Bitcoin Market Cycle Prediction: An In-Depth Exploration

As the cryptocurrency world grapples with the aftermath of significant fluctuations, understanding the Bitcoin market cycle prediction becomes crucial. In 2024 alone, over $4.1 billion was lost due to DeFi hacks, highlighting the urgent need for market awareness and strategic investments. This article aims to provide keen insights into market cycles, ways to predict trends, and practical strategies for investors in both global and Vietnamese contexts.

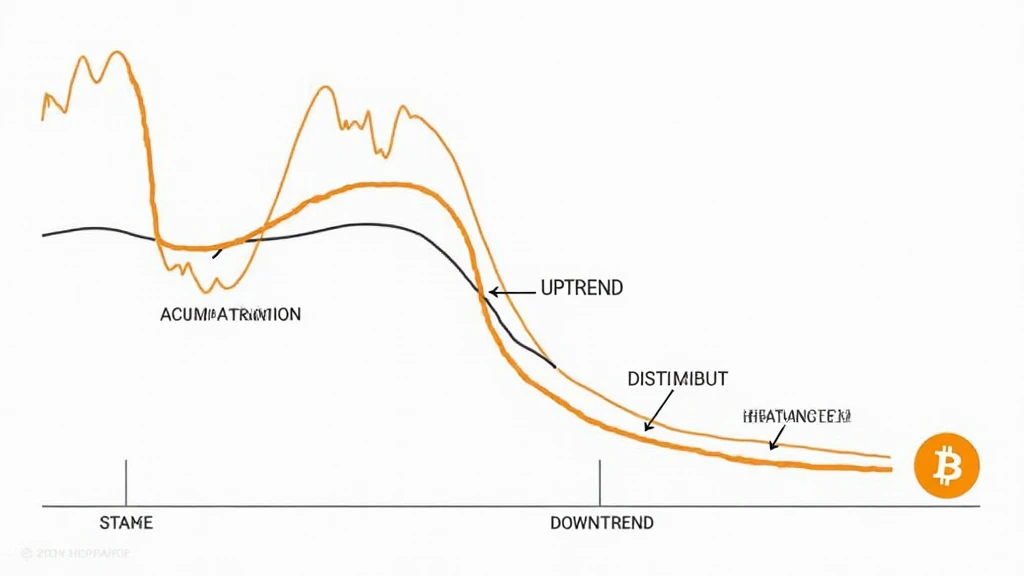

Understanding Market Cycles

Market cycles are the fluctuations in asset prices driven by investor sentiment, economic conditions, and external events. Each cycle typically consists of four main phases: accumulation, uptrend, distribution, and downtrend:

- Accumulation: After a significant price drop, savvy investors often begin accumulating assets, signaling that the market may enter a new growth phase.

- Uptrend: This phase features rising prices driven by increased demand. Enthusiasm grows as market participation increases.

- Distribution: At this stage, early adopters begin selling off their assets, resulting in stable prices while the market sees varied investor reactions.

- Downtrend: Prices decline significantly as panic selling occurs, leading to the next accumulation phase.

Factors Influencing Bitcoin Market Cycles

Several key factors play a role in shaping market cycles, including:

- Market Sentiment: The general attitude of investors affects demand and pricing. For instance, periods of positive news can propel prices upward.

- Technological Developments: Innovations like the introduction of Layer 2 solutions can enhance Bitcoin’s usability and increase its adoption.

- Regulatory Changes: Shifts in legal frameworks directly impact market behavior. For example, new regulations in Vietnam, such as requiring stricter KYC protocols for exchanges, can create uncertainty.

- Macro-Economic Trends: Economic indicators such as inflation rates and global market performance may influence investor behavior in the cryptocurrency market.

The Importance of Historical Data

To make accurate Bitcoin market cycle predictions, analyzing historical data is essential. Here’s a glimpse at the last Bitcoin market cycles:

| Cycle Phase | Bitcoin Price (USD) | Date |

|---|---|---|

| Accumulation | $3,000 | Dec 2018 |

| Uptrend | $64,000 | April 2021 |

| Distribution | $40,000 | July 2021 |

| Downtrend | $19,000 | Dec 2022 |

Source: CoinMarketCap

Predicting Future Trends: Tools and Techniques

Many tools can aid investors in predicting upcoming trends in the Bitcoin market:

- Technical Analysis: Chart patterns and indicators like RSI or MACD can provide vital clues to potential price actions.

- Market Sentiment Analysis: Leveraging platforms such as hibt.com to monitor trader emotions can help gauge future price movements.

- News and Events Monitoring: Regularly checking news and updates related to Bitcoin can offer context and clarity about market reactions to external events.

- On-Chain Analysis: Understanding blockchain data can reveal investor behaviors, highlighting areas of accumulation or sell-offs.

Localized Insights: The Vietnamese Market

With an increasing number of investors in Vietnam seeking opportunities in cryptocurrencies, it’s crucial to tailor our understanding of market cycles to this region:

- According to recent studies, Vietnamese cryptocurrency users have increased by over 45% in 2024, showcasing a growing interest.

- The recent legislation requiring businesses to comply with tiêu chuẩn an ninh blockchain has resulted in increased drive towards legitimacy.

Such local dynamics can drastically shift how Bitcoin’s market cycles unfold, making it important for investors in Vietnam to focus on these changes.

Conclusion

Understanding the Bitcoin market cycle prediction offers investors vital insight into forming effective strategies in the ever-evolving cryptocurrency landscape. As demonstrated throughout this article, keen observation of historical patterns, local market specifics like the Vietnamese growth, and staying abreast of market sentiments are keys to thriving in the world of Bitcoin.

Invest wisely, and always remember that while these insights can guide you, they do not constitute financial advice. Stay informed, adapt to changes, and be prepared for the dynamic world of digital assets.

For a wealth of information on cryptocurrency trends, visit mycryptodictionary.

About the Author

Dr. Nguyen Van A, a renowned blockchain expert with over 15 publications in the field, specializes in smart contract audits and market predictions for various fintech projects.