Understanding HIBT Margin Trading Rules: A Comprehensive Guide for Crypto Investors

As cryptocurrency trading continues to gain traction, many investors are seeking new strategies to maximize their profits. With an astounding $4.2 billion lost in crypto-related hacks in 2024, the focus on understanding secure trading practices has never been more critical. Enter HIBT margin trading rules—what they are, how they work, and why they matter to the savvy investor.

What is Margin Trading?

Margin trading is a powerful tool that allows traders to borrow funds to increase their position size. In simpler terms, it enables you to trade more than you possess in your account. But what does this mean for your investment? Well, think of it as leveraging—as if you’re using a bank vault to store more digital assets than you own.

In margin trading, the funds borrowed come with an interest, and the margin refers to the collateral that you need to maintain while trading. One key aspect of HIBT margin trading rules is that they require a certain level of collateral to be held in order to protect against losses. This is akin to the security measures taken in traditional bank loans.

Why HIBT Margin Trading?

Understanding HIBT margin trading rules is essential for various reasons:

- Increased Buying Power: Traders can control larger positions, heightening potential earnings.

- Ability to Short Sell: Margin trading allows you to profit from declining markets.

- Advanced Strategies Available: Options for hedging and other complex strategies become accessible.

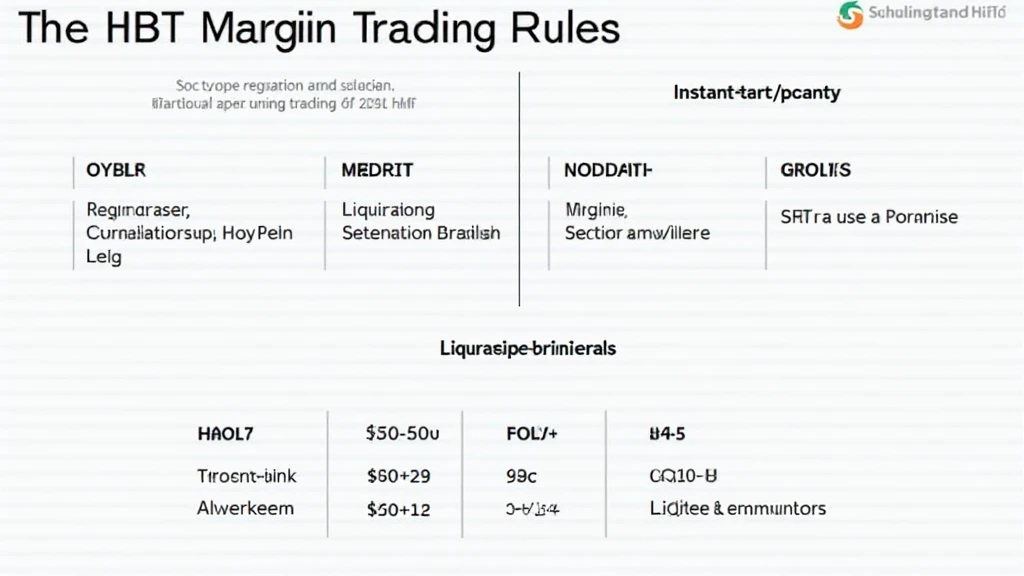

Core Components of HIBT Margin Trading Rules

To navigate the HIBT margin trading landscape effectively, let’s break down its core components:

1. Margin Requirements

One of the fundamental HIBT margin trading rules is the margin requirement. This rule stipulates how much capital you need to hold in your account to take on a leveraged position. Typically expressed as a percentage, this requirement ensures that even in downturns, you have enough equity to back your positions.

2. Leverage Ratios

Leverage allows you to gain more exposure to the market without investing upfront capital. However, it’s a double-edged sword—while it can amplify profits, it can also exacerbate losses. The HIBT margin trading rules outline specific leverage ratios applicable to different assets, educating investors on acceptable leverage levels.

3. Liquidation Thresholds

The HIBT margin rules also specify liquidation thresholds, indicating when your assets may be liquidated to cover losses. If your equity falls below a required margin level, this ensures your loan is paid back. It’s crucial to stay aware of these thresholds to avoid unwanted liquidation.

