Bitcoin Halving Historical Analysis: What to Expect Next

With over $4.1 billion lost to hacks in the DeFi sector in 2024, understanding Bitcoin’s halving events has never been more crucial. Bitcoin halving is a significant event in the cryptocurrency ecosystem that influences market trends and investor behavior. In this analysis, we will delve deeper into the historical occurrences of Bitcoin halving and assess the implications for the future.

Understanding Bitcoin Halving

Bitcoin halving refers to the process by which the reward for mining new blocks is halved, occurring approximately every four years. The primary motive behind this procedure is to control the supply of Bitcoin, ensuring that it does not become inflationary. Here’s the breakdown:

- Original Block Reward: 50 BTC per block.

- First Halving (2012): Reduced to 25 BTC.

- Second Halving (2016): Reduced to 12.5 BTC.

- Third Halving (2020): Reduced to 6.25 BTC.

The Economic Impact of Halving

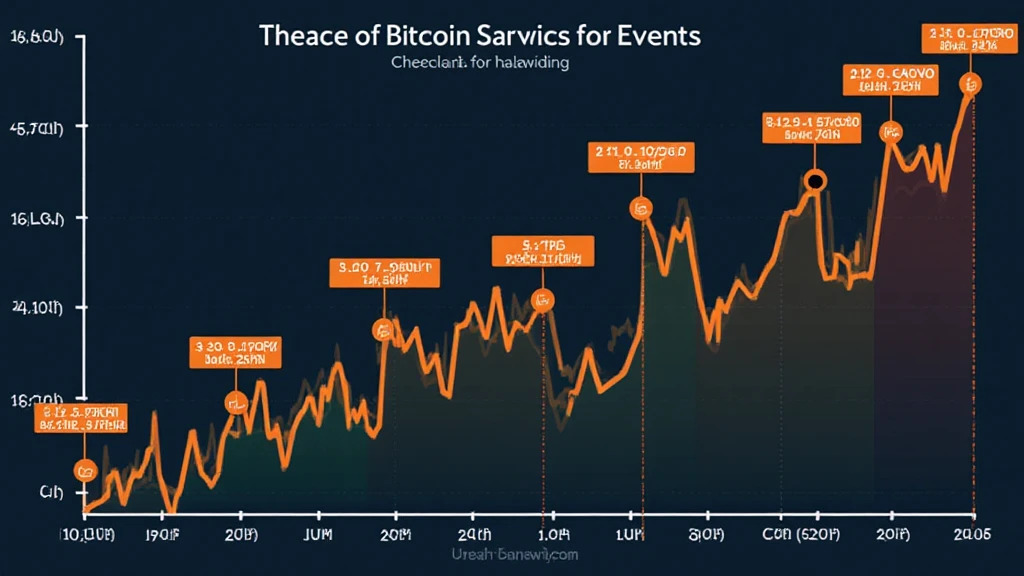

Historically, every halving event has been preceded by a considerable increase in Bitcoin’s price. Let’s break it down:

- Post-2012 Halving: Bitcoin surged to $1,000.

- Post-2016 Halving: Bitcoin reached an all-time high of nearly $20,000 in 2017.

- Post-2020 Halving: Bitcoin price peaked at $64,000 in April 2021.

As we can see, these dramatic price increases often correlate with the halving events. This pattern raises intriguing questions about the potential for future halving impacts, particularly the upcoming fourth halving expected in 2024.

Case Study: 2020 Halving Event Analysis

The most recent halving in May 2020 set the stage for a booming phase in the cryptocurrency market. During this period, many investors drew parallels to the 2016 halving. Factors such as growing institutional interest and an influx of retail investors contributed significantly to this price surge.

| Event | Price Before Halving | Price After 1 Year |

|---|---|---|

| 2016 Halving | $600 | $20,000 |

| 2020 Halving | $8,700 | $64,000 |

What Lies Ahead: The 2024 Halving

As we move closer to the 2024 halving, several indicators suggest potential market behaviors. Analysts anticipate a sustained bullish trend based on:

- Increased Institutional Involvement: Financial institutions show continuous interest in crypto assets.

- Regulatory Developments: Clearer regulations in regions like Vietnam are attracting new investors.

- Global Economic Factors: Inflation in traditional markets could lead to more investments in Bitcoin.

In Vietnam, the cryptocurrency user growth has surged by 300% from 2021 to 2023, indicating a thriving market ready for significant shifts. These factors could enhance the sentiments of both local and international investors.

Long-term Implications of Bitcoin Halving

The long-term impact of Bitcoin halving extends beyond immediate price changes. Considerations include:

- Mining Viability: As rewards decrease, less efficient miners may exit the market.

- Market Liquidity: Reduced supplies can create tighter markets, increasing volatility.

- Investor Confidence: Historically, positive sentiments follow halving, but market dynamics can change.

Conclusion

Given the historical trends of Bitcoin halving and the present market environment, the anticipation for the next event is palpable. Investors must navigate the potential volatility accompanying halving while remaining informed about market dynamics. Preparing for changes ahead is crucial.

In summary, Bitcoin halving has significant historical ramifications, offering insights into market movements. For newcomers and seasoned investors alike, understanding these events is paramount for making informed investment decisions.

For a thorough understanding of upcoming trends, it’s vital to keep an eye on local markets, such as in Vietnam, where the crypto engagement is evolving rapidly. Let’s stay informed and prepared for what’s ahead in the Bitcoin landscape.

Disclaimer

Not financial advice. Always consult your local regulators and do thorough research before making investment decisions.

Author: Dr. David Thompson – A blockchain expert with over 15 published papers in the field, responsible for auditing numerous high-profile projects in the cryptocurrency ecosystem.