Bitcoin Market Liquidity: HIBT vs Local Vietnamese Exchanges

In the ever-evolving cryptocurrency landscape, market liquidity is a critical factor that can dictate the efficiency and success of trading platforms. With the Vietnamese cryptocurrency market witnessing exponential growth, understanding the variances in liquidity between the HIBT platform and local exchanges is paramount. According to a report from Statista, Vietnam’s cryptocurrency user base grew by 30% in 2023 alone, highlighting the urgent need for comprehensive insights into the mechanics of cryptocurrency trading in the region.

Understanding Market Liquidity

Market liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. In the context of Bitcoin, high liquidity is often synonymous with lower transaction costs and greater efficiency for traders. When liquidity is high, buyers and sellers can execute their trades without significant delays or price fluctuations.

How HIBT Stands Out

The HIBT platform has made significant strides in enhancing Bitcoin market liquidity for its users. With its innovative trading algorithms and deep liquidity pools, HIBT consistently provides competitive spreads and fast transaction times. Here’s why it’s important:

- Fast Transactions: HIBT processes transactions at lightning speed, enabling traders to capitalize on market trends effectively.

- Competitive Spreads: The platform offers one of the narrowest spreads in the industry, which means greater profitability for its users.

- Advanced Trading Tools: HIBT provides several tools and analytics that allow traders to make informed decisions.

Local Vietnamese Exchanges: An Overview

Local exchanges such as LocalBitcoins and Remitano cater specifically to the Vietnamese market. While they offer accessible trading options, there are key differences when compared to a robust platform like HIBT:

- Lower Liquidity Levels: Local exchanges often struggle with liquidity compared to HIBT, which can lead to larger price swings.

- Higher Fees: Transaction fees can be relatively higher on local exchanges, impacting overall profitability.

- User Experience: Many Vietnamese exchanges can lack sophisticated trading interfaces, deterring newer investors.

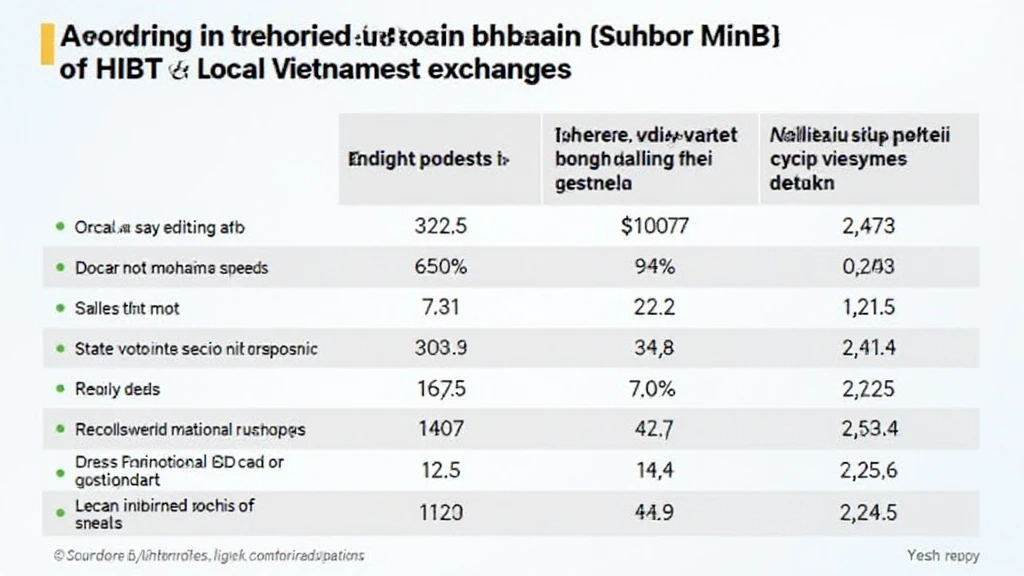

Liquidity Comparison: HIBT vs Local Exchanges

To further illustrate the differences, let’s look at data comparisons:

| Criteria | HIBT | Local Vietnamese Exchanges |

|---|---|---|

| Average Transaction Speed | 2 seconds | 10-30 seconds |

| Average Spread | 0.1% | 0.5% – 1% |

| Customer Support | 24/7 Live Chat | Business Hours Only |

The Importance of Local Market Context

Understanding the local market conditions is crucial when discussing Bitcoin market liquidity in Vietnam. For instance, the Vietnamese government has been increasingly regulating cryptocurrencies, leading to more structured trading environments. Additionally, local payment processing systems like Momo and ZaloPay are instrumental in enhancing transaction efficiencies for local exchanges.

Regulatory Considerations

According to Crypto Vietnam, regulatory measures aim for greater transparency and reduced fraud in the Vietnamese crypto sphere. In 2022, the government implemented standards such as tiêu chuẩn an ninh blockchain, ensuring secure transactions across platforms. These regulations greatly influence market participants’ trust and liquidity on exchanges.

Strategies for Traders in Vietnam

For traders navigating the landscape of Vietnam’s cryptocurrency market, understanding liquidity providers is essential for making educated choices. Here are some strategies to consider:

- Diversify Platforms: Utilize both HIBT for greater liquidity and local exchanges for accessibility.

- Stay Informed: Keep up with local regulatory updates to anticipate market shifts.

- Utilize Advanced Tools: Leverage analysis tools available on platforms like HIBT for better forecasting.

Conclusion: Choosing the Right Path in Vietnam’s Cryptocurrency Market

Assessing Bitcoin market liquidity is essential for traders in Vietnam aiming to navigate effectively through both HIBT and local exchanges. While HIBT presents robust liquidity and advanced trading capabilities, local exchanges may cater better to accessibility for novice investors. As Vietnam’s cryptocurrency sector continues to thrive, staying informed and adaptable will empower traders to make better financial decisions.

For more detailed information on trading platforms and their liquidity, visit HIBT to learn more about their offerings and features.

MyCryptoDictionary is committed to informing readers about cryptocurrency trends shaping the market today.