Understanding HIBT Crypto Order Types: A Comprehensive Guide

In the rapidly evolving landscape of cryptocurrency trading, understanding the various order types can provide you with the tools needed to maximize your potential returns while managing risk effectively. Did you know that in 2023, the trading volume in Vietnam’s cryptocurrency market reached over $4 billion, showing an impressive growth trajectory? However, with the lucrative opportunities come inherent risks, making it essential for traders to comprehend HIBT crypto order types.

Introduction to HIBT Crypto Order Types

HIBT, or High-Impact Buy and Trade, refers to specific strategies employed by traders in the cryptocurrency markets. As the number of Vietnamese cryptocurrency users grows, now surpassing 7 million, understanding these strategies can empower traders to make more informed decisions. The total market cap of cryptocurrencies, hovering around $2 trillion, indicates not only the growth of this sector but the need for traders to be equipped with the right knowledge.

The Basics of Order Types

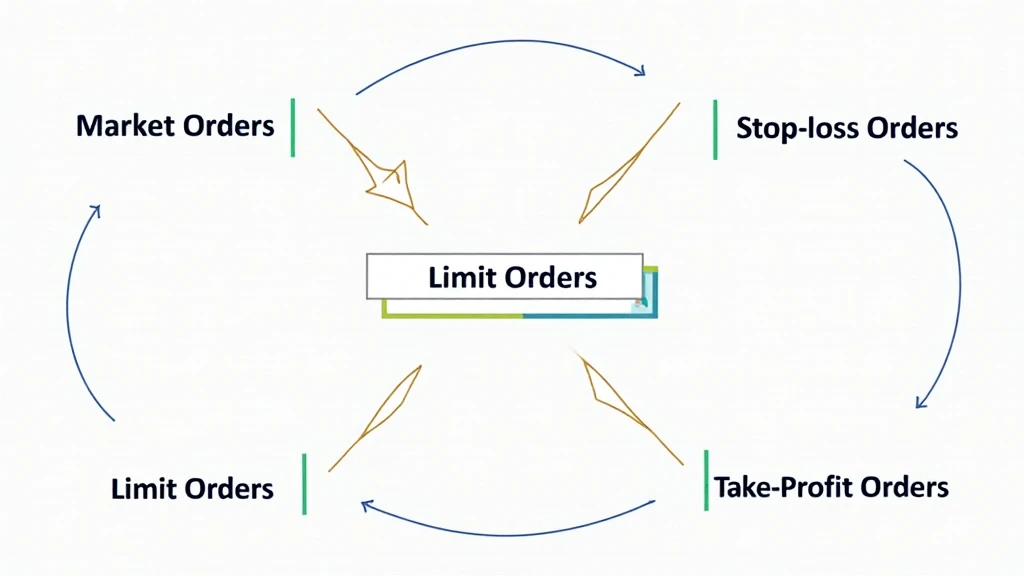

In cryptocurrency trading, order types are rules you set regarding how to execute buy and sell orders. Here are some common HIBT crypto order types that every trader should know:

- Market Orders: These are executed at the current market price and are often used for immediate purchases.

- Limit Orders: Set a specific price at which you want to buy or sell, postponing execution until the market reaches that price.

- Stop-Loss Orders: Automatically sell your assets when they hit a certain price, helping to minimize potential losses.

- Take-Profit Orders: Similar to stop-loss orders but used to secure profits once the asset reaches the desired price.

- Conditional Orders: These orders come into effect only when specific conditions are met, adding an extra layer of strategy.

The Importance of Understanding Order Types

Without a solid understanding of order types, traders may find themselves at a disadvantage. In 2023, 35% of cryptocurrency traders in Vietnam reported significant losses due to misunderstanding order execution. Knowing which order type aligns with your trading goals can make all the difference. It’s like having a well-planned roadmap for a long journey – without it, you might end up lost.

How to Choose the Right Order Type

Choosing the appropriate HIBT crypto order types depends on several factors, including market conditions, your trading strategy, and risk appetite. Here are some pointers to guide your decision:

- Market Conditions: In a volatile market, you may prefer market orders to capitalize quickly on price movements.

- Trading Strategy: Consider whether you are a scalper seeking to make small profits quickly or a long-term investor.

- Risk Management: Utilize stop-loss orders to protect against unexpected market shifts.

Practical Applications of Order Types

Let’s break it down. Think of trading as a game of chess. Each order type is akin to a different piece on the board—each with its unique capabilities, advantages, and strategies.

For instance, using market orders might be your king piece that allows you to secure transactions quickly. On the other hand, limit orders could function like the queen, enabling you to control the game from a distance.

Moreover, Vietnamese traders can utilize local exchanges that understand these dynamics. Platforms with strong liquidity can enhance the effectiveness of each order type, making it essential to research exchange properties.

Case Study: HIBT Orders in Action

To illustrate the effectiveness of HIBT crypto order types, consider the following hypothetical scenario:

- A trader sets a market order to buy Bitcoin when the price is expected to surge.

- As the price indeed moves up, the trader utilizes a stop-loss order to ensure a profit margin should the price drop unexpectedly.

- The trader decides to take profits as Bitcoin reaches a predetermined threshold using a take-profit order.

This dynamic illustrates how mastering these order types can lead to significant earnings while effectively managing risk.

Vietnam’s Growing Crypto Market and Order Types

As highlighted earlier, Vietnam’s crypto market is rapidly expanding, driven by user adoption rates increasing by over 140% in 2023. With such growth, understanding HIBT crypto order types is vital for both new and seasoned traders in the region.

The Vietnamese market landscape is unique in its regulatory environment. Understanding local regulations around trading can provide insights into how to execute your orders responsibly and legally.

Conclusion

In summary, mastering HIBT crypto order types is essential for navigating the vibrant world of cryptocurrency trading. With increased user adoption and market activity in Vietnam, having a clear grasp of these order types can substantially enhance your trading strategy, helping to mitigate risks while maximizing potential gains.

To explore further on this topic, be sure to check out hibt.com for detailed insights and real-time trading analytics.

Disclaimer: The information provided here is not financial advice. Always consult with local regulators or a financial professional before making trading decisions.

Author: Dr. Nguyen Hoang, a cryptocurrency researcher with over 10 published papers on blockchain technology and digital finance, and a leading expert in the auditing of smart contracts.