Unlocking HIBT Vietnam’s Crypto Potential: A Guide to Trailing Stop Orders

In 2024, the world of cryptocurrency saw losses exceeding $4.1 billion due to hacking activities. As this figure continues to rise, effective trading strategies become crucial for investors. This leads us to a comprehensive exploration of crypto trailing stop orders on platforms like HIBT Vietnam and their significance for both novice and experienced investors.

Understanding the Basics of Crypto Trailing Stop Orders

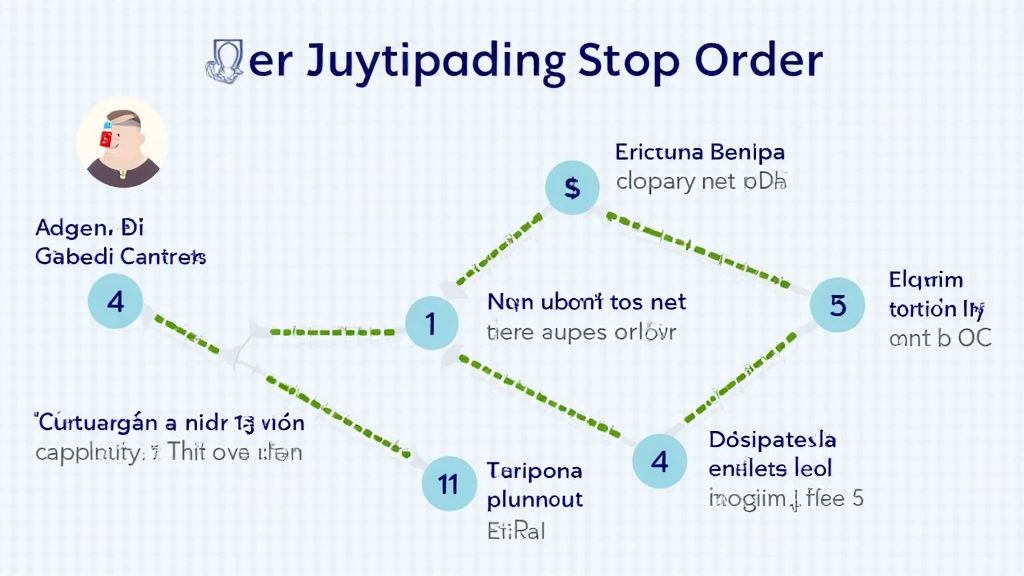

Before diving deep, let’s clarify what trailing stop orders are. Essentially, they are a dynamic form of stop-loss orders that adjust automatically as the price of the cryptocurrency fluctuates. This mechanism allows traders to lock in profits while limiting potential losses.

The Mechanics of Trailing Stop Orders

- Setting the Trail: Traders set a percentage or dollar amount below the market price that will trigger the sell order.

- Market Movement: If the market price increases, the trailing stop price rises correspondingly, giving investors more flexibility.

- Limiting Losses: If the market price falls beyond the trailing stop, the order activates, mitigating larger potential losses.

Using this strategy, it’s much like having a safety net that adjusts based on the acrobatics of market trends. So, why is this particularly vital within the Vietnamese market?

Vietnam’s Crypto Landscape

The Vietnamese crypto market has seen an exponential growth rate, boasting a user increase of approximately 70% in recent years. As of 2022, over 5 million Vietnamese citizens were actively trading cryptocurrencies. With this rise, the need for robust trading tactics, such as trailing stop orders, becomes even more necessary to ensure safety and profitability.

Market Characteristics: Opportunities and Risks

Vietnam’s crypto landscape features a mix of opportunities and risks:

- Growing User Base: With increased tech adoption and internet penetration, more people are entering the crypto market.

- Regulatory Challenges: The legal framework is still evolving, causing some uncertainty among traders.

- High Volatility: Cryptocurrencies are notorious for their price fluctuations, making the knowledge of trailing stop orders invaluable.

As Vietnamese traders look to capitalize on the crypto boom, understanding how to implement trailing stop orders could significantly improve their trading results.

Implementing Trailing Stop Orders on HIBT Vietnam

Now that we have discussed the core concepts and the significance of the Vietnamese market, let’s explore how to set up a trailing stop order on HIBT:

- Step 1: Log into your HIBT account.

- Step 2: Select the crypto asset you wish to trade.

- Step 3: Choose ‘Trailing Stop Order’ from the order types available.

- Step 4: Input your desired trail amount or percentage.

- Step 5: Submit the order and monitor its effectiveness.

This straightforward approach allows you to simultaneously manage your risk and maximize profits without constant supervision.

Practical Examples of Trailing Stops

Let’s illustrate with a practical example:

- Assume you bought a cryptocurrency at $100.

- You set a trailing stop of 10%.

- As the price rises to $120, the trailing stop automatically adjusts to $108.

- If the price then drops below $108, the asset gets sold, locking in your profits.

This method reduces the stress of manual trading while protecting your gains. It is precisely how seasoned traders maintain their edge in fluctuating markets.

Best Practices for Using Trailing Stop Orders

Here are a few tips to maximize your effectiveness with trailing stop orders:

- Understand the Asset: Different cryptocurrencies have different volatility profiles. Knowing your asset deeply will allow for a more informed trailing stop strategy.

- Test Your Strategy: Use demo accounts when available to practice without financial risk.

- Avoid Emotional Trading: Stick to your strategy and avoid deviating from your trailing stop strategy due to emotional responses.

Remember, good trading practices are the bedrock of sustained success in the crypto world.

Future Outlook for Vietnam’s Crypto Market

Moving forward, the trajectory for Vietnam’s crypto market looks promising, with experts predicting a further increase in participation rates. By 2025, potential altcoins could proliferate, presenting ample opportunities for traders who leverage advanced strategies like trailing stop orders.

The Rise of Innovative Solutions

As with the fast evolution of technology, innovative solutions will continuously enhance the crypto trading landscape. Advances in blockchain security (tiêu chuẩn an ninh blockchain) and trading techniques will empower individuals to navigate the market more confidently.

No investment is without its challenges; however, employing tools like trailing stop orders may dramatically change the way Vietnamese traders approach crypto investments, enabling them to capture profits while minimizing risks.

Conclusion

In summary, the potential for growth within Vietnam’s crypto market is substantial, particularly for those who familiarize themselves with mechanisms like trailing stop orders on platforms such as HIBT Vietnam. As the market continues to mature, implementing these strategies can be a game-changer for achieving robust investment results.

For anyone looking to dive into the world of cryptocurrency, understanding and utilizing trailing stop orders is essential for navigating and succeeding in the dynamic landscape we face today. The time to harness these techniques is now.

As always, this article is not financial advice. It’s essential to consult local regulations and consider your financial situation before making any trading decisions. Interested readers can find further information by visiting HIBT Vietnam.

Written by Dr. Nguyen Thanh Long, a blockchain expert with over 15 published papers in technology and finance, leading several high-profile audits in the crypto space.