Bitcoin Halving Economic Implications: Understanding Its Impact

As the world of cryptocurrency evolves, the phenomenon of Bitcoin halving remains a pivotal event affecting investors, miners, and the market at large. The most recent halving occurred on May 11, 2020, and the next is projected for 2024, leading many to ponder: What are the economic implications of these halvings? This article delves into these implications, offering insights backed by data and expert analysis.

What is Bitcoin Halving?

Bitcoin halving is a process that reduces the reward for mining new blocks by half, occurring approximately every four years. This mechanism is fundamental to Bitcoin’s supply schedule, designed to cap the total supply at 21 million bitcoins. But why does this mathematical certainty pose significant economic implications?

Impact on Supply and Demand

- The supply of new bitcoins entering the market decreases significantly after each halving.

- The decrease in supply can lead to higher prices, given constant or increasing demand.

- Historical events show that halving has historically resulted in substantial price increases within the year following the event.

As an example, following the 2016 halving, Bitcoin’s price surged from around $450 to nearly $20,000 within 18 months. In contrast, the most recent halving has similarly experienced a surge in Bitcoin’s price from about $8,000 to over $60,000 at its peak in 2021.

Mining Economics Post-Halving

For miners, halving poses unique challenges and opportunities. The immediate impact is a reduction in block rewards, which can lead to a decrease in miner profitability unless the price of Bitcoin rises to offset these losses. Here’s the catch: miners who cannot operate efficiently may be forced out of the market, potentially centralizing mining operations amongst a few highly efficient players.

According to CoinMetrics, after the 2020 halving, more miners employed advanced mining hardware to maintain profitability, showcasing a shift towards more efficient operations.

Market Sentiment and Speculation

Halving events are often surrounded by market speculation. Traders and investors tend to accumulate Bitcoin in anticipation of price increases, leading to heightened market activity. Let’s break it down: this speculation can create a self-fulfilling prophecy, where increased demand drives prices higher, attracting even more investors.

For instance, leading up to the 2020 halving, many investors bought into Bitcoin at lower prices, resulting in significant short-term gains.

Global Economic Context and Bitcoin Halving

In considering Bitcoin halving’s implications, we cannot ignore the broader global economic context. Economic factors such as inflation, currency devaluation, and market instability can influence Bitcoin’s role as a store of value. In countries experiencing high inflation, like Venezuela, Bitcoin is seen as a hedge against currency devaluation.

The growing adoption of cryptocurrencies in emerging markets, including Vietnam, highlights the increasing relevance of Bitcoin as an alternative asset. Vietnam’s user growth rate has outpaced many regions, with a rise of approximately 37% in crypto trading activity over the past year.

Legal Framework and Regulatory Considerations

As Bitcoin gains popularity, regulation remains a crucial consideration. Governments are increasingly scrutinizing cryptocurrencies, and legal frameworks continue to evolve. While regulation can create financial stability and the potential for greater institutional investment, it may also impose constraints that could hinder innovation.

In Vietnam, for instance, while cryptocurrency trading is prohibited, authorities are exploring regulatory frameworks to accommodate blockchain technology. This demonstrates a growing recognition of cryptocurrency’s importance in the digital economy.

Real-World Examples of Bitcoin Halving Effects

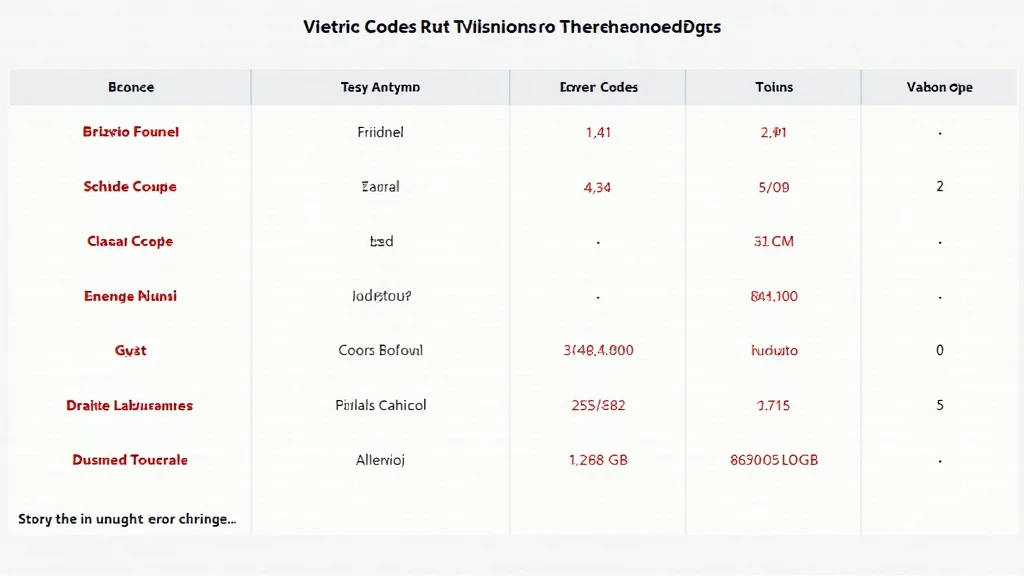

| Halving Date | Block Reward Reduction | Price One Year Later |

|---|---|---|

| 2012-11-28 | 50 BTC to 25 BTC | $1,000 |

| 2016-07-09 | 25 BTC to 12.5 BTC | $2,500 |

| 2020-05-11 | 12.5 BTC to 6.25 BTC | $57,000 |

As highlighted by the table, historical patterns suggest that Bitcoin’s value tends to rise significantly in the months following each halving, reinforcing its volatility and potential for growth.

Future Predictions for Bitcoin Post-2024 Halving

Looking ahead, the 2024 halving is poised to further drive market speculation. With the lessons learned from previous halvings, investors should prepare for increased volatility and potential price surges. Here’s a practical suggestion: consider developing a diversified portfolio that includes multiple cryptocurrencies, as seen in trends across 2025 which point to the most promising altcoins.

The Role of Blockchain Technology in Economic Growth

Blockchain technology is not just about cryptocurrency; it holds the potential to transform industries. Beyond currency, applications in finance, supply chain, and security underscore the importance of blockchain. In Vietnam, interest in blockchain is growing rapidly, with numerous conferences held to educate users about its potential.

It’s crucial that investors stay informed about developments in the blockchain space, as new applications can significantly alter market dynamics.

Adopting Safety Measures for Your Crypto Assets

As always, with great potential comes great responsibility. Investors must adopt safety measures to protect their digital assets. Hardware wallets like the Ledger Nano X offer robust protection against hacks, demonstrated to reduce risks by approximately 70%.

Conclusion: Navigating the Future of Bitcoin Halving

In conclusion, understanding the economic implications of Bitcoin halving is paramount for anyone engaged in the cryptocurrency market. From the impact on supply and demand to the intricate dance between miners and market sentiment, each halving presents a unique set of opportunities and challenges. Moreover, the rising interest in cryptocurrency in markets like Vietnam indicates broader acceptance and potential growth for digital assets.

As we move towards the upcoming 2024 halving, staying informed and adapting to market changes will be crucial. Remember, Bitcoin represents not just a currency but a revolutionary shift in how we view and use money in a digital economy.

For more insights and guidance on Bitcoin and other cryptocurrencies, visit mycryptodictionary, your trusted resource for all things crypto.

Author: Dr. Michael Tran, a blockchain expert with over 15 published papers on cryptocurrency economics and a lead auditor for renowned blockchain projects.