Vietnam Crypto Futures Contract Analysis: Understanding the Market Dynamics

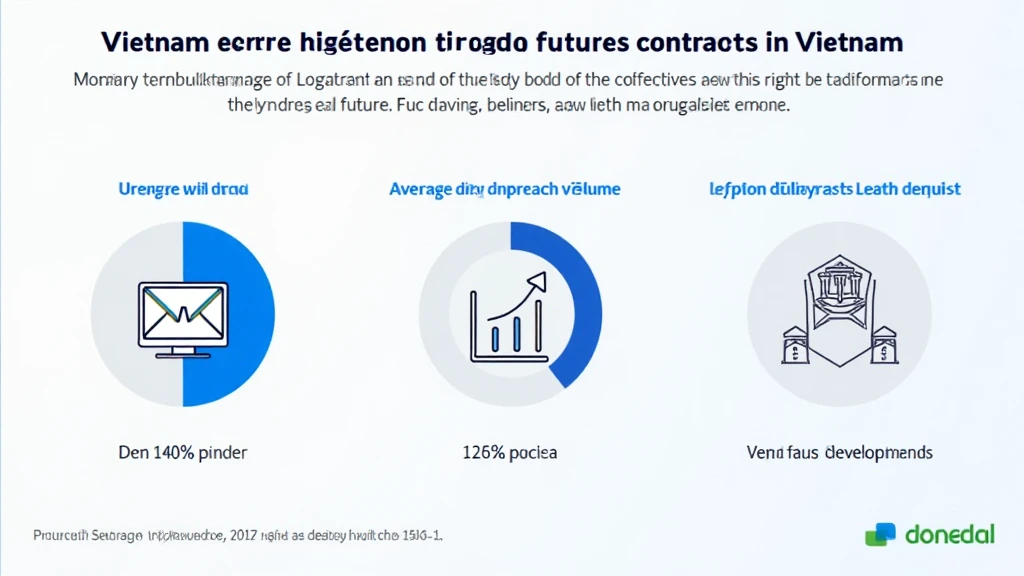

As cryptocurrency rapidly evolves, futures contracts have become a vital tool for traders looking to hedge risk and speculate on price movements. In Vietnam, the crypto market is experiencing a significant shift, with a growing user base and increasing interest in futures trading. According to recent reports, the number of active crypto users in Vietnam surged by over 30% in 2023 alone, highlighting the need for a comprehensive understanding of futures contracts.

The Rise of Crypto Futures in Vietnam

In the past few years, Vietnam has emerged as one of the most vibrant crypto markets in Southeast Asia. With a population increasingly familiar with digital currencies, the demand for futures contracts has skyrocketed. Here’s a closer look at the factors driving this growth:

- User Growth Rate: Vietnam saw a remarkable 36% increase in crypto users as of early 2024.

- Regulatory Clarity: The Vietnamese government is gradually establishing clearer regulations around cryptocurrency trading, enabling safer trading environments.

- Enhanced Trading Platforms: Local exchanges are enhancing their features, including futures trading options that cater to both novice and experienced investors.

Understanding Futures Contracts

A futures contract is a legal agreement to buy or sell a particular asset at a predetermined price at a specified time in the future. This instrument is particularly appealing in the volatile crypto market, as it allows traders to lock in prices and hedge against market fluctuations. In Vietnam, common cryptocurrencies traded under futures contracts include Bitcoin (BTC) and Ethereum (ETH).

Market Dynamics in Vietnam’s Futures Trading

Understanding the dynamics of the futures market in Vietnam is essential for any trader looking to navigate this space effectively. Let’s break it down into a few crucial aspects:

Liquidity and Volatility

Liquidity refers to how easily an asset can be bought or sold without affecting its price. The Vietnamese crypto futures market has witnessed impressive liquidity increases, making it easier for traders to enter and exit positions. However, volatility remains a double-edged sword, presenting both opportunities and risks. Here are some stats:

- Average Daily Trading Volume: Estimated at USD 200 million across top exchanges.

- Price Fluctuations: Daily price swings for major cryptocurrencies often exceed 5%.

Regulatory Environment

As discussed earlier, regulatory clarity is crucial for the growth of crypto trading in Vietnam. Local authorities have started issuing guidelines for cryptocurrency exchanges and trading activities. While the regulations are still evolving, traders must stay updated to ensure compliance and mitigate risks.

For instance, the Vietnamese Blockchain Association has been advocating for clearer policies, which is likely to foster a more secure trading environment in the future.

Strategies for Trading Futures Contracts

Trading futures may seem daunting, but with knowledge and strategy, traders can capitalize on market movements effectively. Here are some important strategies to consider:

Technical Analysis

Technical analysis involves evaluating assets through historical price data to identify trends and predict future movements. Traders can use various tools and indicators, such as moving averages and RSI (Relative Strength Index), to enhance their trading decisions.

Risk Management

Risk management is crucial in any trading strategy. Set stop-loss and take-profit levels to minimize losses and lock in profits. This approach helps navigate the volatile crypto market.

Upcoming Trends in Vietnamese Crypto Futures

The future of crypto trading in Vietnam looks promising, with several trends expected to shape the landscape:

- Increased Institutional Participation: More financial institutions are likely to enter the crypto space, enhancing market credibility.

- More Innovative Products: Expect new futures and derivatives products that provide diverse trading options for investors.

- Technological Advancements: Utilizing AI and machine learning for trading strategies will become more prevalent.

Conclusion

Vietnam’s crypto futures market presents exciting opportunities for traders, highlighted by increasing user participation and the advent of clearer regulations. By understanding market dynamics, utilizing strategic trading strategies, and staying informed about upcoming trends, traders can harness the potential of futures contracts to enhance their trading experience.

As the market evolves, platforms like MyCryptoDictionary can provide valuable insights and resources for navigating the complex world of crypto trading.

Author: Dr. Nguyen Tran – An expert with over 10 years in blockchain technology, having published more than 15 papers on digital assets and led audits for various high-profile projects.