Introduction: The Landscape of Crypto Leverage

With a staggering $4.1 billion lost to DeFi hacks in 2024, the crypto landscape is fraught with risks and uncertainties. As more people turn to crypto investments like HIBT, understanding leverage risks is crucial for safeguarding your assets. This article offers an in-depth examination of the leverage risks associated with HIBT crypto trading, aiming to provide valuable insights for novice and seasoned investors alike.

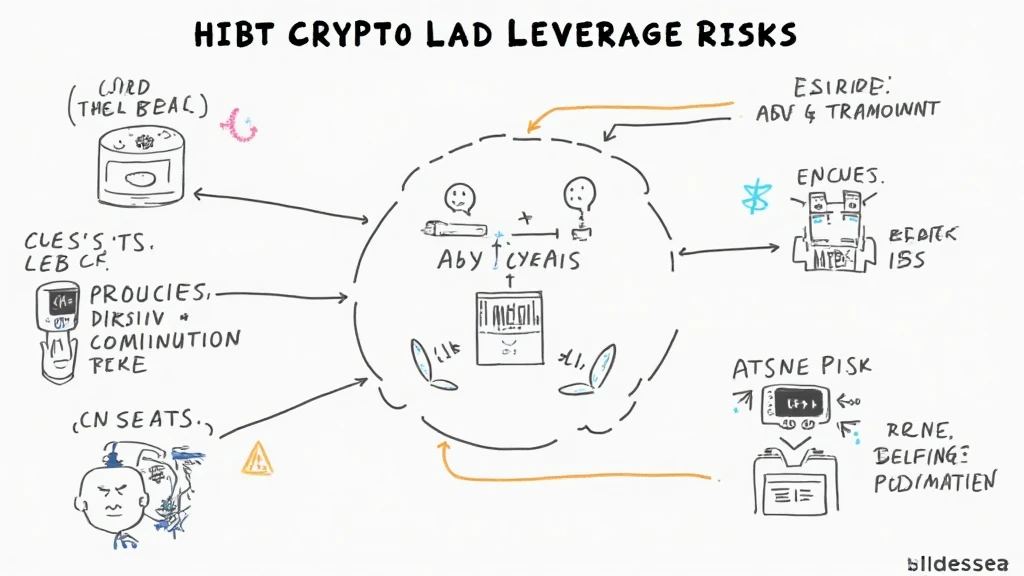

1. What is Crypto Leverage?

Crypto leverage involves using borrowed funds to increase the potential return on investment. When you place a trade with leverage, you can magnify your profits—however, you also increase your exposure to substantial losses. For example, a 10x leverage means that for every dollar you invest, you control ten dollars’ worth of assets.

Like a bank vault for digital assets, leverage requires trust in the platform you choose to use. An understanding of both its benefits and risks is essential for making informed trading decisions.

2. Understanding HIBT Crypto Leverage Risks

HIBT trading leverages can be incredibly appealing, especially during bullish market conditions. However, it is vital to acknowledge the risks:

- Volatility Risks: The cryptocurrency market is notorious for its price swings. A sudden downturn can lead to losses exceeding the initial investment.

- Liquidation Risks: If the market moves against your position, it may trigger liquidation—where your assets are sold to meet margin requirements, resulting in irreversible losses.

- Psychological Risks: Trading with leverage can lead to emotional decision-making, resulting in rash actions and further losses.

- Regulatory Risks: Regulations around crypto leverage are evolving. Traders must stay compliant with local laws to avoid penalties.

3. Evaluating the HIBT Crypto Market

As of 2025, the Vietnam crypto market is witnessing a rapid user growth rate of around 25%, indicating a rising interest in digital assets. Understanding the local dynamics is crucial for mitigating HIBT leverage risks. Key factors include:

- Market Sentiment: Pay attention to how global and local market sentiments can affect HIBT value.

- Economic Environment: Factors such as inflation rates in Vietnam can impact crypto investment strategies.

- Community Awareness: Stay informed about local news surrounding crypto regulations and safety standards.

4. Strategies to Mitigate Leverage Risks

While risks cannot be eliminated entirely, they can be managed through various strategies:

- Start Small: Begin with lower leverage (1-2x) as you familiarize yourself with the platform and the market.

- Set Stop-Loss Orders: Implement stop-loss orders to automatically exit positions at predetermined loss levels.

- Diversify Investments: Avoid concentrating your investments in HIBT alone; consider including other less volatile assets.

- Use Reputable Platforms: Prioritize platforms known for their security features and regulatory compliance.

5. Case Studies: The Real-World Impact of Leverage Risks

In 2024, several traders experienced significant losses in HIBT due to leveraging amidst market volatility. To illustrate, here are two case studies:

- Case Study 1: A trader utilized 10x leverage and suffered a loss of 80% when HIBT dropped by just 10%—triggering liquidation.

- Case Study 2: Another trader employed risk management strategies, using only 2x leverage, which allowed them to weather market fluctuations effectively.

Conclusion: Navigating the HIBT Crypto Landscape Wisely

Investing in HIBT with leverage can offer exciting opportunities, but it’s essential to navigate the associated risks carefully. Stay informed, utilize risk management strategies, and always prioritize security. For more insights on digital assets and protecting your cryptocurrency investments, visit hibt.com.

Your crypto journey can be rewarding, provided you approach it with caution and knowledge.

By following the practices outlined in this article, you can significantly reduce your exposure to leverage-related risks endemic to the crypto space. Always remember, not financial advice; consult local regulators to ensure compliance and make informed decisions.