Bitcoin Mining Farm Energy Costs: An In-Depth Look

With the rapid growth of Bitcoin mining, understanding the energy costs associated with running a mining farm has become increasingly crucial. In fact, according to the Cambridge Centre for Alternative Finance, Bitcoin mining consumes around 104 TWh annually, which is comparable to some countries’ total electricity usage. This article will delve into various aspects of Bitcoin mining farm energy costs, offering insights, expert opinions, and actionable strategies to minimize these expenses.

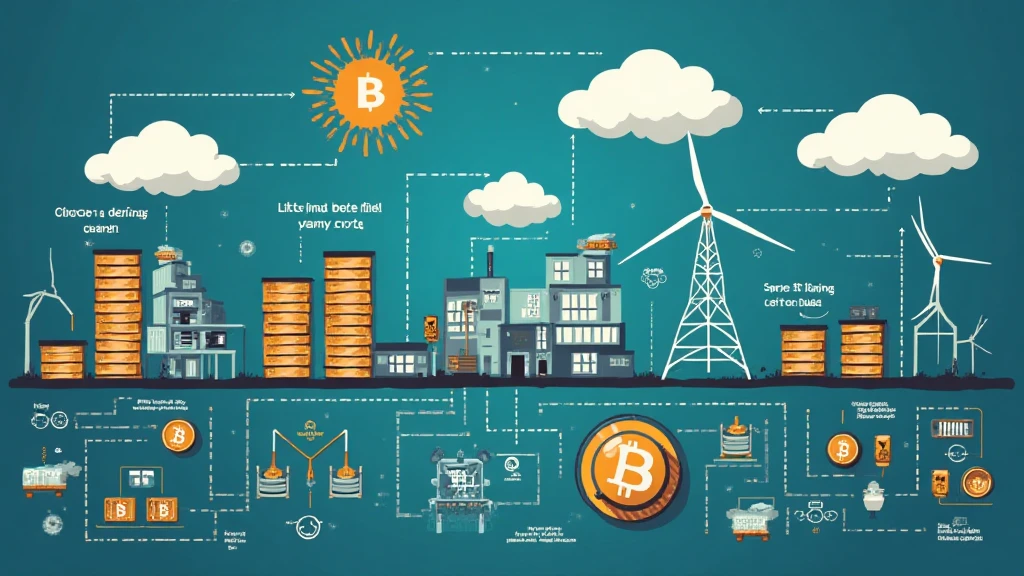

Understanding Bitcoin Mining and Its Energy Demands

To grasp the overall energy costs of a Bitcoin mining farm, it’s important to understand how Bitcoin mining operates. Mining is the process by which transactions are verified and added to the public ledger (the blockchain). This process requires complex calculations, powered by high-performance computers, which inevitably leads to significant energy consumption.

- Mining involves solving complex mathematical problems.

- High-performance machines consume substantial electricity.

- Energy costs account for a significant portion of mining operational expenses.

The Factors Influencing Energy Costs

The energy costs of running a Bitcoin mining farm can vary significantly based on several factors:

- Location: Regions with inexpensive electricity are more attractive for mining farms. For instance, areas in China and regions offering renewable energy sources tend to have lower costs.

- Infrastructure: The quality of the electrical infrastructure can impact the total costs. Poor infrastructure may lead to inefficiencies and increased costs.

- Machine Efficiency: The type of hardware used also affects energy consumption. More efficient machines, like the Antminer S19, consume less energy per hash than older models.

- Cooling Requirements: Mining rigs generate heat, necessitating cooling systems that require additional energy.

Current Trends in Energy Costs

Research shows that energy costs for Bitcoin mining have been fluctuating due to market changes, regulatory impacts, and the global push for sustainable practices. For instance, as countries continue to invest in renewable energy, the costs associated with Bitcoin mining could be drastically reduced.

Moreover, with Bitcoin’s price volatility, miners may find it necessary to adapt their energy strategies frequently. According to a 2025 report by the International Energy Agency, a significant shift towards global energy efficiency is being noted, which may present both challenges and opportunities for Bitcoin miner costs.

How to Optimize Energy Costs

Reducing energy costs is a key element for the survival and profitability of Bitcoin mining operations. Here are some strategies that could help:

- Location Optimization: Establish mining operations in regions with lower electricity rates and favorable mining laws.

- Invest in Efficient Hardware: Upgrading to newer models can significantly decrease energy consumption.

- Use Renewable Energy: Integrating wind, solar, or hydroelectric energy sources can greatly lower costs and improve sustainability.

- Implementing Energy Management Systems: Using software to monitor and manage energy consumption can highlight areas for efficiency improvements.

- Flexible Operations: Miners can pivot their operations based on electricity prices, taking advantage of low-rate periods.

Case Studies: Successful Energy Management

Several mining operations have successfully reduced their energy costs by adopting innovative strategies:

- A mining farm in Vietnam reduced energy costs by 30% by utilizing solar panels. The farm experienced significant growth, correlating with a 20% increase in Vietnamese users engaging in cryptocurrency mining.

- In the USA, a mining operation implemented a combined heat and power (CHP) system, lowering energy costs by 40% while also addressing cooling requirements.

- Another example includes a Russian mining farm that strategically operates only during off-peak hours, thus optimizing their electricity usage significantly.

Conclusion: The Future of Bitcoin Mining Farms

Considering the evolving landscape of Bitcoin mining, coupled with global energy trends, it’s crucial for miners to stay informed and adapt strategies as necessary. Understanding Bitcoin mining farm energy costs is vital for profitability, especially as we move toward 2025. Always remember, optimizing energy usage not only enhances profitability but also contributes to sustainable practices in the cryptocurrency space.

For anyone involved in Bitcoin mining, keep an eye on your energy expenses. It’s not just an operational cost; it’s a significant stakeholder in your mining profitability.

For more insights on optimizing energy use and navigating the crypto market, check out hibt.com. Not financial advice. Consult local regulators.

Published by Dr. Alex Parker, an energy management consultant specializing in blockchain technologies and the cryptocurrency market. Dr. Parker has authored over 15 research papers on energy efficiency in cryptocurrency mining.