Introduction

In a digital economy where the rise of cryptocurrencies is staggering, even the most seasoned investors are looking to capitalize on opportunities. With reported losses of $4.1 billion due to DeFi hacks in 2024, strategizing investments in volatile markets like cryptocurrencies has become crucial. Understanding pricing models for crypto options, especially in a burgeoning landscape like Vietnam, is essential for mitigating risks and maximizing returns. This article delves deep into the crypto options pricing models and how they resonate within the Vietnamese context.

Vietnam and the Crypto Boom

According to recent reports, Vietnam has seen a 200% increase in cryptocurrency adoption among its population. This dramatic rise indicates a growing acceptance of blockchain innovation, with many investors seeking reliable platforms to engage with digital assets. Platforms like HIBT are at the forefront, providing services tailored to the local market.

Understanding Crypto Options

Crypto options are financial derivatives that give purchasers the right but not the obligation to buy or sell a particular cryptocurrency at a predetermined price within a set timeframe. This …

Here’s a simplified breakdown of the different types of options:

- Call Option: Grants the purchaser the right to buy an asset.

- Put Option: Grants the purchaser the right to sell an asset.

In Vietnam, the potential for options trading could reshape how investors approach their cryptocurrency portfolios. The most popular platforms have integrated educational resources to help users navigate this complex arena.

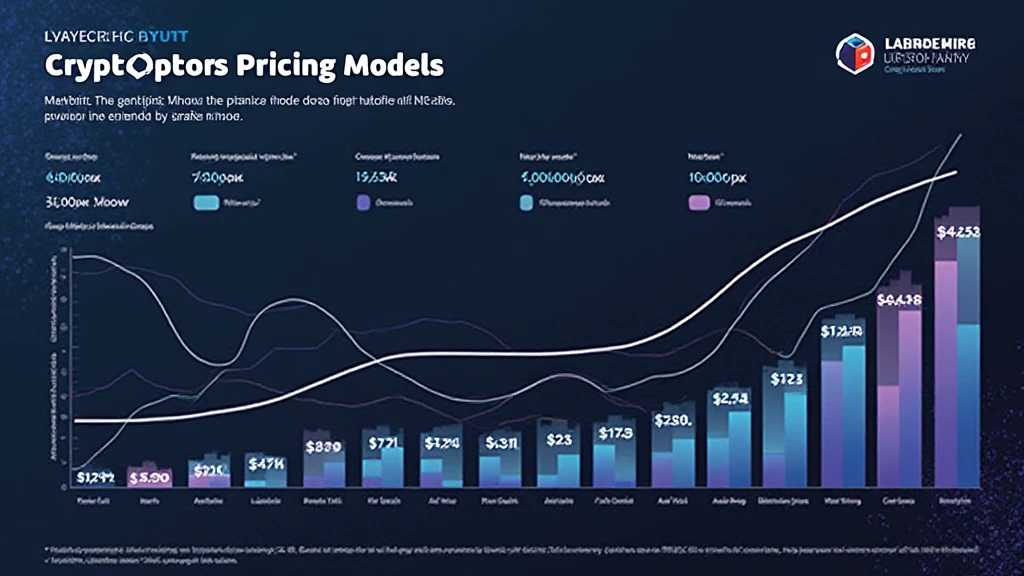

Pricing Models for Crypto Options

Two primary models dominate the pricing of crypto options: the Black-Scholes model and the Binomial model. Each comes with unique methodologies adaptable to the crypto market’s volatile nature.

The Black-Scholes Model

The Black-Scholes model is a mathematical model used for pricing options. It considers factors such as current asset price, strike price, time until expiration, risk-free rate of return, and the asset’s volatility. The formula serves as a benchmark, particularly for European options, which can only be exercised at expiration. In Vietnam, prevailing market conditions demand that traders adjust for local volatility metrics.

The Binomial Model

The Binomial model presents an alternative where price movements are represented through a binomial tree. This model is flexible, accommodating American options that can be exercised before expiration. This flexibility becomes crucial in the Vietnamese market, where swift changes in market dynamics can be expected.

Local Influences on Pricing Models

Factors unique to the Vietnamese market such as regulatory changes and market sentiment also play a vital role in how options are priced. As regulatory bodies move towards formalizing cryptocurrency transactions—consider the growing emphasis on tiêu chuẩn an ninh blockchain (blockchain security standards)—investors must adapt their strategies accordingly.

Market Data Snapshot

To put things into perspective, let’s analyze some key statistics:

| Year | Crypto Users in Vietnam | Annual Growth Rate |

|---|---|---|

| 2022 | 5 million | – |

| 2023 | 10 million | 100% |

| 2024 | 15 million | 50% |

This impressive growth rate highlights the increasing engagement of Vietnamese citizens in cryptocurrency trading, emphasizing the need for robust options trading channels.

Strategies for Navigating Crypto Options in Vietnam

To excel in trading crypto options using the discussed pricing models, consider these strategic insights:

- Hedging: Utilize options to hedge against adverse price movements.

- Diversification: Spread investments across multiple assets to mitigate risks.

- Stay Informed: Regularly monitor regulatory changes affecting the Vietnamese crypto landscape.

Future of Crypto Options in Vietnam

With Vietnam positioning itself as a growing crypto hub in Southeast Asia, the future looks promising. Enhanced regulatory frameworks and growing institutional interest will likely foster confidence among investors.

As a case in point, professional platforms like HIBT are showcasing innovative features designed to resonate with local market behaviors. Understanding the broader context of global trends, including how to audit smart contracts and keeping abreast of security features will be paramount for potential investors.

Conclusion

Navigating the world of crypto options doesn’t have to be daunting. By understanding the underlying pricing models and adapting strategies to the Vietnamese market, investors can position themselves advantageously. The dynamic environment calls for a proactive approach, where utilizing platforms like HIBT can assist learners and traders alike in making informed decisions.

As Vietnam continues to embrace cryptocurrencies, leveraging knowledge about crypto options pricing will not only protect one’s digital assets but also pave the way for substantial growth. In the ever-evolving landscape of blockchain and cryptocurrencies, being equipped with the right tools and models is essential.

**Disclaimer:** Not financial advice. Always consult local regulators and financial advisors before making investment decisions.

For more insights on crypto and blockchain technologies, visit mycryptodictionary.