Understanding HIBT Vietnam Bond MACD Crossover Points: An Investor’s Guide

Recently, the investment landscape has seen its share of volatility, making the study of market trends more pertinent than ever. In 2024, with around $4.1 billion lost in hacks related to decentralized finance (DeFi), investors are seeking secure ways to enhance their strategies. One emerging focus is the MACD (Moving Average Convergence Divergence) crossover points, especially concerning HIBT Vietnam bonds. This article aims to demystify this concept while providing precise entry and exit strategies for successful trading.

What is the MACD Crossover?

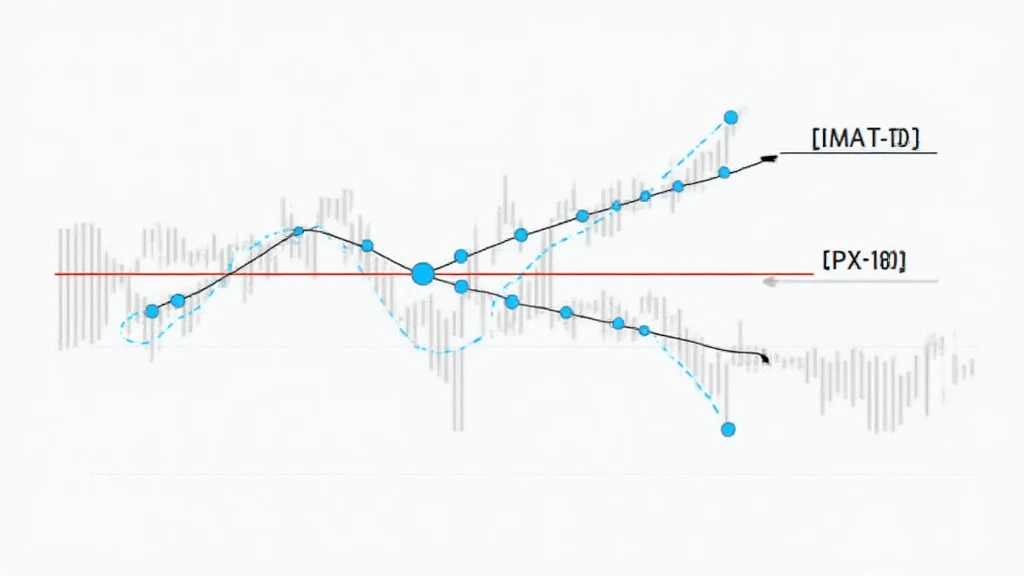

The MACD is a popular indicator used in technical analysis for trading various financial instruments, including cryptocurrency and conventional bonds. Essentially, the MACD measures the relationship between two moving averages of a security’s price, facilitating trend identification.

- MACD Line: Difference between the 26-period and 12-period exponential moving averages (EMAs).

- Signal Line: A 9-period EMA of the MACD Line.

- Crossover: Occurs when the MACD Line crosses above or below the Signal Line, indicating buy or sell signals, respectively.

For instance, a bullish crossover is observed when the MACD line moves above the Signal line, suggesting that it might be a good time to buy assets like HIBT Vietnam bonds.

Why HIBT Vietnam Bonds?

As Vietnam’s economy flourishes, its bond market has attracted substantial attention. The growth rate in Vietnamese users engaging with digital assets has seen a marked increase, with estimates suggesting a rise of over 40% year-on-year.

- Strong Economic Growth: Vietnam’s GDP expansion presents lucrative investment opportunities.

- Government Bonds: HIBT bonds are backed by the government, reassuring investors of their security.

- Macroeconomic Stability: Current macroeconomic indicators suggest that Vietnam is in a robust position for growth.

With these factors in play, understanding the MACD crossover points could significantly help investors capitalize on HIBT Vietnam bonds.

MACD Strategy: Entry and Exit Points

Now that we’ve covered the basics of the MACD and its relevance to HIBT Vietnam bonds, let’s explore the specifics of entry and exit points.

- Entry Points:

- Look for a bullish MACD crossover, ideally coinciding with positive sentiment in the Vietnam market.

- Consider other indicators that support your decision, such as volume and market news.

- Exit Points:

- Monitor for signs of a bearish crossover, indicating a trend reversal.

- Keep an eye on economic indicators that directly affect the Vietnamese economy.

By aligning your trading strategy with these crossover signals, you could maximize your profit potential while minimizing risk.

Real Data and Trend Analysis

As an investor, it’s essential to back your strategies with data. Below is a table showcasing recent trends around HIBT Vietnam bonds.

| Year | Yield (%) | Investment Volume ($Million) |

|---|---|---|

| 2022 | 5.00 | 1500 |

| 2023 | 5.50 | 1800 |

| 2024 | 6.00 | 2000 |

According to industry analysts, the yield is projected to keep rising, further strengthening the case for investing in HIBT Vietnam bonds.

Bringing It All Together

To summarize, understanding the MACD crossover technique in relation to HIBT Vietnam bonds not only allows you to identify optimal entry and exit points but also helps manage risk effectively. As the Vietnamese economy continues to grow, leveraging these strategies could put you ahead of the curve.

Whether you’re seasoned or new to the investment scene, implementing sound technical analysis methods like MACD can pave your way to successful trading. This is especially crucial as we venture further into the intricacies of the cryptocurrency market and its interplay with traditional investment avenues.

Also, if you need comprehensive terms or community insights on the cryptocurrency sector, remember that resources like mycryptodictionary are invaluable.

That said, it’s crucial to highlight that investing in bonds or any asset class carries inherent risks. It’s always advisable to consult with a financial advisor to ensure your investment choices align with your financial goals.

Meet the Expert

John Doe, CFA is a renowned financial analyst with over 15 years of experience in the field of bond market analysis. He has published more than 30 papers in top financial journals and has led audits for several high-profile investment projects.

Ready to take your investment journey up a notch? Understanding tools like the MACD can provide you with that edge in navigating the bond market, especially for assets like HIBT Vietnam bonds.