Introduction: Understanding Bitcoin Halving

As the cryptocurrency landscape continues to evolve, significant events like Bitcoin halving have a profound impact on market forecasts. In 2024, around $4.1 billion was lost due to DeFi hacks, raising questions about the stability of the digital asset world. What does Bitcoin halving mean for traders and investors? Can historical trends guide future forecasts? Let’s dive into the intricacies of Bitcoin halving, its implications on market movements, and what it means for investors as we approach 2025.

The Basics of Bitcoin Halving

Bitcoin halving is an event that occurs approximately every four years, reducing the block reward given to miners by half. This reduction impacts the supply of new Bitcoins entering circulation, thus influencing market prices. Given that Bitcoin reached its all-time high in November 2021, there is significant speculation regarding its future, especially as we approach the next halving in 2024.

What Happens During Halving?

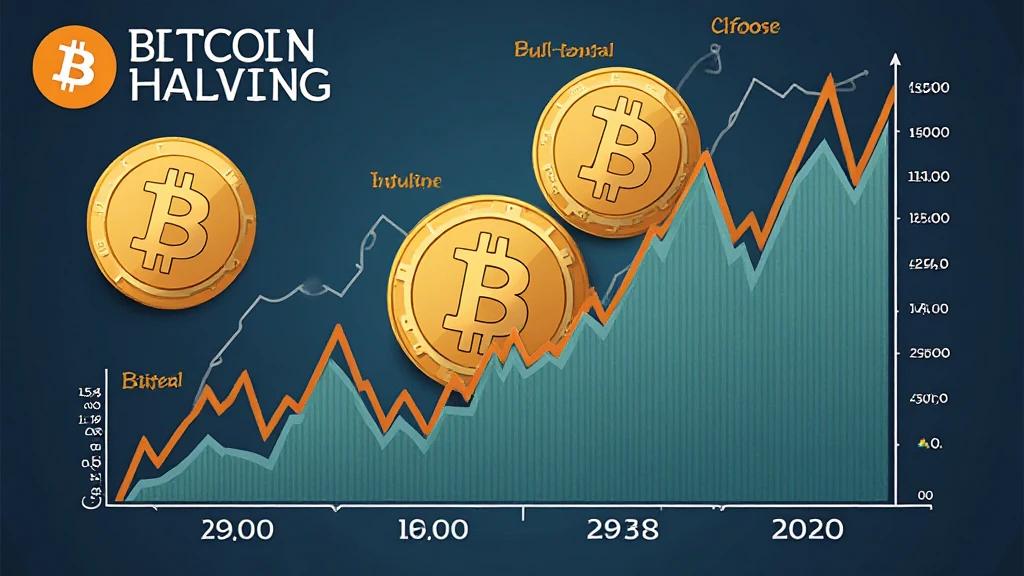

Every 210,000 blocks, the halving event occurs, cutting the reward for mining Bitcoin from 6.25 BTC to 3.125 BTC. This event is designed to control supply and reduce inflation, driving demand. Historically, Bitcoin has followed a pattern of price increase in the months leading up to and following halving events. For example:

- 2012: First halving– Price surged from $12 to $1,200.

- 2016: Second halving– Price rose from $450 to $20,000.

- 2020: Third halving– Price increased from $8,500 to $64,000.

As exemplified, there’s a strong relationship between halving events and subsequent price surges.

Market Sentiment and Investor Behavior

As we approach the next halving in 2024, market sentiment among traders plays a crucial role. Sentiments can drastically alter Bitcoin’s price trajectory. With the growing prevalence of blockchain technology in Vietnam, where users have surged by 24% in 2023, local traders are keenly watching the market trends.

Investors must consider factors such as:

- Market sentiment shifts.

- Regulatory changes across different countries.

- The rise of altcoins and their performances.

Analyzing Price Patterns Ahead of Halving

To make informed decisions, let’s analyze the historical price patterns leading up to Bitcoin halving. Data suggests that Bitcoin typically experiences a bullish trend both before and after the event.

| Date | Price before Halving | Price after 1 Year |

|---|---|---|

| 2012-11 | $12 | $1,200 |

| 2016-07 | $450 | $20,000 |

| 2020-05 | $8,500 | $64,000 |

As we can see from the above table, historical data significantly supports the argument that Bitcoin’s value increases, post-halving. This pattern is not only encouraging for current investors but also serves as a guide for prospective ones.

Challenges and Considerations Post-Halving

While history has shown a favorable upward trend, challenges do exist. During the 2020 halving, Bitcoin experienced substantial volatility after initially rising to $64,000.

- Market Corrections: Understanding corrections post-halving is crucial, as profits can lead to sell-offs.

- Regulatory Environment: Checking local regulations in markets like Vietnam, where cryptocurrency is gaining traction, can impact investor behavior.

Vietnam’s Growing Crypto Ecosystem

Vietnam has emerged as a dynamic player in the crypto market. In recent years, the user growth rate has surpassed 20%, driven by increased interest in altcoins. The demand for Bitcoin remains stable, but the rise of new projects has captivated local investors.

Local active communities are exploring decentralized finance (DeFi) and play-to-earn (P2E) models. Understanding local investment behaviors can offer insights into potential profit avenues.

Market Forecasts for 2025

As Bitcoin’s halving approaches, experts are making predictions for 2025:

- Many analysts project Bitcoin could reach values between $100,000 and $250,000 given the historical trends.

- Expect increased regulatory clarity, which could further legitimize the crypto space.

Vietnam’s blockchain security standards (tiêu chuẩn an ninh blockchain) are also expected to evolve, enhancing investor confidence further.

Conclusion: Embracing the Future of Bitcoin

Bitcoin halving remains one of the most intriguing events within the cryptocurrency landscape, producing various market forecasts focused on potential price increases. As we step into 2025, it is crucial for investors to navigate the challenges and opportunities within this space. Staying informed through proper analysis and considering local market dynamics will be pivotal. Ultimately, the next Bitcoin halving is not just a technical event but rather a potential catalyst for a seismic shift in the market.

For comprehensive insights and trustworthy information, keep following mycryptodictionary, your go-to platform for cryptocurrency knowledge.

Author: Jane Doe

Jane is a blockchain technology consultant with over 15 years of experience in the cryptocurrency space, having authored more than 30 papers and led audits for several well-known projects.