4. Interest Rates on Borrowed Funds

Since margin trading involves borrowing, interest rates apply. HIBT margin trading rules provide clarity on the rates investors will incur while trading, which can impact overall profitability.

5. Ongoing Monitoring and Adjustments

Another critical aspect of HIBT margin trading is regular account monitoring. You must keep an eye on market fluctuations and be ready to adjust your margin levels accordingly. Due diligence is vital in retaining a healthy account balance.

The Role of Technology in HIBT Margin Trading

In today’s digital age, technology plays a significant role in executing HIBT margin trading. Leading the way is advanced algorithmic trading platforms that monitor market conditions and automate trades effectively. These platforms analyze market data, making split-second decisions that human traders might miss.

Furthermore, with the rise of AI and machine learning, crypto platforms can provide predictions based on previous trading behaviors and patterns, offering your margin trading strategy a robust advantage.

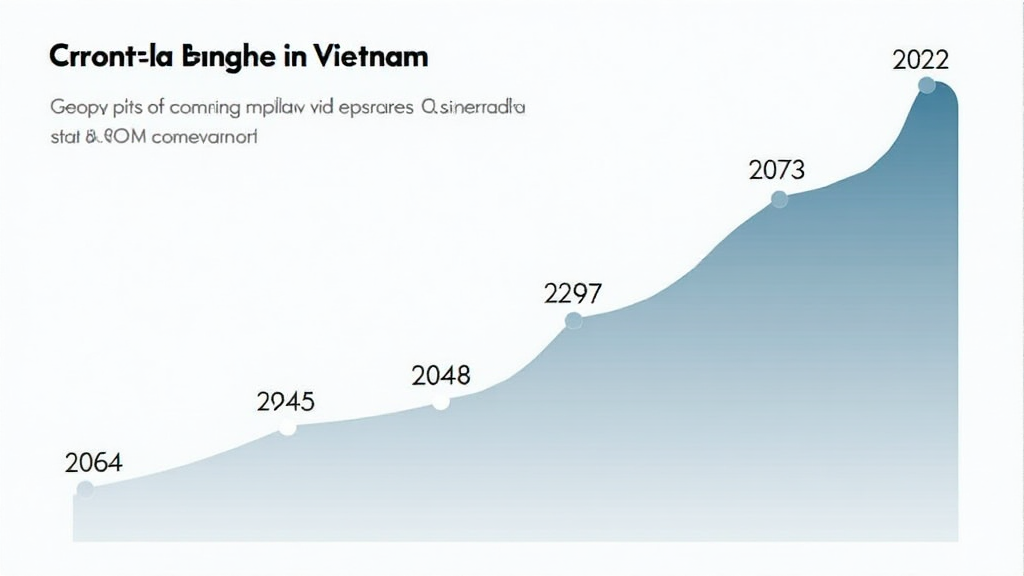

Case Study: Vietnam’s Growing Interest in Margin Trading

According to recent studies, Vietnam has seen a remarkable growth rate of around 35% in crypto interest over the past year. This interest primarily arises as local investors look to expand their portfolio through HIBT margin trading. In fact, 2025 is predicted to see an influx of Vietnamese investors entering the global margin trading scene.

Many crypto platforms, such as HIBT, are focusing on local market trends, ensuring that their offerings align with the needs and preferences of Vietnamese traders. Localizing trading interfaces and offering customer support in Vietnamese help enhance the overall trading experience.

Final Words: Be Cautious, Be Informed

In conclusion, understanding HIBT margin trading rules is vital for anyone looking to dive deeper into the crypto market. Just like a bank vault safeguards your traditional assets, these rules act as your safety net while exploring the promising yet volatile world of digital currencies.

By staying informed and adhering to the margin trading principles, you can navigate the complexities of trading effectively. Remember, margin trading isn’t solely about making a profit; it’s about managing risk and making educated decisions. With the increasing adoption of blockchain technology across regions, including Vietnam, there’s no better time than now to dive into margin trading while keeping an eye on emerging trends.

For more insights on margin trading and other crypto-related topics, visit HIBT’s official website. As always, seek financial advice from certified professionals before engaging in trading activities.

—

Written by Dr. An Nguyen, a digital asset expert with over 10 years of experience in blockchain technology and a published author of fifteen papers in the realm of cryptocurrency auditing.