Exploring Bitcoin P2P Lending Platforms: A Future Perspective

With an estimated 4.5 billion USD lost to hacks in DeFi over the last year, the demand for security and transparency in financial transactions is more critical than ever. The rise of Bitcoin P2P lending platforms offers a unique solution to both borrowers and lenders in today’s evolving economic landscape. This article aims to explore how these platforms are revolutionizing the way people engage with cryptocurrencies and finance.

Understanding Bitcoin P2P Lending Platforms

Bitcoin P2P lending platforms connect borrowers to lenders without the need for traditional financial institutions. This direct interaction allows for:

- Lower interest rates for borrowers

- Higher returns for lenders

- Increased accessibility to loans for individuals without credit histories

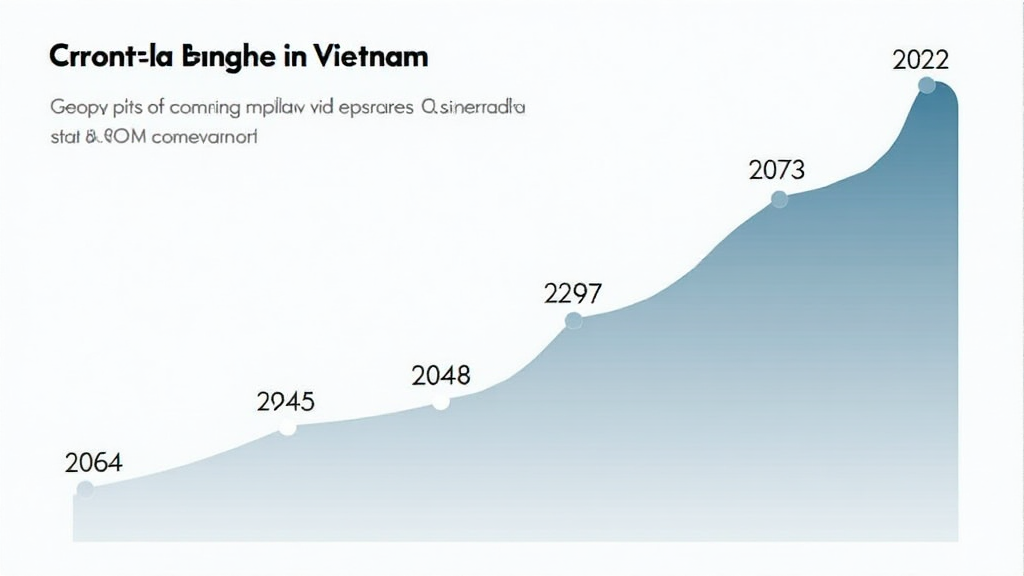

In countries like Vietnam, where financial inclusion is still a challenge, these platforms can significantly increase access to capital. For instance, Vietnam’s fintech market is experiencing a growth rate of 72% annually, indicating a strong demand for innovative financial solutions.

How Bitcoin P2P Lending Works

These platforms operate on the principle of trust and transparency, using blockchain technology to facilitate transactions. Here’s a basic breakdown of the process:

- Registration: Users create accounts on the lending platform.

- Loan Posting: Borrowers can post their loans, detailing the amount, interest rate, and duration.

- Funding: Lenders can browse through various loan requests and choose to fund those they find appealing.

- Repayment: Borrowers are responsible for making payments directly to the lenders.

This process can be compared to a marketplace where buyers (lenders) meet sellers (borrowers), allowing individuals greater control over their financial transactions.

The Benefits of Bitcoin P2P Lending Platforms

Here’s the catch: while there are risks associated with any financial transaction, Bitcoin P2P lending platforms provide several benefits:

- Decentralization: Removes intermediary fees and promotes peer-to-peer interactions.

- Flexibility: Terms can be tailored according to the needs of both parties.

- Privacy: Transaction details are secured on the blockchain, ensuring confidentiality.

As the industry matures, these platforms are becoming more robust, employing innovations to enhance user experience and secure transactions.

Risks to Consider in Bitcoin P2P Lending

Despite the advantages, users must remain vigilant about several inherent risks:

- Default Risk: Borrowers may fail to repay, resulting in losses for lenders.

- Volatility: The value of Bitcoin can fluctuate, affecting the loan’s worth.

- Scams: Fraudulent activities can occur; thus, it’s crucial to choose reputable platforms.

To mitigate these risks, it’s vital for users to conduct due diligence and leverage the platform’s security features.

Exploring the Vietnamese Market for P2P Lending

As mentioned earlier, Vietnam is experiencing a rapid fintech evolution. The emergence of Bitcoin P2P lending platforms aligns well with the country’s economic growth and tech-savvy younger generation. According to Hibt.com, the demand for alternative lending solutions among Vietnamese citizens is on the rise due to limited access to traditional banking services.

- Increased Smartphone Penetration: Over 75% of Vietnamese use smartphones, making access to these platforms easier.

- Growing Cryptocurrency Adoption: With over 30% of the population aware of cryptocurrencies, P2P lending could serve untapped markets.

In this regard, the adoption of blockchain security standards (tiêu chuẩn an ninh blockchain) is imperative. The more secure these platforms are, the more users are likely to participate.

Conclusion: The Future of Bitcoin P2P Lending Platforms

As Bitcoin P2P lending platforms continue to develop, the future looks promising for both lenders and borrowers. They create opportunities for financial inclusion, investment, and capital access. However, to succeed, participants must remain informed and cautious, leveraging the benefits while being aware of the risks involved.

In conclusion, exploring Bitcoin P2P lending platforms not only opens doors to innovative financial strategies but also reflects the shifting landscape of global finance. As we move into 2025, keeping an eye on these trends will be essential for anyone interested in cryptocurrency and decentralized finance.

For detailed insights and resources, visit mycryptodictionary.

Written by Dr. Alex Johnson, a cryptocurrency policy expert who has authored over 25 papers in the field and spearheaded audits for major blockchain projects.