Understanding Bitcoin Expense Ratio Benchmarking

As the cryptocurrency market expands, with Bitcoin consistently gaining traction, understanding key performance metrics becomes crucial. One significant metric that both investors and developers must pay attention to is the Bitcoin expense ratio benchmarking. This involves evaluating the costs associated with Bitcoin investments relative to the potential returns. In 2024 alone, the cryptocurrency sector lost about $4.1 billion due to unexpected fluctuations and security breaches, highlighting the importance of accurate benchmarking.

What is Expense Ratio Benchmarking?

Expense ratio benchmarking is a method used to analyze the efficacy and efficiency of investments by comparing their operating costs to the returns they generate. In the context of Bitcoin, this becomes essential as numerous factors can influence both the cost and potential profitability—from transaction fees to market volatility.

The Relevance of Expense Ratios

- Helps investors and stakeholders make informed decisions.

- Quintessential for evaluating fund performance in the crypto ecosystem.

- Aids in assessing the management quality of cryptocurrency funds.

The Mechanics of Bitcoin Expense Ratio

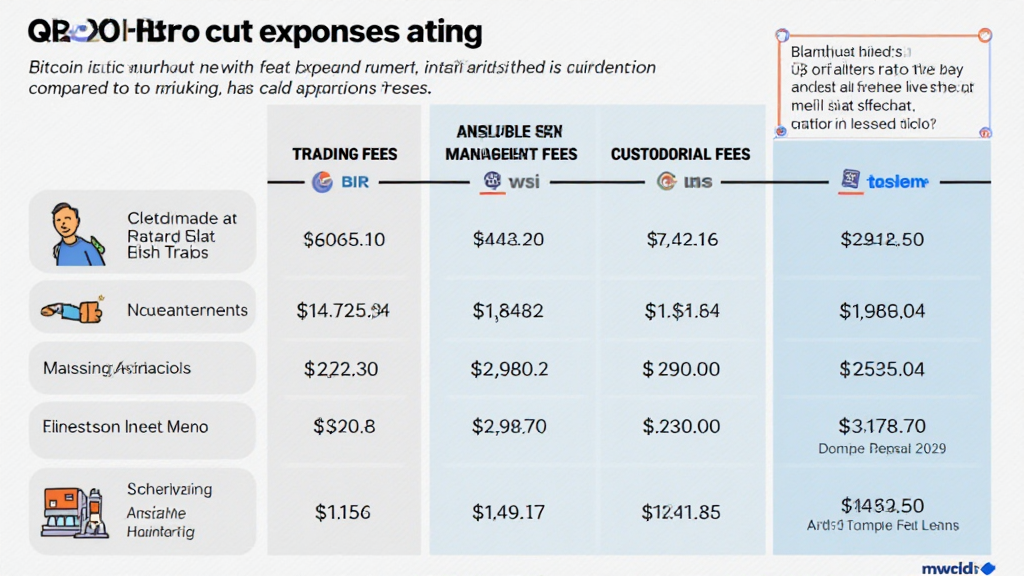

The expense ratio for Bitcoin can be broken down into several components, including:

- Trading Fees: Costs incurred for buying and selling Bitcoin through exchanges.

- Management Fees: Fees charged by fund managers if you’re investing through a cryptocurrency fund.

- Custodial Fees: Charges for the safekeeping of Bitcoin holdings.

Why Benchmarking Matters

Benchmarking the expense ratio against industry standards allows investors to assess whether they are receiving value for their money. For instance, in Vietnam, where the cryptocurrency user growth rate reached over 150% in 2023, having an understanding of expense ratios has become increasingly vital as more individuals invest in Bitcoin.

Factors Influencing Bitcoin Expense Ratios

Several variables can impact the expense ratio:

- Market Volatility: The more volatile the market, the higher the potential fees.

- Exchange Choices: Different exchanges have different fee structures.

- Transaction Methods: Transactions through credit cards may incur higher fees compared to bank transfers.

Vietnam’s Unique Market Dynamics

The rapid adoption of cryptocurrency in Vietnam mandates that users comprehend expense ratios. As pertinent data from Blockchain Vietnam suggests, local exchanges often carry higher fees compared to international counterparts. For instance, while global averages hover around 1.5% in fees, local exchanges have been observed to charge between 2% and 3%.

How to Calculate the Bitcoin Expense Ratio

Calculating the expense ratio is straightforward:

- Identify total operating costs related to your Bitcoin investments.

- Divide this figure by the total assets under management (AUM).

- Multiply by 100 to get a percentage.

For example, if your total operating costs are $500 and your AUM is $10,000, your expense ratio is (500 / 10,000) * 100 = 5%.

Practical Tips for Managing Bitcoin Expense Ratios

Investors can consider several strategies to manage their expense ratios effectively:

- Compare Fees: Use platforms that aggregate exchange rates and transaction fees to choose wisely.

- Opt for Long-Term Investments: Reducing the frequency of transactions can help lower overall costs.

- Stay Informed: Keeping up with market trends can provide insights on when fees may be lower.

Conclusion: The Future of Bitcoin Expense Ratio Benchmarking

In conclusion, as Bitcoin continues to gain momentum globally, including a strong presence in Vietnam, understanding Bitcoin expense ratio benchmarking is indispensable for any serious investor. Navigating through the complexities of fees and expenses can make a significant difference in overall investment performance. As you refine your investment strategies, remember to keep a keen eye on expense ratios to ensure that you are maximizing your returns. With proper understanding and benchmarking practices, investors can make informed decisions and optimize their investment portfolios.

mycryptodictionary is here to help you stay informed and navigate the complexities of cryptocurrency successfully.

Author: Dr. Nguyen Hoang Minh, a leading expert in blockchain technologies with over 15 published papers in finance and cryptocurrency and overseer of several successful crypto projects.