Introduction

Have you ever wondered how much money has been lost to unregulated activities in the crypto space? With an astonishing $4.1 billion lost to DeFi hacks in 2024 alone, it’s clear that investors need to tread carefully. In this rapidly evolving market, having access to Bitcoin market intelligence reports can make all the difference between profit and loss. Today, we’re diving deep into how these reports can help you make informed decisions and navigate the tumultuous waters of cryptocurrency investing.

The Importance of Bitcoin Market Intelligence Reports

Understanding the current trends in Bitcoin and broader cryptocurrency markets is essential for any investor. Here’s the catch: without robust data and analytics, investors are often left in the dark, unsure of the best possible investments. Market intelligence reports offer:

- Detailed insights into market trends and indicators.

- Analysis of investor behavior and sentiment.

- Information on regulatory changes and their impacts.

How to Read Bitcoin Market Intelligence Reports

Reading these reports can sometimes feel overwhelming. Let’s break it down:

- Trends & Indicators: Focus on metrics like transaction volume, changes in wallet addresses, and price fluctuations.

- Investor Sentiment: Analyze what the reports say about community feelings regarding Bitcoin’s future – bullish or bearish?

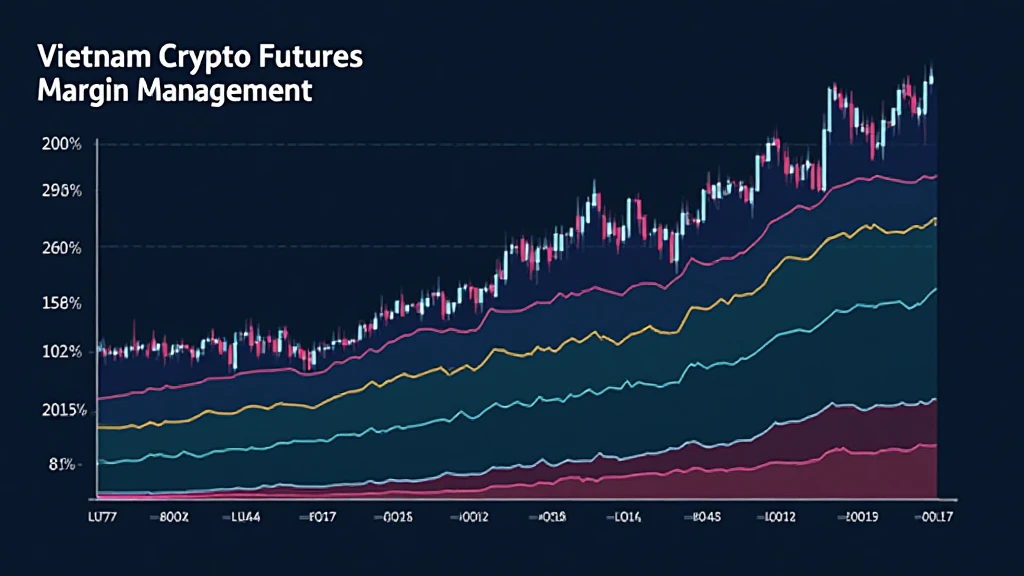

- Regulatory Landscape: Always keep an eye on expected regulations that could impact your investments. For example, the rising interest in blockchain security standards, or “tiêu chuẩn an ninh blockchain”, in Vietnam highlights the global shift towards better governance.

Real-World Application of Market Intelligence Reports

To illustrate how market intelligence can shape investment strategies, consider the following scenario:

Imagine you are evaluating whether to invest in Bitcoin or a new altcoin projected to rise significantly in value in 2025. You pull up the latest market intelligence report which indicates a growing interest in Bitcoin among institutional investors. In addition, you discover that, in the Vietnamese market, user growth rates for cryptocurrency applications have surged by 150% over the last year. With this data, you’re more likely to invest your funds in Bitcoin, knowing that broader institutional interest can push prices higher.

Case Study: 2025’s Potential Altcoins vs. Bitcoin

Let’s explore another prevalent topic in the crypto community: potential altcoins for 2025:

- Ethereum (ETH): Continues to be a strong contender mainly due to its smart contract capabilities.

- Cardano (ADA): Promising developments outlined in recent intelligence reports suggest a future rise.

- Polkadot (DOT): Its unique interoperability features make it attractive for investors aiming for long-term gains.

The challenge here is how to audit your findings effectively. This is where understanding “how to audit smart contracts” becomes crucial. Getting your grasp on the smart contracts underlying these potential investments will give you an edge in your decisions.

Resources to Enhance Your Bitcoin Investment Strategy

To effectively use market intelligence reports, consider integrating these tools into your routine:

- Data Aggregators: Websites like hibt.com provide up-to-date analytics that can inform your decisions.

- Price Monitoring Tools: Tools to track Bitcoin and altcoin performance.

- Forums and Community Insights: Engaging with community forums can provide qualitative data that supplements your quantitative analyses.

Conclusion

In conclusion, utilizing Bitcoin market intelligence reports can significantly enhance your investment strategy and guide you away from potential pitfalls in this volatile market. By understanding market trends, analyzing investor behavior, and staying informed on regulatory changes, you can confidently navigate the world of cryptocurrencies.

As you look to the future, whether you’re considering an investment in Bitcoin or exploring promising altcoins, remember to leverage the data-driven insights available at your fingertips. If you want to take full advantage of the potential this market offers, keep your knowledge current with intelligent and reliable data sources.

Mycryptodictionary wishes you a profitable and informative journey in the crypto world!