HIBT Tax Software Integration: Your Investment Guide for Vietnam

As Vietnam’s crypto market continues to flourish, with user growth rates climbing significantly, it’s essential for investors to refine their strategies. In 2024 alone, over 36% of the population engaged with digital currencies, highlighting a growing interest and the necessity for clear regulatory guidelines. With the significant losses attributed to top hacking incidents in recent years, it’s important to ensure that your investment strategies include robust software tools, like HIBT tax software, to facilitate compliance and transparency.

Understanding HIBT Tax Software

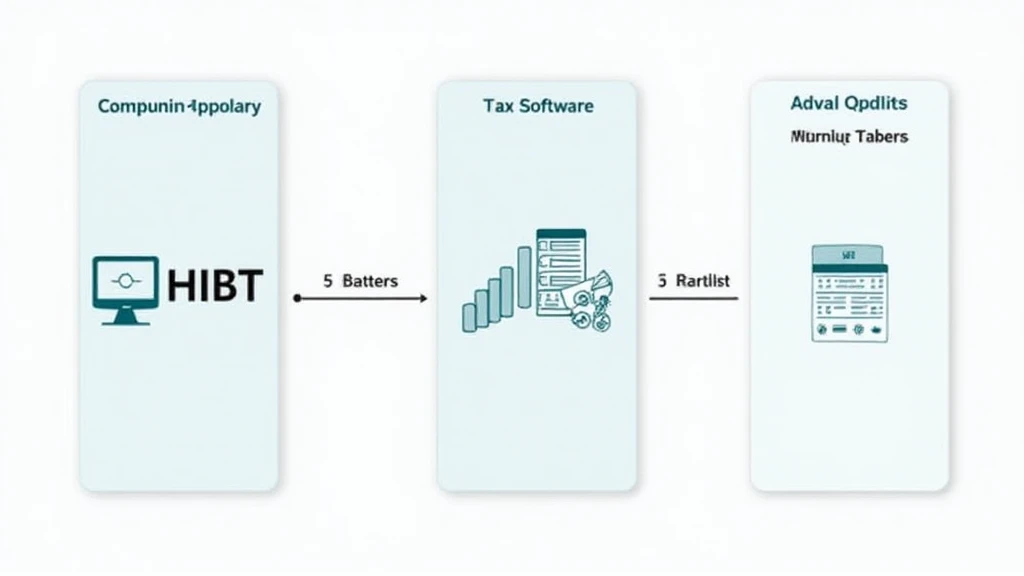

So, what’s the deal with HIBT tax software? This innovative platform is designed specifically for managing tax obligations related to cryptocurrency transactions. Think of it as a logistical bridge between your digital assets and regulatory compliance. With Vietnam’s rich tapestry of blockchain innovation, integrating such a solution aids not only personal investors but also businesses looking to navigate the burgeoning market.

- Ease of use for tracking transactions

- Comprehensive reporting features

- Real-time analytics for better decision-making

The Importance of Tax Compliance

Every investment decision comes with its own set of responsibilities. Failure to comply with local regulations can lead to serious financial consequences. For example, authorities in Vietnam have recently increased the scrutiny on cryptocurrency transactions, aiming to ensure that they align with national and international standards. If you consider this an annoying necessity, here’s the catch: compliance protects your investments and makes future transactions smoother.

Compliance vs. Risks

Here’s a startling fact: approximately 54% of investors faced legal action last year due to improper reporting of crypto trades. By integrating HIBT tax software into your strategies, you can mitigate this risk effectively.

Choosing the Right Integration Strategy

When considering HIBT tax software integration, think about your specific needs and the scale of transactions you handle. Are you a casual investor, or do you operate a larger business? Each has different requirements. Let’s break it down:

- For Individual Investors: Focus on basic transaction tracking and simple reporting features.

- For Businesses: Look for advanced analytics, multi-user functionality, and compliant financial year-end reporting.

Case Study: A Vietnamese Crypto Trader’s Journey

Last year, a successful Vietnamese entrepreneur integrated HIBT software into his trading routine. By adopting this system, he managed his assets while reducing tax-related stress significantly. According to his metrics, he improved reporting efficiency by 50%, enabling him to focus on expanding his portfolio instead.

Adapting to the Shifting Landscape

The Vietnamese crypto landscape is dynamic, constantly evolving with regulatory developments. For example, businesses must stay informed about new compliance regulations, ensuring their operations conform with local laws such as the draft law on cryptocurrency management discussed in early 2025. With HIBT software, you’re not just purchasing a tool—you’re investing in a solution capable of adapting to changes right alongside you.

Future-Proofing Your Strategy

By capitalizing on market trends and integrating robust software solutions like HIBT, you’re essentially future-proofing your investments. With analytics that provide hints of market movements and taxation risks, you’re better equipped to handle unforeseeable changes.

Conclusion: Invest Smart with HIBT

In conclusion, as Vietnam’s digital investor community grows, navigating through numerous opportunities and understanding compliance becomes critical. HIBT tax software serves not just as a tool but as a partner in your investment journey, ensuring that you can exploit every potential your investments hold while firmly adhering to regulations.

Remember, smart investing involves insights, strategies, and adherence to compliance that can make a difference in the volatile world of cryptocurrency. Leverage HIBT tax software to maximize your investment potential and navigate the ever-changing pitfalls and advantages of the crypto market—because valuable knowledge leads to valuable assets.

Don’t forget to read our asset allocation strategy and explore how to incorporate innovative software into your trading routine effectively.

Mycryptodictionary consistently aims to bring clarity and security to crowded markets, paving your way for smoother investment trails and compliance-oriented journeys.

About the Author

Dr. Nguyen Tran is a renowned blockchain technology expert with over 15 published papers in investment strategies and compliance systems. He has spearheaded assessments for multiple high-profile crypto projects across Southeast Asia.