Mastering Bitcoin Market Cycle Management

Introduction

In 2024, the crypto space witnessed over $4.1 billion lost to hacks within decentralized finance (DeFi). As the digital asset landscape continues to evolve, the importance of effective Bitcoin market cycle management cannot be overstated. Understanding market cycles is crucial for both beginners and seasoned investors aiming to maximize their returns while minimizing risks.

Market cycles govern the ebb and flow of cryptocurrencies, including Bitcoin. These cycles can significantly impact investment strategies, making it essential to grasp their nuances. This article seeks to provide valuable insights into managing Bitcoin market cycles effectively.

Understanding Bitcoin Market Cycles

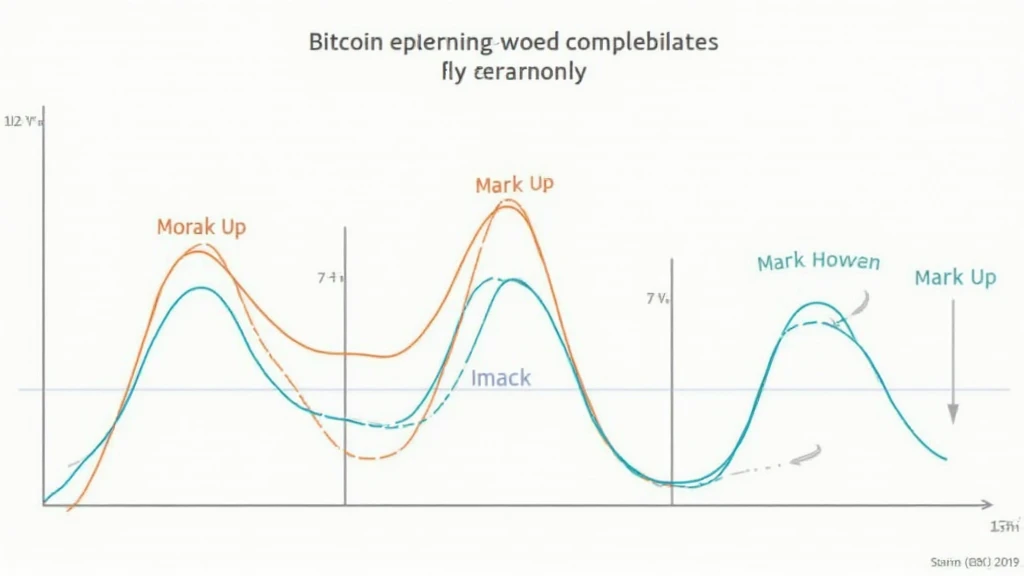

The Bitcoin market operates in cycles, typically ranging from accumulation to euphoria and eventually to despair. Recognizing these phases can help investors make informed decisions.

- Accumulation Phase: This phase marks a period of low prices where informed investors buy Bitcoin, leading to a gradual price increase.

- Mark Up Phase: During this stage, increasing demand drives prices higher, creating euphoric buying pressure.

- Distribution Phase: Here, investors start selling their holdings at peak prices, leading to a slowdown in price appreciation.

- Mark Down Phase: Prices begin to fall as panic-selling occurs, prompting investors to hold off buying until conditions improve.

With these phases in mind, strategic decision-making can lead to profitable investments in the Bitcoin market.

The Role of News in Market Cycles

Market sentiment is heavily influenced by news events. Keeping an eye on major headlines can provide insight into potential price movements. Events such as regulatory announcements or technological advancements can lead to immediate price reactions.

- Example: Positive news relating to institutional adoption can shift the market towards optimism, pushing prices higher.

- Negative Headlines: Conversely, negative news can trigger panic selling, affecting prices adversely.

Investors should stay informed about market trends and adapt their strategies accordingly to navigate through these cycles effectively.

Tools for Analyzing Market Cycles

Investing in Bitcoin involves utilizing various tools to analyze market trends. Here are a few recommended tools:

- Technical Analysis Software: Tools like TradingView and Coinigy help visualize price movements, identify trends, and forecast future movements.

- Sentiment Analysis Platforms: Platforms like Santiment offer insights into market sentiment, helping investors gauge the emotional state of the market.

- On-Chain Analysis Tools: Tools like Glassnode provide data on network activity, revealing insights that traditional analysis might miss.

Leveraging these tools can enhance an investor’s ability to make informed decisions throughout the market cycle.

Implementing a Market Cycle Strategy

Effective management of Bitcoin market cycles requires a strategic approach. Consider the following steps:

- Set Clear Buy and Sell Targets: Defining price levels to buy during the accumulation phase and sell during the euphoric phase assists in maximizing profits.

- Utilize Stop-Loss Orders: Protect investment by setting stop-loss thresholds to minimize losses during the downturn.

- Diversification: Consider diversifying into other cryptocurrencies, especially during distribution and mark down phases.

- Regular Review of Portfolio: Evaluating your holdings periodically ensures that they align with market conditions.

By following these strategies, investors can navigate the complexities of Bitcoin market cycles more effectively.

Case Studies: Successful Cycle Management

Let’s look at real-world examples of successful Bitcoin cycle management:

| Year | Market Phase | Investor Action | Outcome |

|---|---|---|---|

| 2020 | Accumulation | Investors bought during dips | Significant profits in 2021 |

| 2021 | Euphoria | Investors sold at all-time highs | Realized profits before downturn |

| 2022 | Mark Down | Hoarded cash or stablecoins | Positioned for recovery in 2023 |

These examples illustrate how understanding and managing market cycles can significantly influence investment success.

Vietnamese Market Insights

With the rising interest in cryptocurrencies, the Vietnam market has shown substantial growth. According to recent reports, the user growth rate in Vietnam is around 35% in 2024.

As demand increases, Vietnamese users need to understand the significance of Bitcoin market cycle management. tiêu chuẩn an ninh blockchain should be top of mind when participating in the market, ensuring that investments are both safe and strategically sound. Local platforms like hibt.com are increasingly popular for Vietnamese investors looking to enhance their understanding of market trends.

Conclusion

Mastering Bitcoin market cycle management is essential for successful investment in the crypto space. By understanding market phases, leveraging tools, and implementing strategic actions, investors can optimize their returns while mitigating risks. Remember that market dynamics continually shift; staying informed and adaptable is the key to thriving in this ever-changing landscape.

For a deeper dive into related topics, consider reading our Vietnam crypto tax guide, or explore our comprehensive insights on smart contract audits.

My name is Dr. Trần Minh, a blockchain technology researcher with over 15 published papers and a background in auditing notable projects in the cryptocurrency landscape.