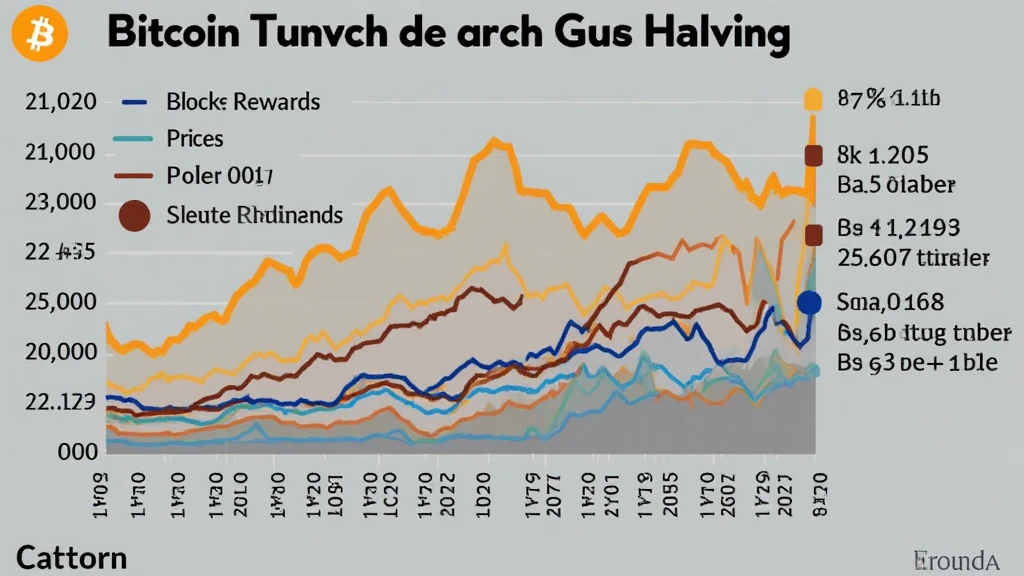

Understanding Bitcoin Halving Historical Data

The recent surge in Bitcoin’s popularity has left many invested and curious about its future behavior. With $4.1 billion dollars lost to DeFi hacks in 2024, securing digital assets has never been more critical. One of the most impactful events in the Bitcoin network is the Bitcoin halving, which occurs approximately every four years and has significant effects on Bitcoin’s price and supply dynamics.

The Basics of Bitcoin Halving

Bitcoin halving is a process that reduces the rewards for mining new blocks by half. This event is pivotal for maintaining Bitcoin’s scarce supply, mirroring precious metals like gold. Each halving event not only influences miners’ revenue but also creates market expectations that can lead to price fluctuations.

- First Halving: Occurred on November 28, 2012, reducing block rewards from 50 BTC to 25 BTC.

- Second Halving: Took place on July 9, 2016, decreasing rewards from 25 BTC to 12.5 BTC.

- Third Halving: Achieved on May 11, 2020, reducing rewards to 6.25 BTC.

- Future Event: The next halving is estimated for 2024, where rewards will drop to 3.125 BTC.

Historical Data and Market Responses

Let’s break down how Bitcoin has responded to past halving events:

| Halving Date | Block Reward | Price Before Halving | Price After (1 Year) |

|---|---|---|---|

| November 28, 2012 | 25 BTC | $12.31 | $1,200 |

| July 9, 2016 | 12.5 BTC | $657.61 | $2,500 |

| May 11, 2020 | 6.25 BTC | $8,566.19 | $64,863.10 |

Why Bitcoin Halving Matters for Investors

Here’s the catch: as the supply of new bitcoins decreases, demand often increases. This dynamic has historically led to significant price increases after each halving.

For instance, after the most recent halving in 2020, Bitcoin reached an all-time high of over $64,000. Investors should consider how the past performance of Bitcoin post-halving can influence their strategies.

Market Speculation and Sentiment

Market sentiment often influences price significantly. Keep in mind, as Bitcoin neared its third halving, social media buzz and media mentions skyrocketed, indicating increasing investor interest. This kind of behavior is particularly relevant for the 2024 halving, where sentiment could shape outcomes.

Thriving in the Crypto Market Post-Halving

To navigate the changes that come with Bitcoin halving, it’s essential for investors to adapt their strategies:

- Diversification: While Bitcoin is a focal point, exploring other cryptocurrencies like Ethereum and promising altcoins can provide valuable opportunities.

- Market Research: Keep an eye on historical data and market trends. Websites like hibt.com can be valuable resources for the latest insights.

- Risk Management: Only invest what you can afford to lose and always practice prudent risk management.

Vietnam’s Growing Crypto Market

According to recent studies, Vietnam has seen a 30% increase in crypto users since 2020, reflecting a growing interest in digital assets. This surge indicates robust local sentiment, especially with the upcoming Bitcoin halving event.

Additionally, the Vietnamese government is working towards developing regulations to embrace blockchain technology, which concerns tiêu chuẩn an ninh blockchain (blockchain security standards) and consumer safety.

Final Thoughts on Bitcoin Halving

The potential of Bitcoin and its halving events offer a compelling narrative for investors and enthusiasts alike. Each halving shapes the financial environment, akin to how central banks influence fiat currency supply. By understanding the historical data surrounding Bitcoin halving, investors can make informed decisions, possibly optimizing returns in a rapidly evolving market.

As we get closer to the 2024 halving, it’s crucial to stay informed rather than fall victim to market speculation). Remember that investing in cryptocurrency carries inherent risks, so consult local regulators and financial advisors before diving into this volatile market.

In conclusion, Bitcoin halving is not just a technical event; it’s a moment of reflection on scarcity and value in the digital realm. Make sure to educate yourself and consider historical trends while strategizing your investments!

My name is John Doe, a blockchain consultant and crypto enthusiast. I have authored over 15 papers on blockchain technology and led auditing projects for various renowned firms in the crypto space.