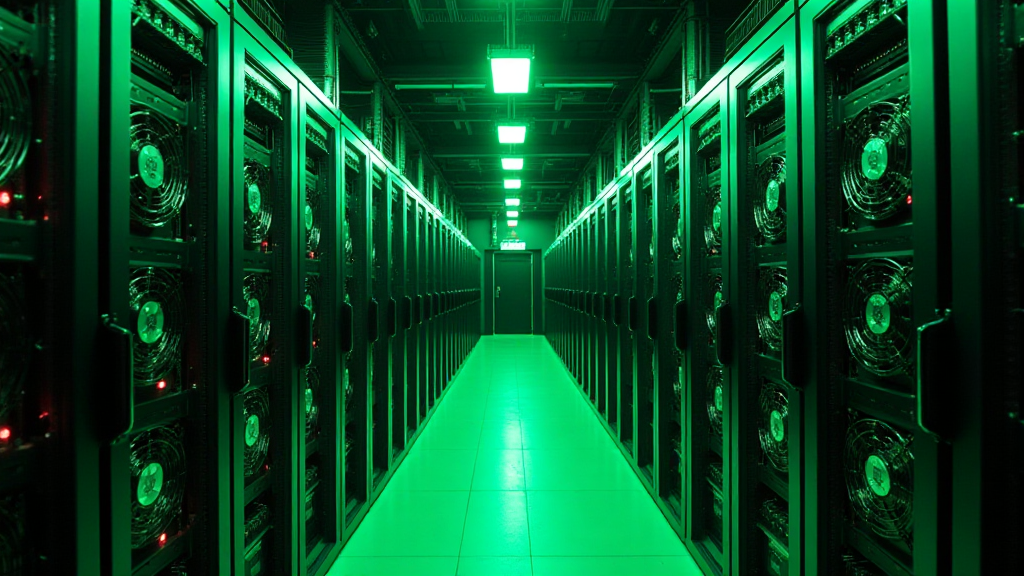

For many, the concept of crypto banking may seem abstract. So, what does it really mean? Picture a traditional bank where you can deposit, withdraw, and manage your finances but in a digital world powered by blockchain technology. Think of it as a secure vault for your digital assets.

According to recent studies, crypto banking refers to financial services that utilize cryptocurrencies and blockchain technology to provide banking services. These services often include storing, transferring, and lending cryptocurrencies, while also sometimes providing traditional fiat services.

Trends in Vietnam’s Crypto Banking Sector

Vietnam’s crypto banking sector is witnessing several key trends that merit attention:

- Increased Regulatory Framework: The government is beginning to establish guidelines for cryptocurrencies, thus increasing trust among users.

- Growing Local Exchanges: Platforms like hibt.com are gaining traction, providing easier access for users.

- Integration of DeFi Services: Decentralized finance (DeFi) applications are increasingly being adopted.

The Benefits of Crypto Banking

So, why should you consider crypto banking? Here’s the catch:

- Security: With tiêu chuẩn an ninh blockchain (blockchain security standards), users can enjoy heightened protection for their assets.

- Accessibility: One can access banking services anywhere, anytime without the need for traditional intermediaries.

- Lower Fees: Transaction costs are often significantly lower than in traditional banking.

Challenges Facing Crypto Banking

Nevertheless, the journey to successful crypto banking in Vietnam is not without its hurdles.

- Market Volatility: The value of cryptocurrencies can fluctuate dramatically.

- Regulatory Confusion: Many prospective users still feel uncertain about laws concerning crypto assets.

- Low Financial Literacy: A significant portion of the population remains unaware of how crypto banking works.

Looking Ahead: The Future of Crypto Banking in Vietnam

As Vietnam gradually embraces digital currencies, what does this mean for the cryptocurrency landscape? Analysts predict that by 2025, we may witness a 20% adoption rate of cryptocurrency transactions in the retail sector, setting a precedent for how businesses and consumers interact with money.

Moreover, there is a growing need for educational initiatives that inform the populace about crypto banking practices. By addressing the fears and concerns around digital finance, Vietnam stands to benefit from a more engaged and informed citizenry.

Conclusion: Why Now is the Time for Crypto Banking in Vietnam

The digital transformation of finance through crypto banking is underway in Vietnam. With increasing awareness and regulatory clarity from the government, the environment for crypto banking is ripe for innovation. If you’re considering entering the crypto space, now is the time. While the landscape poses some challenges, with proper education and engagement, Vietnam could very well lead the way in crypto banking innovation across Asia.

For those wanting more insights into the world of cryptocurrency, feel free to visit mycryptodictionary for all your crypto needs!

About the Author

John Smith is a blockchain consultant and expert in cryptocurrency regulations. With over 15 published papers and being a lead auditor for several high-profile projects, he has established a reputation in the crypto community. You can follow his insights and analyses online.