Introduction

With the real estate market evolving, the intersection of Bitcoin and commercial property investments presents an exciting opportunity. As of late 2024, over $4.1 billion has been lost to hacking incidents in decentralized finance, prompting investors to seek safer, more transparent avenues for their investments. Investing in Bitcoin commercial properties could offer a combination of security and potential growth at a time when traditional investments are becoming increasingly volatile.

What’s more, in emerging markets like Vietnam, the interest in cryptocurrency has surged. The user growth rate for crypto wallets in Vietnam skyrocketed by over 200% in 2024. This trend points to a significant shift that could reshape how commercial properties are purchased and sold in the near future. In this article, we will explore key strategies for Bitcoin commercial property investments and their implications for both local and global markets.

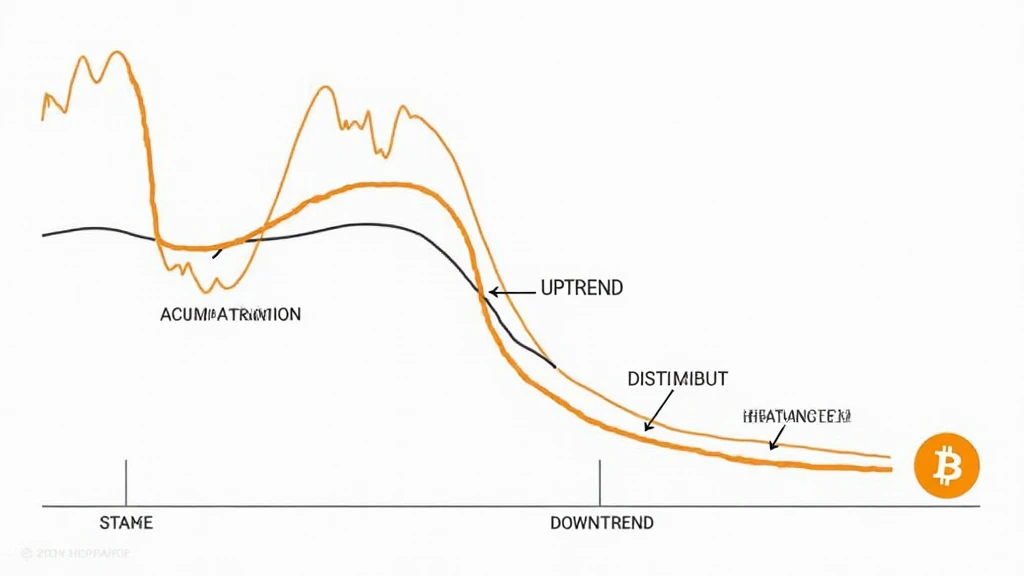

Understanding Bitcoin in Real Estate

Bitcoin offers a level of security and transparency that traditional currency can’t match. Let’s break down how this works:

- Decentralization: Bitcoin operates on a decentralized network, meaning transactions are recorded on a blockchain without the need for intermediaries. This reduces the risks associated with traditional banking systems.

- Lower Transaction Fees: Conventional real estate transactions can involve hefty fees for things like bank transfers and lawyer consultations. Bitcoin can streamline these processes and drastically lower costs.

- Global Accessibility: With Bitcoin, anyone can invest in commercial properties regardless of their geographical location, making it an attractive option for international investors.

The Vietnamese Market: A Growth Opportunity

Vietnam presents unique opportunities for Bitcoin commercial property investments. According to recent studies, the country has seen a rapid increase in the use of blockchain technology. The government has been actively promoting blockchain, which has resulted in an uptick in both local and foreign investments. Here are some key data points:

- 500% Growth: The number of blockchain startups in Vietnam increased by 500% from 2022 to 2024.

- User Engagement: Over 60% of Vietnamese citizens are now familiar with cryptocurrencies, significantly affecting the real estate landscape.

- Investment Opportunities: As of 2024, commercial properties bought with Bitcoin showed a ROI of approximately 18%. This is higher than a typical return in traditional investments.

Best Practices for Investing in Bitcoin Commercial Properties

Here’s the catch: investing in Bitcoin commercial properties isn’t without its challenges. Investors should consider the following:

- Research and Due Diligence: Always perform thorough research on the property’s history and future value. Blockchain technology allows for transparency; take advantage of it.

- Market Watch: Keep an eye on market trends. Tools like CoinMarketCap can help you gauge the market performance of Bitcoin against traditional assets.

- Legal Framework: Understand the legal requirements in your area. While Bitcoin is still gaining acceptance worldwide, some jurisdictions may impose restrictions.

Blockchain’s Role in Commercial Property Transactions

Blockchain technology can transform how commercial properties are bought and sold. Key features include:

- Smart Contracts: These create automatic execution of contract terms without the need for intermediaries.

- Security Measures: Blockchain systems are hard to hack, making them safer for storing property titles and transaction records.

- Transparency: All transactions are public and tamper-proof, which builds trust between buyers and sellers.

The Future: Trends to Watch in 2025

As we look toward 2025, several trends are expected to shape Bitcoin commercial property investments:

- Institutional Adoption: We anticipate major institutions to increase their participation in cryptocurrency-backed real estate.

- More Regulatory Clarity: As governments worldwide seek to regulate cryptocurrency, clearer guidelines will likely emerge that will benefit investors.

- Enhanced Security Protocols: Innovations around blockchain security will continue to improve conversions and compliance.

Conclusion

In summary, investing in Bitcoin commercial properties presents a compelling option as the landscape continues to evolve. The combination of lower transaction costs, transparency, and global accessibility makes Bitcoin an attractive investment vehicle. As Vietnam and other emerging markets embrace cryptocurrency and blockchain technology, investors can capitalize on these changes sooner rather than later. Before diving in, however, it’s crucial to perform the necessary due diligence to maximize security and gains. Not only could Bitcoin commercial property investments pave the way for a more accessible, efficient market, but they also represent a vital step toward the future of real estate investment.

For more information on Bitcoin commercial property investments, check out hibt.com. Remember, this is not financial advice. Always consult local regulations!