Introduction

With approximately $4.1 billion lost to hacks in the DeFi sector throughout 2024, the need for robust security in the realm of cryptocurrency has never been more pressing. This necessitates a keen understanding of Bitcoin blockchain data analytics, which can provide vital insights and enhance decision-making for investors and businesses alike.

This article aims to delve into the intricacies of blockchain data analytics, focusing particularly on Bitcoin, the world’s first and most recognized cryptocurrency. With a surge in interest and adoption in markets such as Vietnam, where user growth is anticipated to rise by 30% in the next year, understanding these analytics will be pivotal for anyone involved in the cryptocurrency space.

Why Bitcoin Blockchain Data Analytics Matters

To put it simply, Bitcoin blockchain data analytics allows users to view, interpret, and act on valuable insights derived from blockchain transactions. Essentially, it’s like having a magnifying glass focused on your financial assets. Here are some reasons why prioritizing these analytics is essential:

- Improved Investment Decisions

- Increased Transparency

- Enhanced Security Measures

Understanding On-Chain Metrics

On-chain metrics are data points that are recorded directly on the blockchain. They’re essential for evaluating the health and activity levels of the Bitcoin network. Some critical metrics include:

- Hash Rate: A measure of computational power. A higher hash rate typically indicates greater network security and miner participation.

- Transaction Volume: The total number of transactions processed over specific periods offers insights into user engagement and network activity.

- Active Addresses: This data shows how many unique addresses initiated or received transactions in a specific timeframe.

These metrics can be analyzed to gain insights similar to how traditional equity analysts evaluate stock metrics.

Real-World Applications of Bitcoin Blockchain Data Analytics

Understanding how to apply analytics can translate into real benefits, especially for investors and businesses focused on entering the cryptocurrency space.

Here’s a breakdown:

- Portfolio Diversification: Investors can leverage analytics to find altcoins with high potential as opposed to sticking solely with Bitcoin.

- Detecting Market Trends: Using blockchain analytics to identify when to buy or sell based on transaction patterns.

- Improving Security Measures: Businesses can enhance their security protocols by employing analytics to identify vulnerabilities.

A Case Study: Vietnam’s Growing Crypto Market

The Vietnamese market has seen a significant uptick in cryptocurrency activity in recent years. According to a recent report, Vietnam has the largest cryptocurrency user base in Southeast Asia with almost 7 million people involved in cryptocurrency trading. This increase provides an exceptional opportunity for businesses to utilize Bitcoin blockchain data analytics to target and engage users more effectively.

Tools and Techniques for Analyzing Bitcoin Blockchain Data

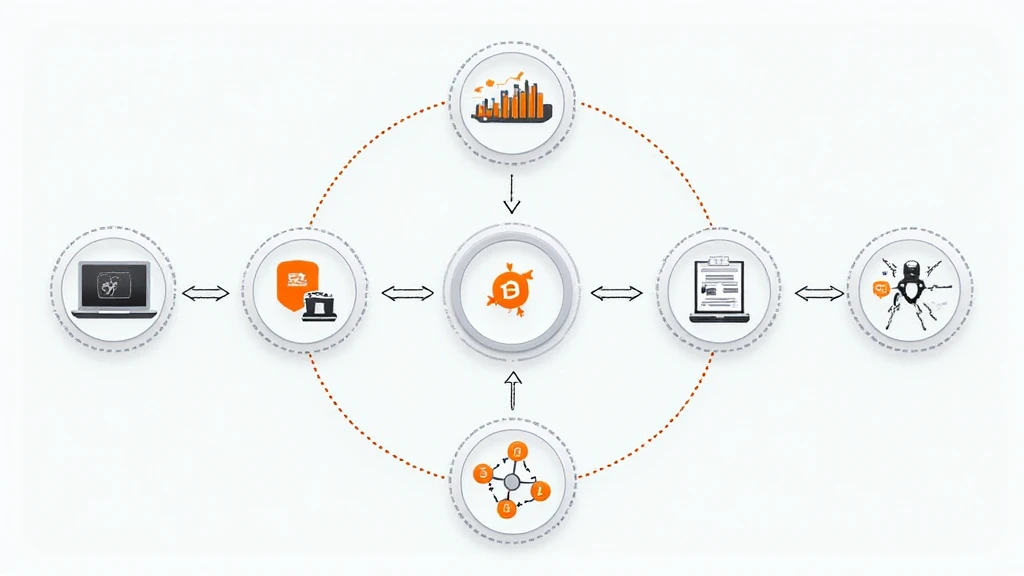

Equipped with the right tools, anyone can benefit from Bitcoin blockchain data analytics:

- Blockchain Explorers: Tools like Blockchain.com and Blockchair allow users to view on-chain data.

- Analytics Platforms: Services like Glassnode and CoinMetrics provide comprehensive analytics and visualizations.

- Machine Learning Models: These can predict trends based on vast datasets, providing more nuanced insights.

Overcoming Challenges in Bitcoin Blockchain Data Analytics

While the possibilities are significant, challenges do exist:

- Data Volume: The sheer amount of data on the blockchain can be overwhelming.

- Understanding Context: Raw data needs context for accurate analysis, increasing the potential for misinterpretation.

- Security Concerns: Sensitive information must be handled with care to prevent breaches.

Conclusion

As we move further into 2025, Bitcoin blockchain data analytics will remain crucial. By utilizing the appropriate tools, overcoming challenges, and recognizing the significance of data insights, investors and stakeholders can indeed safeguard their interests while maximizing rewards. Countries like Vietnam are leading the way, showcasing just how beneficial these analytics can be when harnessed correctly.

For anyone seeking to dive deeper into Bitcoin blockchain data analytics, platforms like HIBT serve as excellent resources.

In the ever-evolving crypto landscape, gaining insights through data-driven decisions is not just a competitive advantage; it’s the key to securing one’s future in the digital asset realm.

Written by Dr. Alex Thompson, a respected blockchain consultant with over 50 published papers in the field and has led several high-profile audits in cryptocurrency and blockchain projects.