Introduction

As the cryptocurrency landscape continues to evolve, it’s crucial for users to stay informed about the tools that can simplify their finance management. In fact, a report from Chainalysis indicates that Vietnam ranks among the top countries with the highest crypto adoption rates, with a staggering 29% of the population engaging in digital asset trading. Amidst this growing trend, the recent launch of the Hibt tax calculator tool is a game-changer for local users navigating the complexities of crypto taxation.

This article aims to provide comprehensive insights into the Hibt tax calculator tool, detailing its features, benefits, and how it can aid Vietnam users in managing their cryptocurrency taxes effectively.

Understanding the Needs of Vietnam’s Crypto Users

Vietnam’s cryptocurrency market has seen exponential growth, spurred by a young, tech-savvy population. However, with an increase in digital asset transactions comes the pressing need for secure and accurate tax calculations. According to recent statistics, Vietnam witnessed an impressive growth rate of 350% in cryptocurrency transactions in 2023 alone. As more individuals delve into trading altcoins, ensuring compliance with local tax regulations becomes paramount.

The Launch of Hibt Tax Calculator Tool

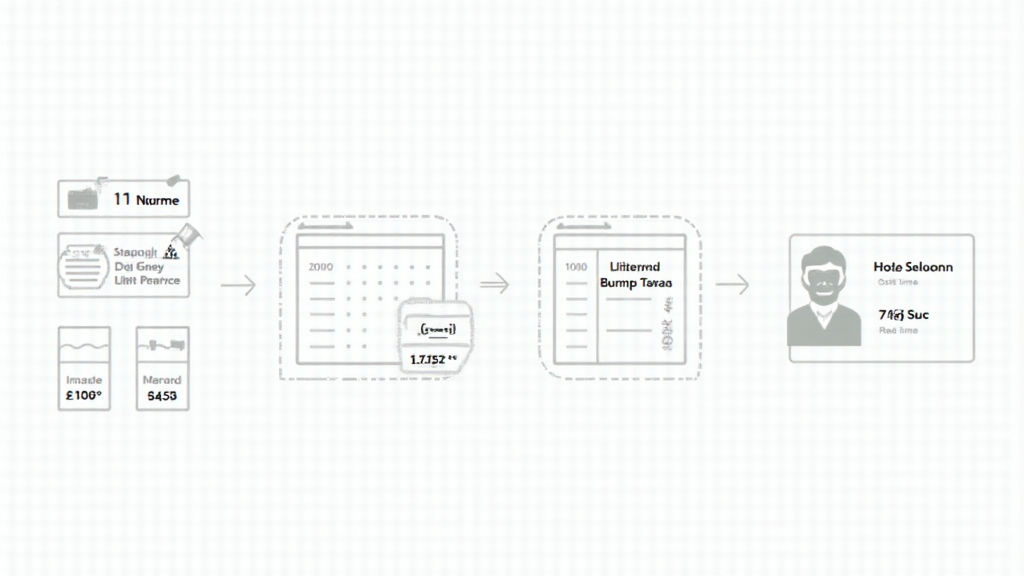

The Hibt tax calculator tool has been designed with the Vietnamese market in mind, offering user-friendly features that align with the country’s unique regulatory landscape. Here’s a breakdown of what the tool offers:

- Easy Integration: Seamlessly integrates with popular wallets and exchanges, making it easier for users to track their transactions.

- Comprehensive Reporting: Generates detailed reports tailored to Vietnam’s tax regulations, simplifying compliance.

- Real-Time Updates: Provides timely updates on changes in tax laws and guidelines, ensuring users are always informed.

Key Features of the Hibt Tax Calculator Tool

With various features designed to enhance user experience, the Hibt tax calculator tool stands out among existing services. Here’s what makes it exceptional:

- Multi-Currency Support: Supports various cryptocurrencies, including Bitcoin, Ethereum, and popular altcoins, ensuring comprehensive coverage for Vietnam users.

- User-Friendly Interface: Designed for ease of use, allowing even novices to navigate the tool effortlessly.

- Secure Data Handling: Implements robust security measures to protect sensitive financial information, aligning with the tiêu chuẩn an ninh blockchain.

The Importance of Accurate Tax Calculations

In a rapidly growing market like Vietnam, not adhering to tax regulations can lead to severe consequences. The Vietnamese government has established clear guidelines for taxing crypto transactions. It is crucial for users to accurately calculate their capital gains and losses to remain compliant.

The Risks of Non-Compliance

Failing to report cryptocurrency earnings can lead to hefty fines and legal troubles. Reports suggest that Vietnamese authorities are tightening regulations, and crypto users must remain vigilant. The Hibt tax calculator helps mitigate these risks by ensuring users report their earnings accurately.

Leveraging Tools for Compliance

Tools like the Hibt tax calculator not only simplify tax filing but also empower users to take control of their financial documentation. By automating reports, users spend less time on calculations and more time focusing on their trading strategies.

Real-World Applications: Case Studies

Let’s explore some real-world cases illustrating how the Hibt tax calculator tool positively impacts Vietnam users:

- Case Study 1: A trader with diverse holdings utilized the Hibt tool for year-end reporting, successfully filing their taxes with zero discrepancies.

- Case Study 2: A group of investors leveraged the calculator’s comparative function to analyze potential capital gains from various altcoins, helping them make informed investment decisions.

Conclusion

With the launch of the Hibt tax calculator tool, Vietnam users are now equipped with an essential resource tailored to meet their cryptocurrency taxation needs. As the digital asset market continues to thrive, the importance of accurate reporting cannot be overstated.

By embracing tools like the Hibt tax calculator, individuals can navigate the complex world of cryptocurrency taxes with confidence and clarity. Be sure to explore the features of the Hibt tax calculator and take the necessary steps to ensure your crypto investments are both profitable and compliant.

For more information and a detailed guide on optimizing your cryptocurrency tax strategy, visit hibt.com.