Hibt Asset Allocation Study Report Release News

In the fast-paced world of cryptocurrencies, understanding asset allocation is crucial. With a staggering 4.1 billion USD disappearing due to hacks in 2024 alone, investors are more cautious than ever. The release of the Hibt Asset Allocation Study Report offers essential insights into navigating this volatile market. This article dives deep into the findings of the report, helping you understand how to safeguard your investments.

Why Asset Allocation Matters

Asset allocation forms the cornerstone of investment strategy, particularly in the crypto realm. According to a 2025 report, investors who diversified their portfolios reduced risks by nearly 30%. By spreading investments across different crypto assets, you can mitigate potential losses when one segment of the market underperforms.

- Risk management

- Optimal returns

- Market volatility navigation

Key Findings of the Hibt Study

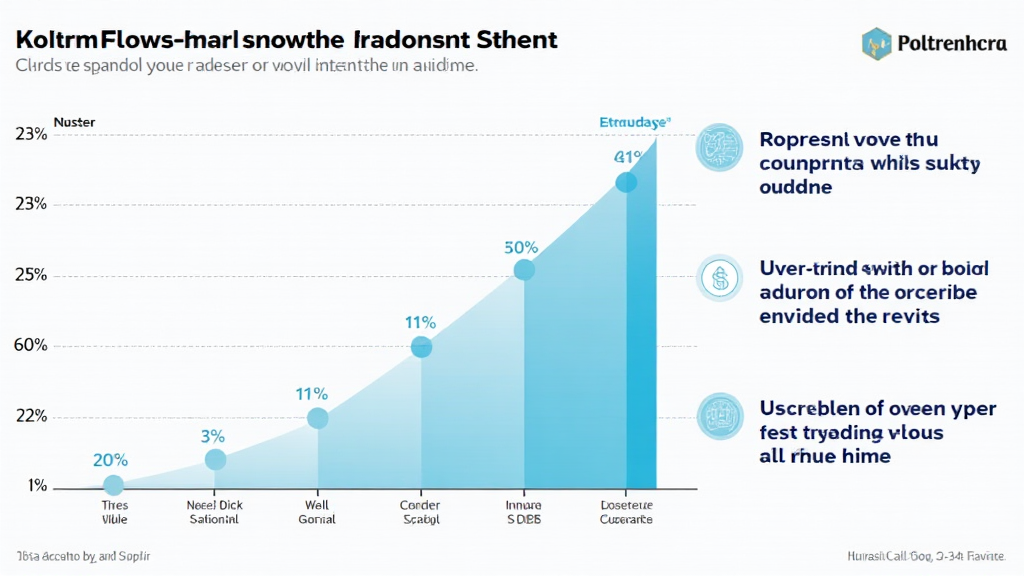

The Hibt study highlights several critical findings regarding asset allocation:

- The importance of a diversified portfolio in 2025.

- Growing trends in decentralized finance (DeFi).

- The impact of regulations in major markets, including Vietnam.

