Introduction: Understanding Market Sentiment

In the volatile world of cryptocurrencies, understanding market sentiment can be a game changer. According to recent reports, the Bitcoin market has experienced fluctuations resulting in a staggering $4.1B lost to market shifts in just 2024 alone. This volatility prompts traders and investors to seek out reliable methods for tracking sentiment, which can inform their trading decisions.

So why should tracking Bitcoin market sentiment matter to you? It provides a lens through which you can interpret market movements and make informed decisions. This article aims to provide a comprehensive guide on tracking Bitcoin market sentiment, leveraging both technical insights and practical applications.

What is Bitcoin Market Sentiment Tracking?

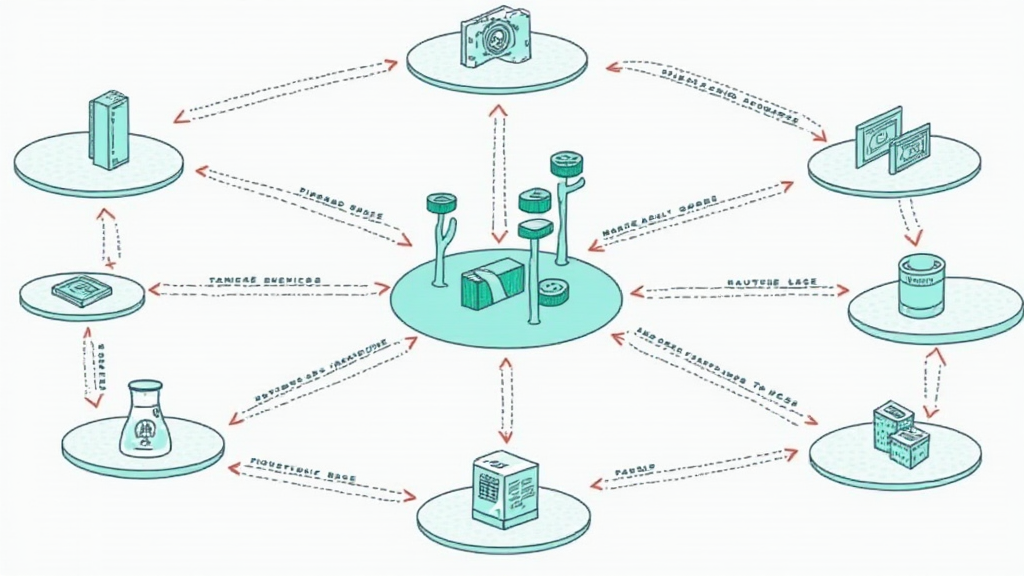

Market sentiment tracking involves analyzing the collective emotions and attitudes of traders and investors toward Bitcoin. This sense of sentiment can be discerned from various channels, including social media, news articles, forum discussions, and trading volumes.

For instance, Vietnamese users have shown a growing interest, with a 20% yearly increase in cryptocurrency adoption reported in the latest studies. As more Vietnamese engage in trading, understanding their sentiment can be pivotal for trading strategies that consider local trends.

Key Indicators of Market Sentiment

- Social Media Analytics: Platforms like Twitter and Telegram are invaluable for gauging sentiment through the volume and tone of discussions.

- News Sentiment Analysis: Financial news articles can sway market perceptions significantly. Utilizing sentiment analysis tools to evaluate the positivity or negativity of news articles can provide insights into market movements.

- Trading Volume: A surge in trading volume often correlates with shifts in sentiment. High trading volumes may indicate heightened interest and investor confidence.

Tools for Tracking Bitcoin Market Sentiment

To make informed trading decisions, several tools can be of assistance. Here are some popular options:

- Alternative.me’s Crypto Fear & Greed Index: This index provides a snapshot of market sentiment ranging from ‘fear’ to ‘greed’, making it easier to gauge overall market conditions.

- Token Metrics: It offers market sentiment indicators along with project fundamentals to provide a multi-dimensional view.

- Google Trends: By analyzing search trends for Bitcoin, you can assess public interest and sentiment on a global scale.

Sentiment Tracking in the Vietnamese Market

The Vietnamese cryptocurrency landscape is becoming increasingly vibrant. With local users growing, it is crucial to track sentiment within this market specifically. Understanding local nuances can lead to better trading results. For instance, Vietnamese investors tend to react positively towards news about regulatory clarity, reflecting higher confidence levels.

Integrating Sentiment Analysis with Trading Strategies

How can you incorporate market sentiment analysis into your trading strategies?

- Sentiment-Driven Trading: Develop a trading strategy that reacts to sentiment indices. For example, during periods of extreme ‘fear’, consider accumulating Bitcoin.

- Combine with Technical Analysis: Use sentiment as a complementary tool alongside technical indicators to make more robust trading decisions. For instance, if market sentiment is positive but technical indicators suggest otherwise, it may warrant a cautious approach.

- Psycho-Economic Indicators: Monitor psychological factors such as FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, Doubt). These can significantly impact market movements.

Case Study: Responding to Market Sentiment Shifts

Let’s break it down with a case study. In late 2024, Bitcoin experienced a rapid price decline due to unfavorable comments from influential market figures. During this time, tracking social media sentiment revealed increased panic, indicated by a sharp rise in negative posts. Many traders used this insight to adjust their positions, minimizing losses.

This highlights the importance of continuous market sentiment tracking. A trader who acted decisively based on sentiment data could have mitigated significant losses.

Challenges in Bitcoin Market Sentiment Tracking

While tracking sentiment can prove beneficial, several challenges persist:

- Noisy Data: The sheer volume of unfiltered data can lead to misleading sentiment signals.

- Bias in Sentiment Analysis: Algorithms may not always accurately interpret human emotions, leading to skewed results.

- Market Manipulation: Be aware of pump-and-dump schemes that distort genuine market sentiment.

Conclusion: The Future of Bitcoin Market Sentiment Tracking

As the cryptocurrency landscape evolves, so will the tools and techniques for tracking Bitcoin market sentiment. For investors and traders, staying ahead of sentiment trends can provide a competitive advantage. In an era where Vietnam’s crypto user base is growing, understanding local sentiment becomes increasingly important.

In summary, to navigate the uncertainties of the crypto market, it is crucial to integrate sentiment tracking into your investment strategies. As always, remain cautious and consult with local regulations and experienced advisors.

For more insights on cryptocurrency and market sentiment, visit mycryptodictionary.