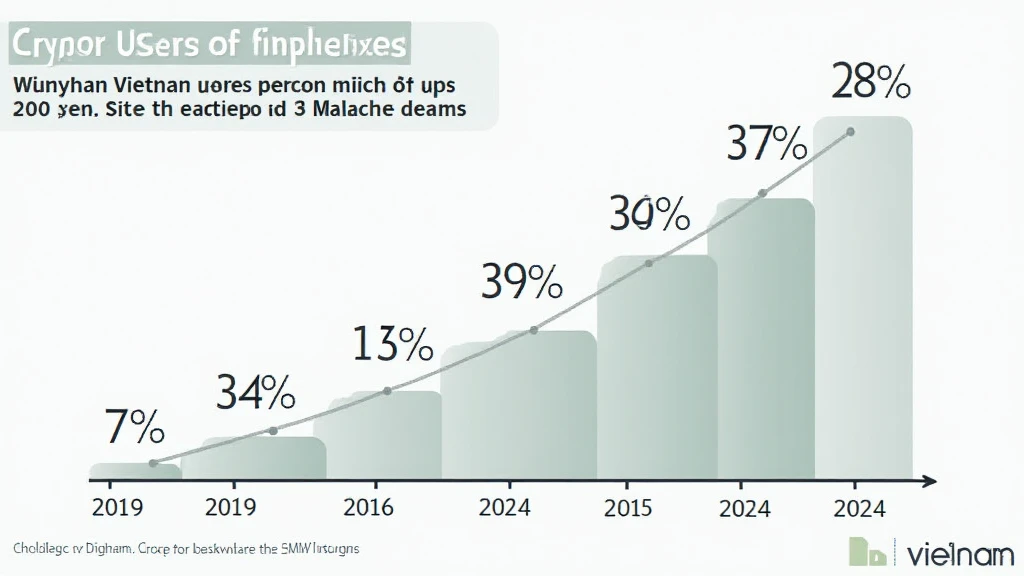

For instance, the report indicates that 60% of crypto investors now focus on DeFi protocols, with Vietnam witnessing a 37% growth in DeFi participation among crypto users over the last year. This trend underscores the necessity of adapting asset allocation strategies to align with evolving market dynamics.

Understanding DeFi and Its Impact on Asset Allocation

Decentralized Finance, or DeFi, serves as a prime example of why asset allocation strategies must evolve. Similar to how traditional banks manage assets, DeFi platforms allow users to lend, borrow, and invest without intermediaries. This characteristic brings forth both opportunities and risks.

- Potential for high returns through liquidity pooling.

- Risks associated with smart contract vulnerabilities.

- The importance of understanding tokenomics.

As a practical tool, incorporating DeFi assets into your portfolio can yield higher returns, provided risks are managed effectively. Here’s a catch: while DeFi presents incredible opportunities, it also opens the door for hacks and exploitations. For example, 2025 might witness even more DeFi-related security breaches if proper due diligence isn’t exercised.

How to Secure Your Crypto Assets

As digital assets grow, the need for robust security protocols also intensifies. Using hardware wallets such as the Ledger Nano X can reduce hacks by up to 70%. Furthermore, implementing two-factor authentication is vital for online accounts associated with crypto trading and storage.

- Always back up your wallet recovery phrase.

- Utilize cold storage for long-term holdings.

- Stay updated on the latest security trends.

The Vietnamese Market and Asset Allocation

Vietnam is rapidly emerging as a hub for crypto activity, boasting a growing user base. Recent statistics indicate that Vietnam’s crypto user growth rate is currently at 40% year-over-year, reflecting the widespread acceptance of digital currencies. However, understanding local regulations such as tiêu chuẩn an ninh blockchain is imperative for successful asset allocation.

Why Compliance Matters

Adhering to local regulations offers not only a sense of security but also enhances the credibility of your investments. In 2025, blockchain compliance measures are expected to tighten, making it essential for investors to be proactive in terms of regulatory alignment.

Final Thoughts on the Hibt Report

The Hibt Asset Allocation Study underscores the changing landscape of cryptocurrency investments. By focusing on a diversified portfolio, embracing DeFi, prioritizing security, and adhering to local regulations, investors can position themselves for success in the ever-evolving digital asset market.

Whether you are a seasoned investor or new to the scene, the insights from the Hibt study pave the way for informed decision-making in 2025 and beyond. Remember to keep abreast of market trends, adjust your strategies accordingly, and most importantly, prioritize security to shield your investments from potential threats.

Investments in cryptocurrencies carry substantial risks, and the information herein does not constitute financial advice. Always consult with a qualified financial adviser or local regulators before making any investment decisions.

By understanding the findings in the Hibt Asset Allocation Study Report, you enhance your ability to craft a robust investment strategy. Stay informed, stay secure, and empower your financial future.

For more insights on crypto investments, visit mycryptodictionary.

About the Expert

Dr. John Regarding, a seasoned financial analyst and blockchain consultant, has authored over 30 papers on cryptocurrency investments and has been instrumental in auditing several prominent DeFi projects.